Our climate change strategy sets out our strategic response to climate change and how we think The Pensions Regulator (TPR) can help trustees meet the challenges from climate change.

Published: 7 April 2021

CEO's introduction

We are, as a society, at a crossroads. Across everything we do, we need to assess our actions against the unprecedented risk we face through climate change.

In recent times we’ve faced a crisis caused by a pandemic. We’ve all taken urgent action to protect ourselves, our loved ones, our friends and our colleagues. We’ve looked after each other. We need to treat climate change in the same way, and it is the planet this time that we also need to look after. Climate change could be - no, it will be - more catastrophic to our way of life than the pandemic if left unchecked. There is no vaccine, it is much more complex than that. It is equally urgent.

Global heating has the potential to de-stabilise the social and economic conditions on which we depend for our pensions system. The impact has financial consequences as well.

At TPR we know that trustees are talking about this already, exploring how climate change affects asset prices and looking at the huge opportunities that will come from a global pivot towards low carbon economies. In a world where the climate emergency is real and urgent, this is the prudent approach. I believe that, wherever the focus lies for trustees, it is absolutely the case that any scheme that does not consider climate change is ignoring a major risk to pension savings and missing out on investment opportunities.

This document sets out our strategic response to climate change and how we think TPR can help trustees meet the challenges from climate change. We do not underestimate the scale of those challenges and we know that many schemes are still near the starting line. However, new pensions legislation gives a vital framework for action while driving development right across the market. Regulators across the entire UK investment chain are committed to disclosure of climate information and the government is making plans to achieve its target of net zero carbon emissions by 2050. This means a landscape of resilient pension schemes that protect savings from climate risk is entirely within reach. I look forward to working with trustees and shaping the debate within industry to help deliver that.

Charles Counsell, Chief Executive

Strategic context

Climate change impacts broadly across society. Every business, all parts of the economy and the financial market will be impacted. As such, it is systemically significant to pensions, to our regulatory regime and to our statutory objectives. For example, it’s directly relevant to our objective of protecting member benefits: if trustees fail to consider risks and opportunities from climate change, or fail to exercise effective stewardship, then they face the risk that investment performance will suffer. Defined contribution (DC) savers will miss out on the best outcomes while defined benefit (DB) schemes are sponsored by employers whose financial positions and prospects for growth are dependent to varying extents on how they respond to climate change.

Green Finance Strategy

A key policy driver in our work on climate change is the government’s Green Finance Strategy . This aims to transform the UK’s financial system for a greener future and sets out steps towards the unprecedented levels of investment in green and low carbon technologies, services and infrastructure that will be needed to meet the government’s commitment to bring domestic greenhouse gas emissions to net zero by 2050.

This transformation requires climate and environmental factors to be fully integrated into mainstream financial decision-making across all sectors and asset classes. One of the most influential international initiatives to achieve this is the Taskforce on Climate-related Financial Disclosures (TCFD) . Recommendations drawn up by the TCFD have become a key framework for a co-ordinated approach that puts climate change at the heart of financial decision-making. In the Green Finance Strategy, the government sets out an expectation that large asset owners would disclose in line with the TCFD recommendations by 2022.

The Pension Schemes Act 2021

For occupational pension schemes, this expectation is being taken forward through the new Pension Schemes Act, which writes climate change into pensions law in the most comprehensive way to date.

Proposed new regulations for prescribed schemes adapt the TCFD recommendations to make them relevant to trustee decision-making structures. For example, a TCFD recommendation under the heading of ‘governance’ translates into a requirement for trustees to have oversight of climate-related risks and opportunities. Under the heading of ‘metrics and targets’, trustees will be asked to work out the scheme’s carbon footprint by calculating greenhouse gas emissions of the investment portfolio. Trustees will also have to set climate-related targets. Trustees will have to disclose their findings by publishing a report that shares what they’ve discovered about their scheme and details of their governance arrangements.

