Valuations and recovery plans of UK defined benefit and hybrid pension schemes.

Published: 17 August 2023

You can save the contents of this page as a PDF using your web browser. Open the print options and make sure the destination/printer is set as 'Save as PDF':

Overview

This is the 2023 update to The Pensions Regulator’s (TPR’s) annual funding statistics for UK defined benefit (DB) and hybrid schemes. The underlying data are sourced from valuations and recovery plans submitted to TPR both for schemes with deficit positions, and from annual scheme returns for schemes with surplus positions. The tables in the annex are prepared in accordance with the UK Code of Practice for Official Statistics.

The update is based on tranche 16 schemes with effective valuation dates falling from 22 September 2020 to 21 September 2021 inclusive.[1] These valuations fall within the sixth triennial cycle of scheme funding with due dates for receipt falling within the period December 2021 to December 2022.

This report shows funding trends in the context of market conditions, assumptions and scheme characteristics that impact on valuations. It also describes reported arrangements for recovery plans, employer contributions and contingent security.

The report is comprised of several sections. Specifically, Section 2 summarises the key figures in the current tranche. Section 3 discusses market conditions associated with the current tranche. Funding levels are summarised in Section 4 and funding strategies are summarised in Section 5. Valuation assumptions are reported in Section 6. Data summaries (tables) contained in the annex provide more detail on the high-level trends presented in this document. Note that tranche 16 schemes belong in the cohort with tranches 1/4/7/10/13, meaning comparisons with other years will generally be limited to these tranches.

Footnotes for this section

- [1] Please note that the effective valuation dates for tranche 16 do not cover instability in gilt yields as a result of liability-driven investment (LDI) strategies in September 2022.

Tranche 16 summary

By 26 June 2023, TPR had received over 1,710 valuations (annex Table 1.1) with an effective valuation date covered by tranche 16. Of schemes submitting these valuations, 70.6% had previously submitted valuations in tranches 13, 10, 7, 4 and 1.

Overall, 38.7% of schemes reported a surplus on the technical provisions (TPs)[2] funding basis (annex Table 1.2a).

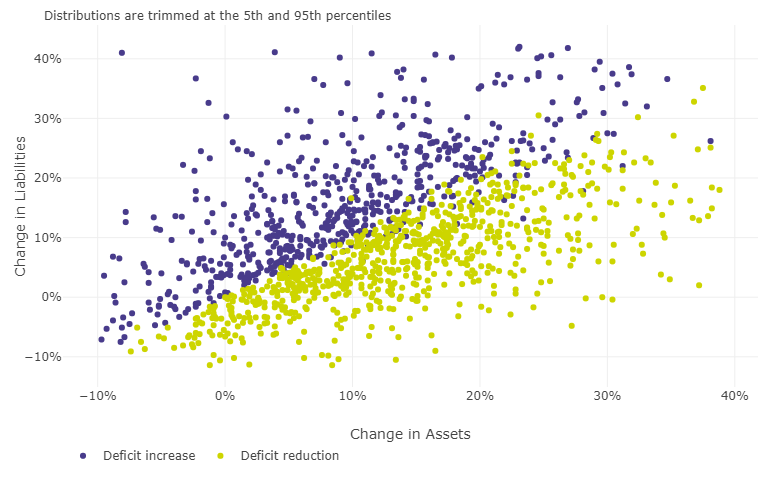

Assets, liabilities and deficits/surpluses in this report are defined on a TP basis, unless otherwise stated. See the glossary section in the annex for further information. Assets and liabilities grew at approximately equal rates between tranche 13 and 16 for a majority of schemes, resulting in a relatively unchanged average[3] funding ratio on a TPs basis (annex Table 2.1a). Compared to tranche 13, average annual deficit reduction contributions (DRCs)[4] as a proportion of TPs for tranche 16 are lower at the median in nominal terms (annex Table 3.4). The relative increase in average annual DRCs between tranches 13 and 16 is 7.9% at the median in nominal terms, while the median extension to the recovery plan (RP) end date is 2.3 years.

Figure 1, below, illustrates the distribution of changes in deficits measured on a TPs basis for tranche 16 schemes that previously submitted tranche 13 valuations (1600 total schemes in both tranches). At the median, scheme assets grew by 11.4%, whereas TPs grew by 9.7%. The median relative change in deficits for all schemes was -6.8%, with 54.4% of all schemes experiencing a reduction in deficit over the inter-valuation period.

