This is the draft code of practice for the authorisation and supervision of collective defined contribution schemes (the CDC code).

You can save the contents of this page as a PDF using your web browser. Open the print options and make sure the destination/printer is set as 'Save as PDF':

Introduction

This code of practice is issued by The Pensions Regulator (TPR), the body that regulates occupational pension schemes in the UK. It relates to the authorisation and supervision of collective money purchase schemes (known as collective defined contribution or CDC schemes), which were introduced by the Pension Schemes Act 2021 (the Act) and the Occupational Pension Schemes (Collective Money Purchase Schemes) Regulations 2022 (the Regulations).

The publication of this code of practice is a statutory requirement1. This code’s purpose is to set out clearly how an application for authorisation must be made and the matters we will take into account when considering applications. The code will help those involved in CDC schemes to understand how to satisfy us that the authorisation criteria are met at application and continue to be met throughout supervision.

It sets out the information we expect to use for our assessment, and the standards we expect to see. If we are not satisfied that a CDC scheme meets all the criteria, we must refuse to authorise it: our decision on this will be informed by the expectations in this code.

This code applies to those involved in the operation of a CDC scheme, for example trustees and their advisers.

This code assumes that trustees have a good knowledge of all relevant legal requirements and of our expectations in other codes of practice, which may apply in addition to this code and the CDC legislation.

Our statutory objectives are:

- to protect the benefits of pension scheme members

- to reduce the risk of calls on the Pension Protection Fund (PPF)

- in relation to the exercise of functions under Part 3 of the Pensions Act 2004 only, to minimise any adverse impact on the sustainable growth of an employer

- to promote, and improve understanding of, the good administration of work-based pension schemes

- to maximise compliance with the duties and safeguards in the Pensions Act 2008

We have several regulatory tools, including issuing codes of practice, to enable us to meet our statutory objectives. Codes of practice give practical guidelines about the requirements of pension legislation and set out standards of conduct and practice expected of those who must meet these requirements.

This code is supported by a number of products, including guidance, which assist trustees in applying for authorisation and throughout supervision to understand the evidence that must be provided.

Status of this code of practice

Codes of practice are not statements of the law and there is no direct penalty for failing to comply with them, although the Regulations require some parts of this code to be complied with and provide for penalties if they are not. This is known as a legislative underpin, and the code indicates which parts this applies to. In addition, when determining whether the legal requirements have been met, a court or tribunal must take account of any provisions of a code that it considers relevant.

We make a clear distinction between legal duties and our expectations in the code by using the word ‘must’ when referencing legal duties, and ‘should’ for our expectations. We use ‘need’ if the process is necessary to allow a scheme to operate but there is no expectation or legal requirement.

The code sets out what we will consider in deciding whether we are satisfied that a CDC scheme meets the authorisation criteria. This includes the information we expect to take into account in our assessment and the standards we expect to see. If we are not satisfied that a CDC scheme meets all the criteria then we must not authorise it (or may de-authorise it), and our decision on this will be informed by the expectations we have set out in this code.

If there are grounds to issue a risk notice, improvement notice or compliance notice, we may direct a person to take, or not to take, steps specified in the notice. These directions may be worded by reference to a code of practice issued by us, and failing to comply with an improvement notice or compliance notice carries a penalty. If we decide not to authorise a CDC scheme, or to de-authorise a CDC scheme after it has been authorised, the reasons for our decision may refer to this, or any other, code of practice.

Authorisation

CDC schemes must be authorised in order to operate2 and this code sets out the process for trustees to make an application for authorisation. For a CDC scheme to be authorised, we must be satisfied that it meets all the authorisation criteria3.

This code sets out what we expect to take into account in deciding whether we are satisfied that a CDC scheme has met the criteria. The code should be read in conjunction with the relevant legislation and accompanying guidance that gives more practical information about how trustees can show that the scheme meets the authorisation criteria.

The application for authorisation must be submitted by the trustees and must be in our required format4. The application form will guide trustees through the information and evidence that must be submitted.

If a qualifying CDC scheme or a scheme that is intended to be a CDC scheme does not meet the legislative requirements or does not apply for authorisation before it starts to operate, it must cease operating and wind up. It must also wind up if it is subsequently de-authorised.

We expect trustees to be open and honest in the information they provide and in their dealings with us. Providing false or misleading information could lead to a CDC scheme not being authorised or being de-authorised.