While mandatory disclosure of climate risks in line with the TCFD recommendations initially applies to larger schemes and all master trust and collective DC schemes, all schemes already have duties in relation to climate change. For example, as of 2019, trustees of schemes with 100 or more members have been required to set out in their statement of investment principles (SIP) policies on stewardship and on environmental, social and governance considerations (including climate change) that they consider financially material. These schemes also need to publish their SIPs and implementation statements on a publicly accessible website[1].

The community we regulate

We know there are excellent examples of trustee action on climate change. For example, Nest - the UK’s largest pension scheme by membership - has set out plans to be net zero across its investments by 2050 or earlier. Meanwhile, the BT Pension Scheme - the UK’s largest private sector DB scheme - has announced that it’s heading to net zero greenhouse gas emissions by 2035.

These are impressive plans and we welcome them. However, while Nest and BT’s ambition may be shared by trustees of other schemes, these are trailblazing schemes in taking action on such an extensive scale. We would like to see all schemes learn what they can from these examples and take steps, as appropriate, to manage their climate risk.

Getting to net zero

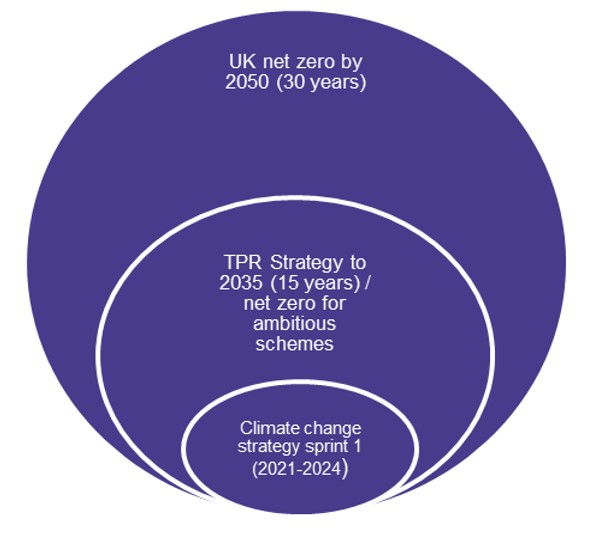

Occupational pension scheme trustees, like all parts of our economy, will be impacted by the goal set by the UK government to bring all greenhouse gas emissions to net zero by 2050. Through management of the climate risk to their members, trustees will also play an important role. We have looked at what we think will be different over three different time periods:

- the 30-year horizon to 2050

- a 15-year horizon aligned with our Corporate Strategy, published in 2020

- the next three years, which is the first ‘sprint’ of delivering our Corporate Strategy (covering 2021-2024)

| Timescale | What do we think will be different? |

|---|---|

| To 2050 |

|

| To 2035 |

|

| To 2024 |

|

Looking beyond climate change, there are other sustainability-related financial risks such as biodiversity loss, and targets such as the UN’s Sustainable Development Goals, which are interlinked but distinct. This strategy focuses on climate change as an immediate financial risk and trustees face specific duties in relation to climate change. However, future iterations of this strategy could encompass wider risks and trustees are encouraged to bear these in mind.

Our corporate strategy

The plans outlined here align with our Corporate Strategy, which puts the pension saver at the heart of all we do. The climate change work sits under the strategic goal of ensuring that decisions made on behalf of savers are in their best interests, and the Corporate Strategy says the following:

Aims and objectives

Our aims

- We will create better outcomes in later life for workplace savers by driving trustee action on the risks and opportunities from climate change.

- We will seek to influence debates around pensions and climate change.

- We will, as a business, take part in the transition to net zero.

Aim: we will create better outcomes in later life for workplace savers by driving trustee action on the risks and opportunities from climate change

The government has set out a clear path on climate change through updated investment regulations and now through the Pension Schemes Act 2021. Many schemes face requirements to report on climate change, whether in line with the policies in the SIP or, for those schemes in scope, in line with the recommendations of the TCFD.