Figure 1: distribution of the change in deficits from tranche 13 to tranche 16 (all schemes in both tranches)

Source(s): TPR

Key figures at a glance

- Schemes in surplus: 38.7%.

- Average ratio of assets to TPs for schemes in deficit and surplus: 93.7% (median: 95.4%).

- Average ratio of assets to TPs for schemes in surplus: 109.5% (median: 105.9%).

- Average ratio of assets to TPs for schemes in deficit: 84.4% (median: 88%).

- Average recovery plan length for schemes in deficit: 5.7 years (median: 5 years).

- Average nominal single effective discount rate (SEDR) for tranche 16 schemes in deficit and surplus: 1.86% (median: 1.83%) with 50% of assumptions falling on or between 1.51% and 2.22%. SEDR is defined in the methodology section of the annex.

- Average real SEDR for schemes in deficit and surplus -1.56% (median: -1.52%); with 50% of assumptions falling on or between -1.82% and -1.19%.

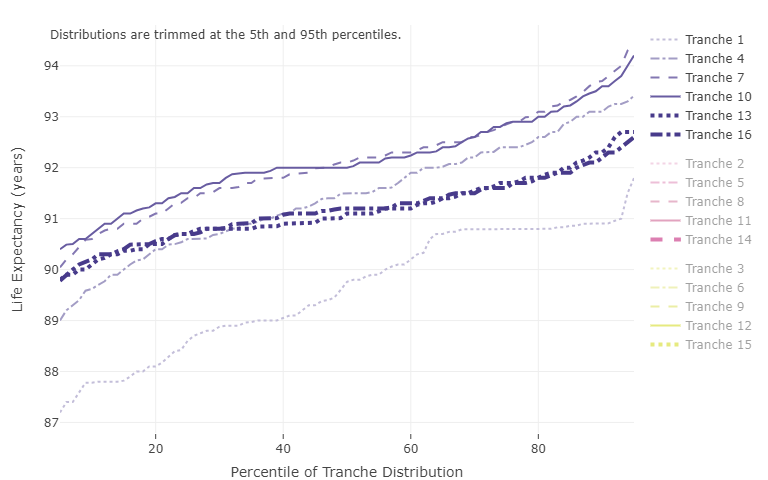

- Median life expectancies (years) of future pensioners currently aged 45 for schemes in deficit and surplus; male: 88.7; female: 91.2.

Footnotes for this section

- [2] Technical provisions are a calculation undertaken by the actuary of the assets needed at any particular time to make provision for benefits already considered accrued under the scheme using assumptions prudently chosen by the trustees - in other words, what is required for the scheme to meet the statutory funding objective. These include pensions in payment (including those payable to survivors of former members) and benefits accrued by other members and beneficiaries, which will become payable in the future.

- [3] Where ‘average’ is used in the report, it refers to the mean.

- [4] Deficit reduction contributions are contributions made by sponsors to the scheme in order to address any asset to TPs deficit, in line with the Schedule of Contributions and the recovery plan.

Market conditions

The FTSE All-Share (UK equities) Returns Index for the inter-valuation period between 31 March 2018 and 31 March 2021 (which includes the effective date of many tranche 16 valuations) was 9.9%.[5]

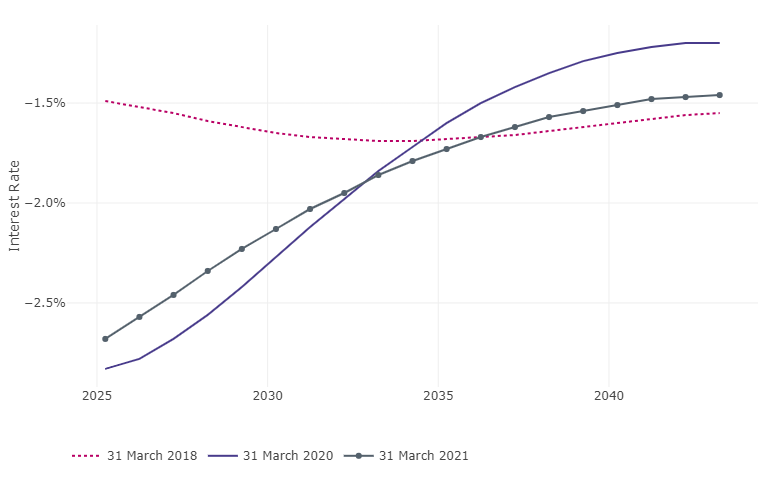

Figure 2, below, shows market expectations for real interest rates as estimated by the Bank of England in the inter-valuation periods.