Supervision

Once a CDC scheme is authorised, those running it must continue to satisfy us that it meets the authorisation criteria. Our continuing assessment of this is called supervision.

Supervision is a risk-based, proactive process that allows us to understand how a CDC scheme continues to meet the authorisation criteria. As part of this process, there will be a supervisory return containing updates against the criteria. We can ask for this no more than once a year. Significant events must also be reported to us as they may have an immediate impact on a scheme’s continuing ability to meet one or more authorisation criteria.

If we are no longer satisfied that a CDC scheme meets the authorisation criteria, we may take regulatory action, including de-authorising it5.

Footnotes for this section

- [1] Section 90(2)(jc) and (jd) of the Pensions Act 2004

- [2] Section 7(1) of the Act

- [3] Section 9(1) of the Act

- [4] Section 8(1) and (2) of the Act

- [5] Section 30(1) of the Act

What is a CDC scheme?

This section of the code covers the characteristics that a CDC scheme must have to be eligible to apply for authorisation. If a scheme does not meet the legislative requirements, we cannot assess an application to authorise it and it cannot operate. This section summarises the position using definitions taken from the Act and Regulations, and should be read in conjunction with them.

Trustee boards should consider taking professional advice to establish that their scheme has the characteristics required by legislation.

A CDC scheme6 is defined as an occupational pension scheme that:

- is a qualifying scheme or a section of a qualifying scheme

- can provide only qualifying benefits

A qualifying scheme or section of a scheme7:

- is an occupational scheme established under an irrevocable trust by an employer

- is not a relevant public service scheme

- is only used, or is only intended to be used, by a single employer or two or more connected employers

Employers are connected8 if they:

- are group undertakings in relation to each other as defined in section 1161(5) of the Companies Act 2006, or

- are structured so that the economic position of the shareholders of each company is, as far as practicable, the same as if they held shares in a single company that makes up the combined business

A qualifying benefit9:

- includes the payment of a pension

- is provided from the available scheme assets (ie assets that come from member and employer contributions and are available to pay benefits collectively)

- will be adjusted periodically in accordance with the scheme rules

- does not include other benefits or otherwise qualifying benefits with different characteristics

If a CDC scheme has qualifying benefits and other benefits, for example a lump sum or a DC benefit at an individual level, these must be separated into different sections and only the qualifying benefits will be subject to authorisation10. To be separated correctly:

- a section providing a qualifying benefit cannot provide any other type of benefit

- contributions made in respect of a qualifying benefit must only be made into a section providing qualifying benefits

- assets are apportioned to each section and cannot be used for paying the benefits of a different section

All qualifying benefits provided in a section must accrue at the same rate or amount for all members in that section, have the same rate or amount of contributions paid by or on behalf of members in that section and have the same normal pension age for all members in that section. Where an employer wishes to change any of these characteristics, or where there are different characteristics at first application, the benefits must be provided under a different section and each section must be authorised, either at initial application or as different qualifying benefits are created.

Footnotes for this section

- [6] Section 1 of the Act

- [7] Section 3 of the Act

- [8] Section 49(2) of the Act and regulation 3 of the Regulations

- [9] Sections 2 and 3 of the Act

- [10] Section 3(6) of the Act

Applying for authorisation

CDC schemes must be authorised in order to operate11, and this code describes the process for trustees to apply for authorisation.

The application for authorisation must be submitted by the trustees in our required format12. Trustees must satisfy us that the scheme meets the authorisation criteria, and the application forms will guide them through the evidence that must be submitted.

If we are satisfied that the authorisation criteria are met, we must authorise the scheme13.

If we are not satisfied that a scheme meets all the criteria, we must refuse to authorise it14.

If we decide not to authorise a scheme, we will give reasons and you may refer the decision to the Upper Tribunal15.

Once operating, a scheme must continue to meet all authorisation criteria for it to remain authorised.