A core part of our work on climate change is to regulate on and, if necessary, enforce against, these requirements. Trustees must clearly evidence that words and intentions translate into action. This includes reporting on their stewardship activities, which in some cases may be the most effective way to follow through on intentions regarding climate change.

This is a rapidly evolving landscape and we know that expectations on trustees will change over time, even within the legislative framework. Therefore, we will be clear about our expectations, and we will work with the industry as we develop and implement our regulatory approach.

Objective 1

We want to see schemes publish their SIP, implementation statement and, for those in scope, disclose their TCFD report. Where they do not, and it is appropriate to do so, we will take enforcement action, which we may publicise.

These disclosures represent compliance with the basics on climate change.

Objective 2

We will publish guidance outlining our approach to the new TCFD regulations. We may take enforcement action against those not meeting legal duties.

Guidance will illustrate how trustees can take national and international climate change goals into account.

Aim: we will seek to influence debates around pensions and climate change

Integrating climate change into pension scheme trustees’ plans and decision-making structures will pose new and interesting challenges. The world of green finance is moving incredibly quickly and debates around divestment versus engagement, ‘greenwashing’, standards and metrics are real and complex. Savers are increasingly showing that they too are interested in understanding where their pension savings are being invested and the impact of these investments.

We will work with government, the wider financial industry and other stakeholders to understand and influence these important and ongoing debates, and to be a strong voice highlighting climate-related risks and opportunities for savers and the pensions industry.

Alongside this, we will work closely with other financial regulators to drive change and to co-ordinate our work. It is only by working across the sector that we will be able to meet our collective goals.

Objective 3

We will use our communications tools to promote this strategy, call on our regulated community to meet our expectations in line with Objectives 1 and 2, and be clear about the steps we have taken to contribute to climate goals as a business and enhance our credibility.

We will use communications to help nudge those who run pension schemes to comply with legislation and take account of our guidance.

Objective 4

We will work with government, key stakeholders and other financial regulators, participating in groups on climate change and stewardship to influence debate, align plans where relevant, and sharing insights. We will continue our membership of cross-government groups.

We will work across the financial sector towards consistent behaviours and high-quality information for trustees on climate risk.

Aim: we will, as a business, take part in the transition to net zero

As well as working with our regulated community, we will take responsibility for the climate impacts of TPR as a business. This means reducing our own environmental impact, managing climate risks and adapting to new conditions.

We have already started this work but there is more to do, especially given that our impact will have changed in light of the move to more home-based working since 2020.

Objective 5

Before the UN COP26 climate change conference in November 2021, we will publish a Climate Adaptation Report. This will include an outline of our plans towards using the recommendations of the TCFD, where applicable, as a framework for our own management of climate risk.

By reporting against the TCFD recommendations, we will align ourselves, where applicable, with an approach used across the financial sector.

Objective 6

We will set a 2030 net zero carbon emissions target for TPR and by 2024 we will set out our plans to achieve this.

This will demonstrate that we are taking part in the transition.

Our regulatory approach

We drive up standards and tackle risk by engaging with the pension schemes we regulate. Our regulatory approach focuses on four areas:

- Setting clear expectations

- Identifying risk early

- Driving compliance through supervision and enforcement

- Working with others

We will apply this regulatory approach towards achieving our climate change objectives as follows:

Setting clear expectations

We work with those we regulate to ensure that the standards we set out are clear and easily adopted.

Schemes have existing obligations to consider and manage climate-related risks. We will outline our approach to the most recent climate change regulations by publishing guidance that clarifies what we will be looking for from schemes as they assess, manage and prepare to report in line with climate change measures from the new Pension Schemes Act. We will follow this up when the regulations are reviewed in 2023 by working with the Department for Work and Pensions (DWP) to share best practice TCFD reports. More broadly, we will review guidance and fill gaps where regulation has moved on.