Forward interest rates at the end of March 2021 potentially indicate market expectations for rising yet negative rates over the time horizon.

Figure 2: UK instantaneous real forward curves

Source(s): Bank of England

Footnotes for this section

- [5] Source: Refinitiv

Funding levels

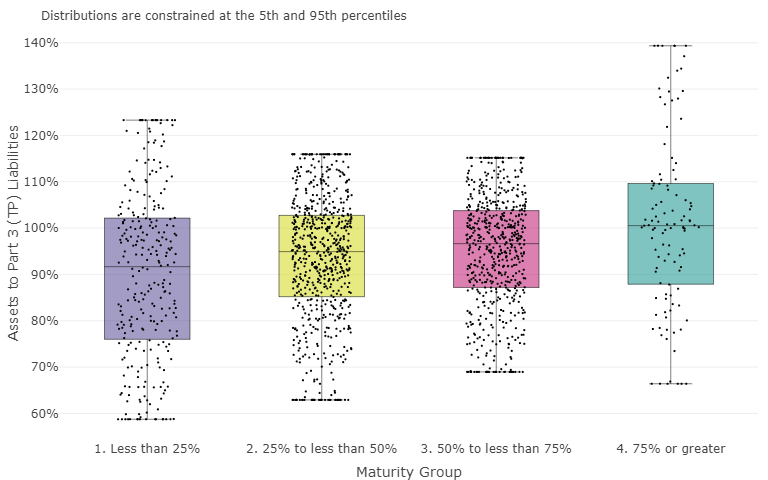

Figure 3, below, shows the distribution of the ratio of assets to TP liabilities for tranche 16 schemes according to scheme maturity group. The four categories describe a scheme’s ratio of pensioner TPs to total TPs.

The median level of TP funding ranges from 94.9% among schemes with maturity levels between 25% and 50% to 100.5% for schemes with maturity levels of 75% or greater.

Figure 3: assets to Part 3 (TP) liabilities (%) by maturity (tranche 16, all schemes)

Source(s): TPR

Tranche 16 schemes saw improved asset positions compared to tranche 13 schemes in the previous cycle. This may have been due to the combined impact of:

- sponsor contributions (regular and remedial)

- positive (overall) gains on investments in the three years to valuation

- Average ratio of assets to TPs for schemes in deficit and surplus: 93.7% (median: 95.4%; annex Table 2.1a)

- Average ratio of assets to TPs for schemes in surplus: 109.5% (median: 105.9%)

- Average ratio of assets to TPs for schemes in deficit: 84.4% (median: 88%; annex Table 2.3a)

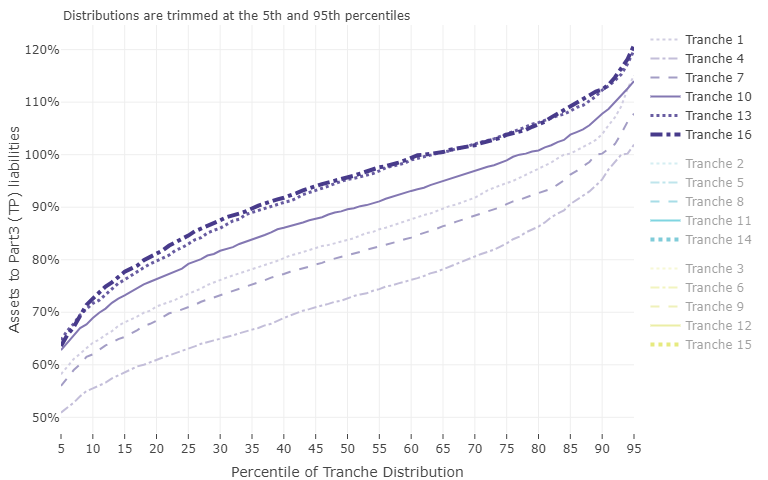

Figure 4, below, illustrates the distribution of the ratio of assets to TPs for tranches 1, 4, 7, 10, 13 and 16. Funding levels in tranche 16 were similar to those seen in tranche 13. At the median, the TP funding ratio for tranche 16 was 95.7%, and was 95.3% within tranche 13.