This section of the code covers:

- the initial application process, including:

- a summary of the evidence to be submitted

- the process and timeline for an application

- how to apply for more than one section

- how to apply for an additional section to an authorised scheme

- application fees

What to include in the initial application for authorisation

Authorisation criteria

Trustees must include the following in their application16:

In addition, for us to authorise an application we must be satisfied that17:

- those involved in the scheme are fit and proper persons

- the design of the scheme is sound

- the scheme is financially sustainable

- the scheme has adequate systems and processes to communicate with members and others

- the systems and processes used in running the scheme are sufficient to ensure that it is run effectively

- the scheme has an adequate continuity strategy

Application timeline

Trustees can apply for authorisation at any time. However, we strongly encourage trustees to engage with us before submitting a formal application. We will consider that an application has been made once we have received a completed application form and supporting evidence for each of the authorisation criteria, and the authorisation fee has been paid. We will check that the application is complete and tell you within seven days if anything is missing.

Once we are satisfied that we have received a complete application, we will inform you that the assessment period has begun from the date the application was submitted. We must tell you within six months of this date whether the scheme has been authorised18.

During the assessment period we may ask for information or clarification. We acknowledge that circumstances (such as corporate activity in the employer, or a change of trustee) may require you to update your application during the assessment period. Any changes should be sent to us, with reasons, as soon as possible. Because we have a statutory deadline of six months to make a decision, we are more likely to be able to take account of changes or new information if we are notified earlier in the assessment process.

Application fee

A standard fee of £77,000 must be paid by BACS transfer for us to accept receipt of a completed application19. If an application is withdrawn during assessment and then resubmitted, the resubmission will be treated as a new application and the full standard fee must be paid for it.

Applying for more than one section at initial authorisation

In applying to be authorised as a CDC scheme, trustees may seek authorisation for a scheme with one section (an undivided scheme) or multiple sections (a divided scheme). The reasons for separating a scheme into different sections are set out here.

For completeness, trustees must submit evidence about the authorisation criteria for each section regardless of whether there is any duplication between sections.

Explain how the sections differ

When applying for a divided scheme, trustees should explain in a separate mapping document how the sections differ from one another, referencing sections where this is the case. This document will need to describe the following:

- the reasons for having multiple sections.

- the level of shared management dependency across multiple sections, including:

- whether there are systems and process in place across all sections, and

- whether the same persons subject to fit and proper person requirements are common across all sections

- any differences in scheme design between sections as each will be assessed on its own merits for soundness and financial sustainability

- the strategy for communicating with members across multiple sections, highlighting the subject areas that will be common to all sections or specific to one or more sections – special care will be expected over messaging to members of more than one section

Application fee

When submitting multiple sections, trustees must designate the “primary section” that the standard fee of £77,000 will apply to20.

The fee for authorising each other section is calculated on a cost-recovery basis and will not exceed the standard fee21.

We will check that the application is complete for each section and tell you within seven days if anything is missing. As part of this check, we will assess the additional work and complexity involved in evaluating a multiple-section scheme, after which we will specify a non-negotiable fee for each section submitted that is not the primary section.

It is in trustees’ interests to clearly state the commonality and differences between sections so we can accurately assess how much resource is required to authorise each section. Trustees should provide a detailed table showing where commonality and management interdependency sit across all sections of the scheme. For example:

- if only the people already authorised as fit and proper in the scheme are to operate in another section, we will consider no further checks on their fitness and propriety necessary, but

- if a section introduces new systems and processes that are not presently used for the scheme, we will assess those new elements in full.

Applying for a new section to be added to an authorised scheme

When assessing a new section to be added to an already authorised scheme, we will apply the principles described above for authorising a divided scheme, namely that trustees should explain how the new section differs from those already authorised.

When applying for a new section, trustees must inform us which section the existing authorisation will apply to22. For completeness, trustees must submit evidence for all the authorisation criteria for the new section even if there is duplication with a previously authorised section23.

Application fee

The fee will be based on the approach outlined above for the non-primary sections of a divided scheme and will:

- be calculated on a cost-recovery basis

- not exceed the standard fee24

- be based on an upfront assessment of the level of duplication between the new and an existing section to estimate the level of analysis required.

If there is a high level of commonality with an existing section, then the learning gained through supervising the existing section should help in reducing the resource and time required to assess the new application. As above, it will be in trustees’ interests to state clearly the commonality and differences between the new and existing sections.