Measures in the Pension Schemes Act initially apply to master trusts and larger schemes. By the end of 2023, we anticipate that approximately 90% of DC scheme memberships will be in schemes that are reporting in line with the TCFD recommendations. However, although around 75% of DB scheme assets will be in schemes complying with the regulations, the figure for DB memberships is lower, with approximately 60% expected to be covered by the end of 2023 . The impact of climate change on some employers could be very significant, and integration of covenant, actuarial and investment risk is key to successful saver outcomes. As such, our guidance will specifically consider how to take account of the impact of climate change in Integrated Risk Management (IRM), which will help to engage smaller schemes more with climate-related risks.

We expect the impact of climate change on some superfund models, particularly those targeting long-term run-off, could be very significant. We believe that a proactive approach to assessing, mitigating and monitoring climate risk for those models is key to successful saver outcomes. As the DB superfund market evolves, as part of our initial assessment of individual superfund models, as ceding schemes transfer in, and during ongoing supervision, we will seek to ensure that the requirement we set for a 'climate risk management plan' is adhered to and that the plan is effectively implemented.

Meanwhile, our new modular code of practice will include modules on climate change and stewardship to outline our expectations of trustees in these areas.

We will further support the development of trustees’ knowledge and understanding by updating the content on climate change in our Trustee Toolkit.

Our advocacy and our work with stakeholders in support of Objectives 3 and 4 will play an important role in clarifying our expectations.

| Products/outputs under ‘Setting clear expectations’ | To meet/support objective |

|---|---|

| Guidance on regulations from the Pension Scheme Act 2021 | 2 |

| Share best practice TCFD reports | 2 |

| Climate risk management plan for superfunds | 1, 2 |

| Climate change and stewardship modules in new code of practice | 1, 2 |

| Update Trustee Toolkit | 1, 2 |

Identifying risk early

We know that climate change presents financial risk for scheme investment strategies and sponsoring employers. Trustees must take climate-related risks and opportunities into account if they are to achieve the best outcome for scheme beneficiaries, particularly as impacts from climate change are increasingly apparent across the globe. People’s savings will also suffer more immediate consequences from exposure to firms who are unprepared for the low carbon transition. Meanwhile, opportunities from climate change will be more apparent as governments worldwide scale up net zero policies.

To help identify the extent of risk from climate change, we will examine scheme reports on scenario analysis in more detail by carrying out a thematic review on scheme resilience to climate-related scenarios. We recognise that investment portfolios, and therefore people’s pension savings, will suffer detrimental consequences in high-emission scenarios. We will publish our findings and use these to inform any revisions to our guidance.

We recognise that stewardship activities help trustees monitor risk, and stewardship has a key role to play in ensuring that an investment portfolio is robust in the face of climate change. As of 2020, trustees have a duty to report on stewardship and engagement activities through an implementation statement. We will review a selection of these statements and publish our findings. We encourage trustees to sign up to the 2020 UK Stewardship Code, which outlines best practice on improving investment governance and risk management while driving long-term success of companies; and on communicating activity and progress towards addressing systemic risks such as climate change.

Monitoring of schemes through our ongoing supervision activity (see below) will help with preventing problems from developing in the first place.

| Products/outputs under ‘Identifying risk early’ | To meet/support objective |

|---|---|

| Thematic review on resilience to climate-related scenarios | 2 |

| Publish review of implementation statements | 1, 2 |

Driving compliance through supervision and enforcement

We use a wide range of regulatory interventions with those we regulate.

Our relationship supervision approach helps us to build strong ongoing relationships so we can monitor schemes more closely, outline our expectations, and prevent problems from developing in the first place.

We will prepare our staff as needed throughout the organisation so we are confident in talking about climate change. This is essential groundwork for when the measures from the Pension Schemes Act 2021 come into force, as these make consideration of the risks and opportunities from climate change a key part of scheme governance.

We expect all schemes, regardless of size, to be able to achieve compliance with the basics, including as outlined in Objective 1. The quality of this reporting can be an indication of the quality of scheme governance.

