Guidance

The role of the employer and what they need to think about in relation to their scheme if considering a corporate transaction.

Issued: June 2009

Ensuring proper support for pension scheme liabilities

There are many responsibilities for employers with regards to their pension scheme.

As an employer considering a corporate transaction, you'll want to satisfy yourself that you run little or no risk of being targeted by the regulator's powers to ensure defined benefit pension schemes are properly supported.

In addition to ensuring you fulfil any legal requirement arising from the transaction, including to the pension scheme, you'll need to understand the full effect of any corporate transaction on the security of the scheme.

Some corporate transactions could affect the sponsors' ability to meet their obligations to the pension scheme either on an ongoing basis or in the event of insolvency and would, as a result, be detrimental to the scheme. These transactions could, potentially, be seen as falling within the remit of our anti-avoidance powers.

However, in the vast majority of corporate transactions we do not expect it will be necessary, or proportionate, for us to take action. We've put together some examples which illustrate our approach to the material detriment test grounds of our anti-avoidance powers.

Understanding the effect on the scheme of a corporate transaction

When considering taking a business decision that affects the company's finances or underlying structure it's important that:

- you work with the trustees in order to understand the nature and impact of the event and whether appropriate mitigation to the pension scheme needs to be made;

- conflicts of interest are managed appropriately (both employers and trustees may need to seek independent professional advice); and

- you take a systematic approach – keeping a record of advice, decisions and outcomes (your records could form part of a statutory defence should we ever decide to consider a contribution notice on the grounds of material detriment).

Clearance statement

If you need certainty that you are not at risk from the regulators' anti-avoidance powers before undertaking a transaction that could be detrimental to the pension scheme, you can apply to us for a clearance statement. (A clearance statement will not give you approval of a transaction, but it will give you assurance that we won't use our anti-avoidance powers in relation to that transaction.)

Clearance is a voluntary process. It is only relevant where consideration of the proposed transaction has led you to believe that it may be materially detrimental to the ability of the scheme to meet its pension liabilities.

Of course, you may be able to come to the conclusion that the transaction is not materially detrimental, or has been properly mitigated, from discussions with trustees or from legal advice, without the need to seek clearance from us.

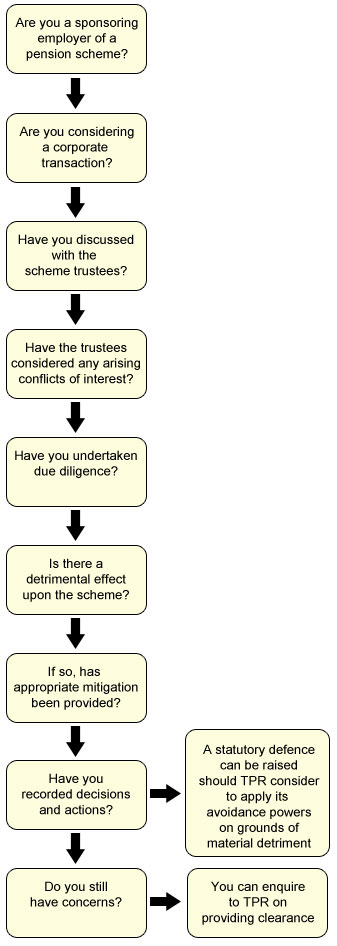

Below is a diagram outlining questions you may wish to answer when undertaking a corporate transaction. This will help you to understand your position in relation to the regulator's anti-avoidance powers.

Employer considerations in respect of the material detriment test

Transcript of the flowchart - employer consideration in respect of the material detriment test (PDF)

Read our clearance guidance which explains the clearance process, transactions and events that are materially detrimental to the scheme.