Figure 4: ratio of assets to part 3 (TP) liabilities (%) (all schemes, all tranches)

Source(s): TPR

For schemes submitting valuations in both tranche 13 and tranche 16, the median increase in asset values between valuations was 11.4%, and the median increase was 9.7% for TPs. The average ratio of assets to TPs for tranche 16 was 93.7% (99.2% weighted[6]). This represents a 0.2 percentage point change on average over tranche 13. The average ratio is generally higher for schemes:

- that report liabilities in respect of active memberships

- with stronger covenants (deficit schemes only)

- without a contingent asset

- with shorter recovery plans

- that are more mature

For schemes in surplus only, the average ratio of assets to TPs was 109.5% (105.7% weighted).

See Tables 2.1 and 2.3 in the annex for further detail on funding ratios

Footnotes for this section

- [6] Weighted by TPs

Funding strategies

Recovery plans

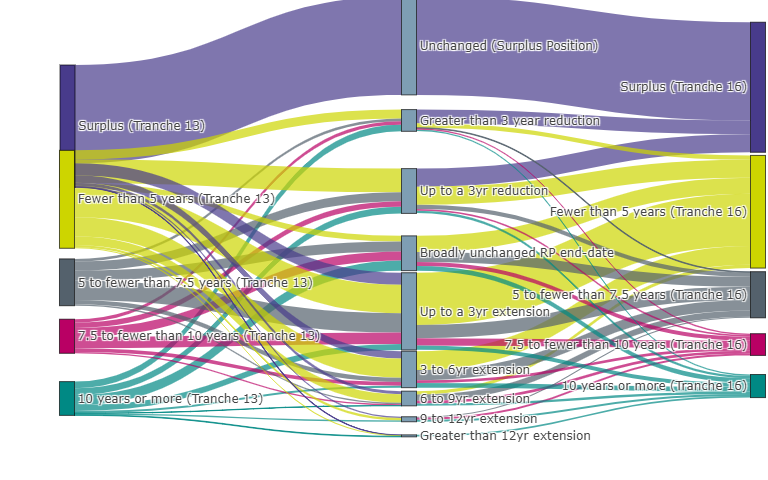

Overall, 29.1% of schemes with valuations in both tranche 13 and tranche 16 reported a surplus of assets over liabilities in both tranches. Of schemes in both tranches, 9.8% moved into a position of surplus and 7.2% moved into deficit from a surplus position in tranche 13.

Over half, 53.9%, of schemes with valuations in both tranche 13 and tranche 16 were in deficit in both tranches. However, 71.9% of these schemes had a shorter RP in tranche 16 compared to that agreed under the tranche 13 valuation, in part due to a reduction in the size of their deficit.

Given the (broadly) three year inter-valuation period itself, a reduction in RP length of less than three years between tranches still represents an extension to the date at which the scheme is anticipated to be fully funded. Figure 5, below, shows the distribution of changes to recovery plan end dates for tranche 16 schemes that had previously submitted tranche 13 valuations. Over half of schemes - 61.0% - have brought forward their RP end dates or have left them broadly unchanged (including those which remain in surplus). Conversely, 21.7% of schemes have extended their RP end date by up to three years (representing a RP of a similar length in tranche 16 relative to that agreed in tranche 13), with 17.3% extending their RP end date by more than three years.

Figure 5: distribution of changes to recovery plan end dates, by tranche 13 and tranche 16 recovery plan length groups (schemes in both tranches 13 and 16)