Footnotes for this section

- [11] Section 7(1) of the Act

- [12] Section 8(2) of the Act

- [13] Section 9(4) of the Act

- [14] Section 9(5) of the Act

- [15] Section 10 of the Act

- [16] Section 8(3) of the Act

- [17] Section 9(3) of the Act

- [18] Section 9(2) of the Act

- [19] Regulation 7(1) of the Regulations

- [20] Regulation 7(3) of the Regulations

- [21] Regulation 7(4) of the Regulations

- [22] Regulation 5(2) of the Regulations

- [23] Regulation 8(2) of the Regulations

- [24] Regulation 7(5) of the Regulations

The authorisation criteria

We will need to be satisfied that a CDC scheme meets all the authorisation criteria for it to operate in the market25.

The authorisation criteria are as follows26:

a. Fitness and propriety

All individuals being assessed must be able to satisfy us that they are fit and proper because they meet the standard of honesty, integrity and knowledge appropriate to their role.

b. Systems and processes

The scheme must have sufficient IT systems in place to run efficiently and have robust governance processes to manage the scheme effectively and comply with all relevant requirements.

c. Member communications

The scheme must have adequate systems and processes to communicate with members so they understand the risks and benefits of the scheme in particular how target benefits may change.

d. Continuity strategy

Sufficient contingency planning is crucial to the effective running of a scheme and there must be a credible strategy for how members will be protected if there is a triggering event.

e. Financial sustainability

A scheme must have sufficient financial resources to ensure us it can operate at set-up and thereafter following a triggering event without increasing the cost to members.

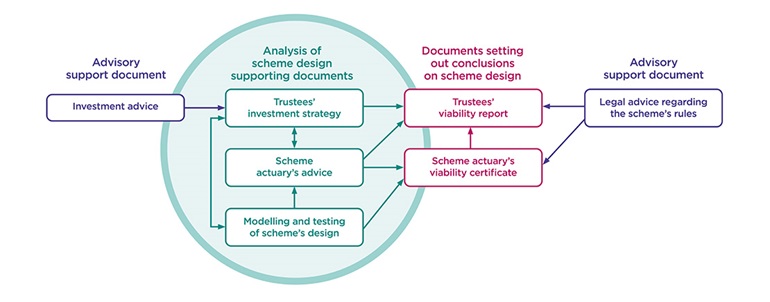

f. Sound scheme design

A scheme must have a sound scheme design. This should be demonstrated in the viability report supported by evidence including appropriate advice from suitably qualified professionals and modelling and testing appropriate to a scheme’s complexity.

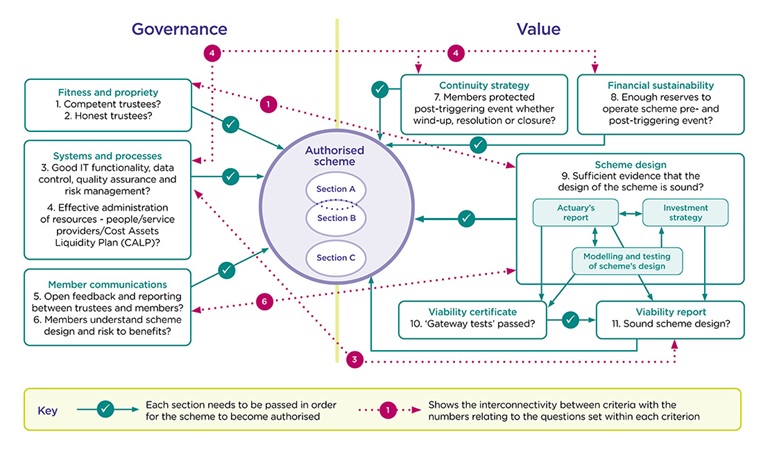

Interconnectivity between criteria

There are strong links between all the authorisation criteria, and none can be assessed in isolation. For example, we could not approve the fitness and propriety criterion if we were not confident that trustees were competent to assess the scheme actuary’s analysis of whether the scheme’s design is sound, and capable of judging whether it is being communicated appropriately to members.

Figure 1 summarises the authorisation criteria and the key interrelations between them. It shows that the authorisation framework is a web and not a linear journey, as a change or issue in one area could have a strong bearing on how we assess another criterion.

Figure 1: CDC authorisation criteria

Read a transcript of Figure 1: CDC authorisation criteria.