To help identify instances of non-compliance with disclosure obligations, we will implement new regulations by adding questions to the scheme return, requesting the web addresses for climate change-related documents as laid out in Objective 1. We will also publish on our website an index of the web addresses of schemes’ SIPs.

| Products/outputs under ‘Driving compliance through supervision and enforcement’ | To meet/support objective |

|---|---|

| Climate change training for teams | 1, 2 |

| Add questions to scheme return on web addresses of SIP, implementation statement and TCFD report | 1 |

| Publish index of SIP web addresses | 1 |

Working with others

Our regulation is more effective – more comprehensive and more consistent – when we work in conjunction with our regulatory partners and stakeholders. And this is even more important in such a complex and interrelated area as climate change, where people need to co-ordinate work not only across different sectors in the UK, but around the world.

We have already been part of a Treasury-led TCFD taskforce that has produced a roadmap showing how the UK’s financial sector will move towards information on climate-related risks and opportunities being available across the investment chain by 2025. Importantly, the roadmap includes plans by the Financial Conduct Authority (FCA) for asset managers to report on climate change risks. This is crucial information for trustees as they prepare to report on climate risk and develop portfolio-based climate metrics.

Though not reflected in the roadmap, we will monitor developments affecting the Local Government Pension Scheme, as the Ministry of Housing, Communities and Local Government intends to consult on TCFD reporting in 2021 with a view to implementation by 2023.

We will continue to meet with other financial regulators to develop consistency in our work on climate-related risks and opportunities, and stewardship practice. We will help to align behaviours and incentives across the investment chain, and share insights, gathered through our relationships with trustees and industry experts. We recognise the critical role advisers and third-party providers play in supporting trustees, and will engage with these.

We will keep up-to-date with the work of the Climate Working Group of the UK Regulators’ Network to liaise on plans towards net zero across the UK’s broader regulatory community.

We will include climate change in our dialogue with stakeholders through advisory panels, events and other formal and informal discussions on our regulatory approach and policy.

‘Working with others’ as outlined above will help us in the development of guidance under Objective 2, as we will take the experience and expertise of others into consideration.

| Products/outputs under ‘Working with others’ | To meet/support objective |

|---|---|

| Participate in cross-government groups, regulators forum on climate change and in the Stewardship Regulators Group | 4 |

| Climate change content in updates to stakeholders | 3 |

Influencing the debate

As the regulator for occupational pension schemes, we are uniquely placed to help the pensions industry to change behaviours to meet the profound challenges of climate change and to advocate on its behalf within government.

Through effective communications, including campaigns, guidance, media opportunities, speeches and blogs, parliamentary meetings and stakeholder engagement, we will be clear about our expectations on climate change.

But we will do more. The debates around the most effective ways to combat climate change utilising financial levers, while also maintaining the best outcomes for savers, are fast-moving and complex. We will be an active, influential and bold voice in those debates.

As our Corporate Strategy highlights, the pensions landscape, the needs of savers and the wider regulatory framework around us, are evolving rapidly. The socio-economic and political impacts that climate change will bring are a prime example of where regulatory frameworks will evolve to manage this changing environment.

As a regulator, we will continue to use our in-depth knowledge of the pensions industry to help government as it continues to develop policy, to take account of the needs of savers and the challenges trustees face when running their schemes. Via our joint work with the FCA on consumer journeys, we will seek to better understand how savers view climate change and if it can be used to drive behaviour change on climate risks.

In Autumn 2021, we will publish our Climate Adaptation Report, which will outline our findings on how those running pension schemes are responding to and managing the risks and opportunities from climate change. This new research, as well as information gathered from our supervisory activities, will enable us to present and advocate for well-informed, rounded policy proposals.

We will ask about climate change in our Perceptions Tracker survey so we can monitor opinions and perceptions of us as a regulator. We will monitor our share of voice on climate change in the media by developing our tracking tool.

| Products/outputs under ‘Influencing the debate’ | To meet/support objective |

|---|---|

| Climate change content in communications and media campaigns | 3 |

| Measurable increase in share of voice in relation to climate change across online, print and social media | 3 |

| Publish Climate Adaptation Report in autumn 2021 | 5 |

| Track views about climate change via Perceptions Tracker survey | 3 |

Taking part in the transition

Climate change is relevant to the decisions we make as a business, from the strategic to the everyday.