Source(s): TPR

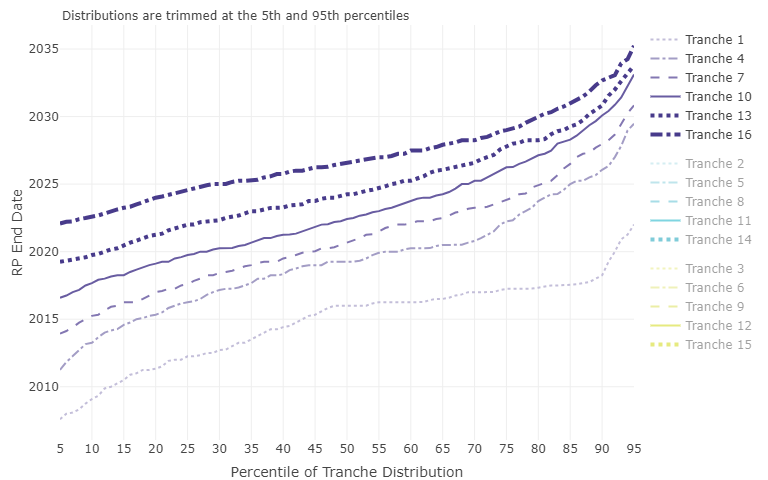

Figure 6, below, highlights the distribution of RP end dates by tranche (tranches other than the 1/4/7/10/13/16 cohort are hidden by default).

Compared with tranche 13, tranche 16 end dates have increased by 2.3 year at the median, 1.3 years at the 75th percentile and 1.5 year at the 95th percentile.

Figure 6: distribution of recovery plan end dates (schemes in deficit, all tranches)

Source(s): TPR

In respect of their first valuations under scheme-specific funding, schemes in tranche 1 had a median RP end date falling in 2016. Under the sixth cycle of funding, broadly the same set of schemes have a median RP end date falling in 2026.

The mean and median RP lengths for tranche 16 schemes in deficit were 5.7 and 5 years respectively. For tranche 13 these figures were 6.5 and 5.5 years respectively (annex Tables 3.3 and 3.1).

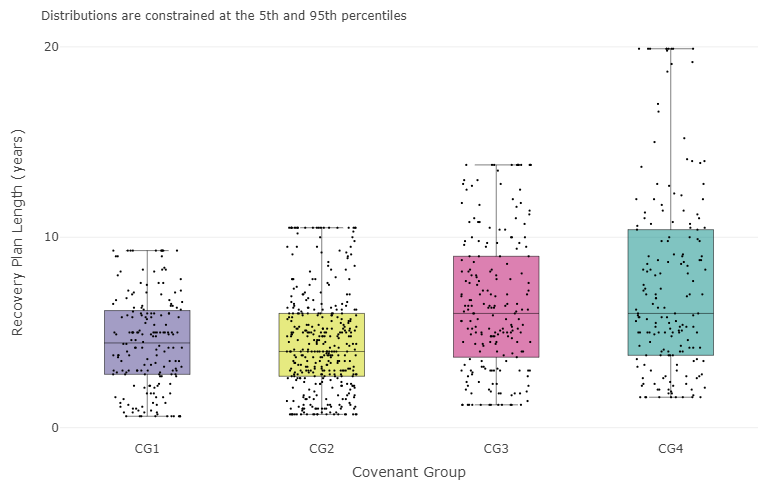

Longer recovery plans tend to be associated with schemes:

- with weaker covenant support[7]

- with lower levels of funding on a TP basis

- with at least one contingent asset (annex Table 3.3)

- holding higher proportions of return seeking assets

See Tables 3.1, 3.2 and 3.3 in the annex for more detail on RP length

Figure 7, below, shows the distribution of RP lengths for tranche 16 schemes by covenant group. Three quarters of schemes in covenant group 1 (strong) have recovery plans of up to 6 years, while the same proportion of schemes in covenant group 4 (weak) have recovery plans of up to 10 years.

Figure 7: distribution of recovery plan length by covenant group (tranche 16 schemes in deficit)

Source(s): TPR

Table 1, below, shows the median extension to RP end date according to covenant group migration. The largest increase is 2.3 years for schemes migrating from covenant group 1 to covenant group 2 over the inter-valuation period.

Table: Median recovery plan end date extension by covenant group migration (tranche 16 schemes in deficit only)

| Covenant Group (Tranche 16) | ||||

|---|---|---|---|---|

| Covenant Group (Tranche 13) | 1 | 2 | 3 | 4 |

| 1 | 1.2 | 2.3 | ||

| 2 | 0.8 | 1.1 | 1 | 1.7 |

| 3 | -0.1 | 0.6 | 0.6 | 0.2 |

| 4 | 0.5 | 0.7 | 1.9 | |

Contributions

The relative increase in average annual DRCs between Tranches 13 and 16 was 7.9% at the median. The same figure between Tranches 10 and 13 was 3.1% at the median.

As a proportion of liabilities calculated on a TPs basis, the average annual DRCs for tranche 16 schemes was 2.1%.

This figure was influenced by increases in liabilities calculated on a TPs basis, as well as changes in nominal DRCs. The median increase in TPs was 9.7% and the corresponding relative increase in average annual DRCs was 7.8%. A higher level of DRCs as a percentage of liabilities on a TPs basis is associated with:

- shorter recovery plans

- smaller schemes (by both TPs and members)

- lower maturity

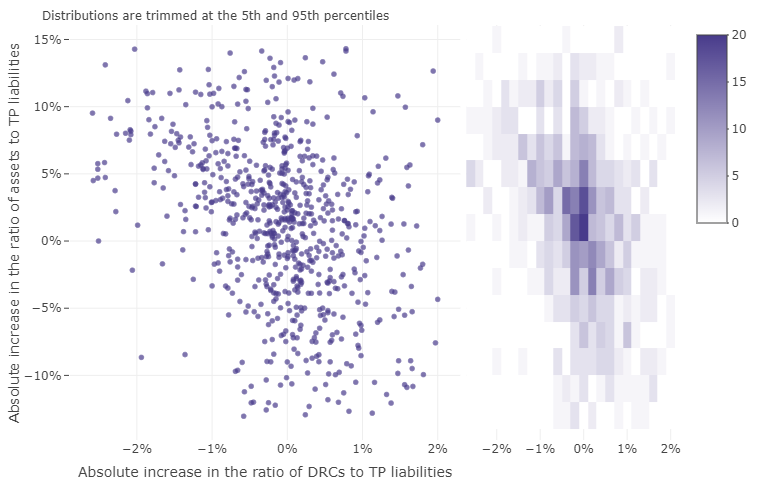

- schemes with a lower ratio of assets to TPs

Figure 8, below, shows the extent to which the percentage point increase in average annual DRCs as a proportion of TPs varies by the percentage point increase in TPs funding between tranche 13 and tranche 16 (schemes in deficit). This suggests a general inverse relationship between increases in DRCs and assets as a proportion of TPs.

Figure 8: absolute percentage increase in DRCs as a proportion of TP liabilities vs. Absolute percentage increase in the ratio of assets to TPs (schemes in deficit only; tranche 13 to 16)

Source(s): TPR

Asset allocation

Approximately 58.4% of tranche 16 schemes have less than 40% of assets invested in return-seeking[8] asset classes, while around 15.5% of schemes have more than 60% allocated to return-seeking asset classes (annex Table 1.2a).

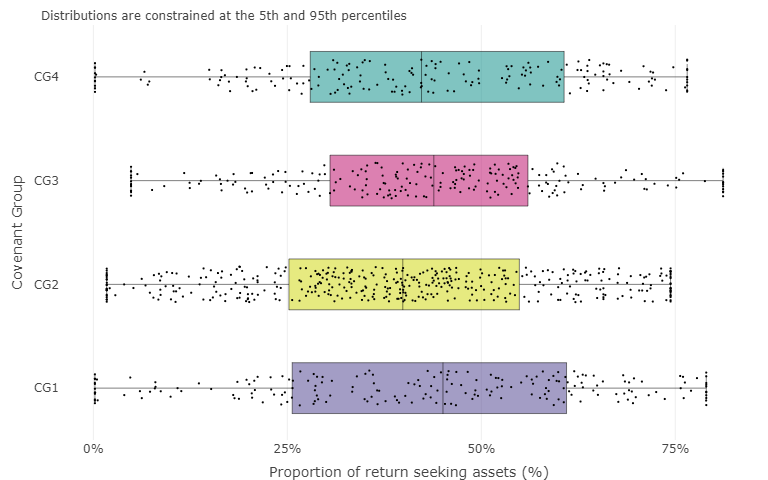

Figure 9a, below, shows the distribution of return-seeking assets by covenant group. The median allocation to return-seeking assets was 45.1% for covenant group 1 schemes. For covenant group 4 schemes, this value was 42.3%. The allocation to return-seeking assets is distributed fairly similarly across covenant groups.