We believe it is only right to apply high standards to ourselves as well as those we regulate. To that end, we will develop and improve our own behaviour as an organisation in relation to climate change.

We have already taken steps in this direction, for example we have a Sustainability Network led by volunteers from our staff and supported by senior management. The network has produced a report on greenhouse gas emissions from 2012 to 2020, finding a reduction during this period – but also finding that this was not the full story as it did not include 'known unknown' emissions, such as commuting, home working and outsourced IT. We will continue to work to better understand our environmental impact.

We will continue to build in climate change considerations when we make major operational decisions. For example, we are currently reviewing our accommodation strategy as the lease on our premises runs out in 2023 and one of our core design principles is a commitment to reduce negative environmental impacts.

We will bring this work into a coherent and forward-looking picture by setting ourselves a challenging target of achieving net zero greenhouse gas emissions by 2030.

We will disclose our plans to reach the target by reporting in line with the recommendations of the Taskforce on Climate-related Financial Disclosures.

Our approach to the TCFD recommendations would be as a non-financial entity, for example we do not hold financial assets on which to report. However, we are part of a financial system for which TCFD is transforming management of climate risk and so it is consistent for us to integrate this in our own practices where applicable. This will include reporting on the climate risks that we face in our operations and our plans for managing these.

| Products/outputs under ‘Taking part in the transition’ | To meet/support objective |

|---|---|

| Work to understand our environmental impact | 6 |

| Plan towards net zero by 2030 | 6 |

| Publish TCFD report | 6 |

Evaluation

We will set milestones as points at which to check against our objectives. We will see if we achieved what we set out to do, as part of the bigger picture of moving towards a landscape of resilient pension schemes that protect savings from climate risk.

Broader concerns

We are required by law to consider how our work impacts equalities. This is called the Public Sector Equality Duty and it helps us understand how our work can help create a pensions system that works for everyone.

In developing this climate change strategy, we considered how different people will be affected by the activities so that policies and services are appropriate and accessible to all and meet different needs.

The equality impacts of new requirements from the Pension Schemes Act 2021 have been assessed by the DWP. The DWP’s initial findings are that protected characteristics are not adversely impacted: the proposed regulations require disclosure of the information and protected characteristics have no bearing on whether the information will be provided to members. The DWP will use statutory guidance to set out expectations around the accessibility of the content. For example, to address any issues with online access, the DWP proposes that all members be notified of the circumstances when they request a hard copy of the TCFD report in their annual benefit statement.

In developing policies and guidance that implement the strategy, we will undertake further equality impact assessments. These may consider, for example, the differing needs and interests of DB and DC savers given the differing characteristics of those cohorts.

Our Corporate Strategy identified a shift in the pensions landscape towards DC schemes, where savers carry the direct financial risk on their investments. The pensions they will receive are more directly dependent on investment decisions made by trustees than is the case for DB schemes, and so trustee decisions on the risks and opportunities arising from climate change are particularly relevant for DC savers. A high proportion of Generation X - those born between 1965 and 1984 - and most Millennials - those born between 1985 and 2004 - fall into this group. This is particularly the case for lower income savers. DC schemes also, on average, tend to have a greater proportion of women and BAME savers. As such, while action on climate change is important from all trustees, no matter the type of pension scheme, we believe particular urgency is required from DC trustees, whose savers are most directly at risk in this context.

We will also consider equality impacts as we develop ideas about how we will take part in the transition to net zero as a business.

Climate change in itself is an issue of inequality. The UN says:

“The impacts of climate change will not be borne equally or fairly, between rich and poor, women and men, and older and younger generations.”

Impacts fall most heavily on those already more vulnerable, and already with the least resources to respond. As we put our climate strategy into action we will keep this overarching inequality in mind.

Footnote

[1] Not all schemes currently have to publish their implementation statement, but all schemes that produce a SIP must do so by 1 October 2021.