Figure 9a: distribution of return-seeking assets by covenant group (tranche 16 schemes in deficit)

Source(s): TPR

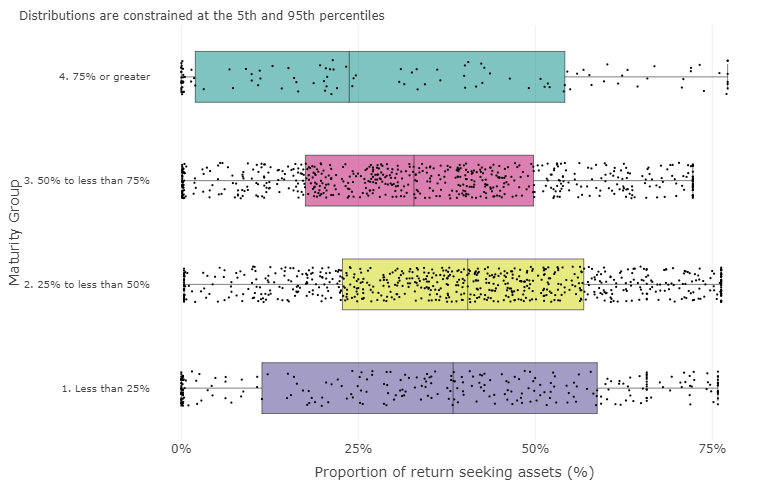

Figure 9b, below, shows the distribution of return-seeking assets by maturity group (as measured by the ratio of pensioner liabilities to total liabilities). The median allocation to return-seeking assets was 40.5% for schemes with 25% to less than 50% maturity, compared to 23.7% for schemes with greater than 75% maturity. Generally, we observe a decreased allocation to return-seeking in the most mature group, compared to the other groups.

Figure 9b: distribution of return-seeking assets by scheme maturity group (tranche 16 schemes in deficit)

Source(s): TPR

Contingent security

Within tranche 16 schemes, 15.4% of schemes had additional security in the form of one or more contingent assets. These typically, but not always, take the form of guarantees from a sponsor’s parent or associated group entity.

Within the current tranche, 5.9% of schemes had contingent assets that are formally recognised by the PPF in the calculation of the PPF risk-based levy, whereas 9.6% had contingent assets that are not recognised by the PPF but are reported as additional security in support of funding.

The presence of contingent assets is associated with larger schemes, by both members and liabilities.

See Tables 2.6 and 2.7 in the annex for more information on contingent security

Footnotes for this section

- [7] Covenant Groups (1-4) are assigned at the point of initial RP reviews to facilitate prioritisation. These grades may vary to the view taken during case-level intervention, where a wider range of information is taken into account. They are defined as: Covenant Group 1 - strong; Covenant Group 2 - tending to strong; Covenant Group 3 - tending to weak; and, Covenant Group 4 - weak. Covenant assessments are not usually undertaken for schemes in surplus

- [8] ‘Return-seeking assets’ in this report include equities, commodities, 60% of insurance policies, 75% of property, 80% of hedge funds, 25% of corporate bonds and assets held in the ‘other’ category

Valuation assumptions

Discount rates

Market experience and changing expectations over the inter-valuation period may be reflected in discount rates to varying degrees, depending on investment strategy and/or valuation approach. The statistics show an association between the TPs discount rate and a scheme’s investment strategy. The investment strategy of a scheme is approximated here by the scheme’s allocation to return-seeking assets. It may also consider the ability of the employer to underwrite downside risk.

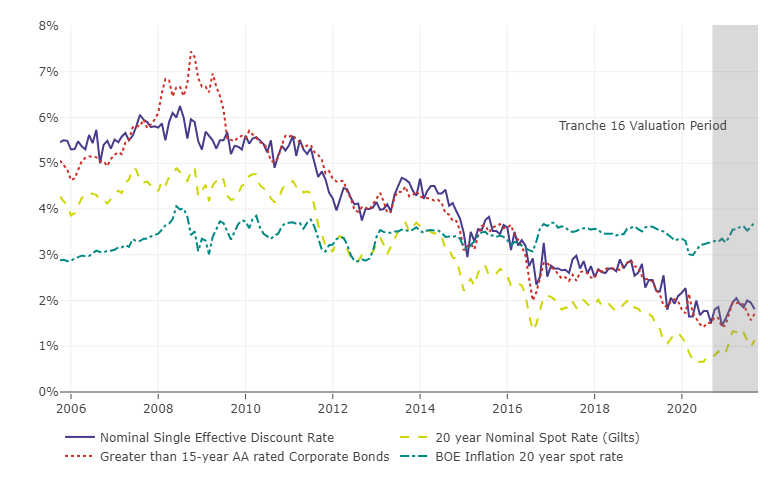

The 20-year nominal spot rate on gilts was 1.13% at the end of the tranche 16 valuation period. The gap between implied inflation and the nominal gilt yield, which had widened during the tranche 13 to tranche 16 inter-valuation period, kept real yields negative over the three-year period between most valuations.

For 31 December 2020 and 31 March 2021 (the two most common tranche 16 valuation dates), the 20-year spot rates on gilts were 0.73% and 1.37% respectively, while the corresponding median single effective discount rates (SEDR) for valuations were 1.60% and 2.05% respectively.

Figure 10, below, shows the median SEDR relative to 20-year UK gilts, 20-year spot inflation, and greater than 15-year AA-rated corporate bonds (for schemes in deficit in tranches 1 to 7 and for all schemes in tranches 8 to 16).

Figure 10: median (nominal) SEDR, Bank of England nominal gilts 20-year spot rate, greater than 15-year AA corporate bonds, and BOE 20-year inflation

Source(s): TPR, Thomson Reuters, Bank of England, Markit iBoxx

The average real SEDR was -1.56% for tranche 16, compared to -0.77% for tranche 13. The average outperformance of the real SEDR over the 20-year real government spot rate was 0.84% for tranche 16, compared to 0.87% for tranche 13.

See Table 4.2 in the annex for more information on discount rates

Life expectancies

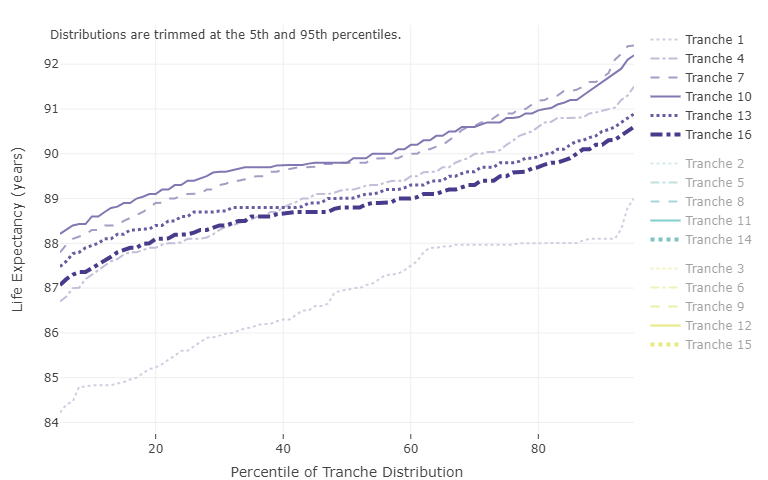

While there were notable increases in average assumed life expectancies over the first three funding cycles, reflecting stronger mortality assumptions over that period, assumptions regarding average life expectancy are generally lower for tranche 16 schemes relative to tranches 13 and 10, for both future and current pensioners.

See Tables 6.1 - 6.2 in the annex for more information on life expectancies

This reflects the general trend observed in the wider population over the last few years and that almost all schemes use the CMI mortality projection model when allowing for future improvements (see Tables 5.1 - 5.4 in the annex).

In respect of the underlying mortality assumptions:

- 85.8% of tranche 16 schemes used the Self-Administered Pension Scheme (SAPS) tables

- 54.5% applied a scaling factor or rating to base tables to adjust for scheme experience

- 95.2% used the continuous mortality investigation (CMI) projection model (first published in 2009) to allow for future improvements

- while 82% of schemes assumed a long-term rate of improvement/underpin of 1.5% or higher with 6.2% assuming a rate of 2% or higher

Figures 11a and 11b, below, show the distribution of assumed life expectancies for future male and female pensioners currently aged 45 respectively, for tranches 1, 4, 7, 10, 13 and 16. Generally, tranche 16 life expectancy is at its lowest for both males and females since tranche 1.

Figure 11a: distribution of life expectancy assumptions for future male pensioners currently aged 45 (all tranches)

Source(s): TPR

Figure 11b: distribution of life expectancy assumptions for future female pensioners currently aged 45 (all tranches)

Source(s): TPR