Footnotes for this section

- [25] Section 9(1) of the Act

- [26] Section 9(3) of the Act

Fitness and propriety

Who we will assess for fitness and propriety

Those fulfilling various roles in relation to a CDC scheme must show that they meet satisfactory standards of fitness and propriety27. For a scheme to be (and remain) authorised we need to be satisfied that all relevant individuals can show the appropriate skills and characteristics on their appointment and throughout supervision. We will also need to be satisfied that the trustee board as a whole has sufficient competence to carry out their role. The Regulations set out the matters we must consider in our assessment28.

Each individual subject to the assessment must provide a declaration and criminal conviction certificate29. The other evidence required by us will vary from role to role. We will also take into account:

- evidence of competence

- statements of development

- evidence of qualifications or learning programmes

- other relevant professional experience

- matters we consider appropriate, including those relating to a connected person30

- matters that occur in and outside the UK

Details of the application process and the relevant forms are provided online. Trustees must:

- identify each person subject to a fit and proper test31

- ensure that we receive sufficient evidence about them for us to complete our assessment

- carry out due diligence (to the extent possible) to determine if the relevant persons meet the requirements to be fit and proper, and identify any action needed

Identifying who is subject to the fit and proper test

Trustees need to identify any individual, or group of individuals, who perform one or more of the roles to be assessed for fitness and propriety. We will assess each of those persons.

Where the roles are fulfilled by a corporate entity, we will assess the appropriate senior individuals, but we will not normally assess the corporate entity.

Where an individual or legal entity has more than one role in relation to a CDC scheme, they will be assessed for fitness and propriety in relation to each role. We may look through corporate structures to the individuals on relevant boards who are performing core functions in relation to the scheme. A core function includes a strategic, executive or management role carried out in respect of, or on behalf of, a person subject to the fit and proper assessment.

We may also consider other matters, including whether there are any persons connected to those we are assessing that are relevant to our assessment of fitness and propriety.

The person who establishes the CDC scheme

This is the person who entered into the trust deed and rules. They may:

- have provided the initial financial backing for the CDC scheme

- remain connected to the CDC scheme

We will not assess a person who has no decision-making capacity in, or influence over, the scheme.

Trustees

The following people need to be identified:

- all trustees who are appointed as individuals

- all the directors of a corporate trustee of the scheme

- all individuals who perform core functions and make decisions on behalf of a trustee director that is itself a corporate body

Persons who can appoint or remove trustees

We will assess all persons identified in the trust deed, or other documents, as having the power to appoint or remove trustees.

We will not normally assess members who vote as part of an election or selection process.

Persons who can amend the trust deed

We will assess all persons identified in the trust deed, or other documents, as having the power to amend the deed.

We will not normally assess:

- members who vote on or consent to amendments

- employers who can change the admission criteria only for their section or for individual members

How we assess fitness and propriety

The Regulations set out what we must take into account when determining whether we are satisfied that a CDC scheme is operated by fit and proper persons32. In assessing this, we will consider the current and past behaviour of persons (conduct), their competence to fulfil the requirements of their role at the scheme, and any relevant financial matters.

We will also consider:

- the impact on others of the past or current behaviour or actions

- how long ago the issue occurred

- whether there has been a pattern of behaviour which creates concern

The following modules (honesty, integrity and financial soundness, trustee competence and conduct of individuals) describe the factors that are more likely to satisfy us that a person is fit and proper. In a few serious matters, for example certain unspent criminal convictions or bankruptcy, we are very unlikely to be satisfied that an individual is fit and proper. This is because these are strong indicators that a person lacks the integrity or competence needed to be charged with the care of members’ pension savings and managing their scheme.

If an application is submitted where these factors are relevant to an individual, trustees should explain how they took reasonable steps to satisfy themselves that the individual meets the requirement to be fit and proper.

In some cases, an individual will automatically be barred under existing legislation from acting in certain capacities; for example, an undischarged bankrupt cannot be a trustee.

Honesty, integrity and financial soundness

We must be satisfied about the honesty, integrity and financial soundness of all persons being assessed. We will not be satisfied that an individual is fit and proper if they33:

- are subject to a bankruptcy order, bankruptcy restrictions order (including an interim order) or an award of sequestration

- are disqualified from acting as a director due to improper conduct

- are prohibited or disqualified from acting as a trustee (in any capacity)

- have an unspent criminal conviction related to dishonesty, fraud or financial crime

Mitigations – financial matters

If an individual has been, or is likely to be, subject to bankruptcy, a county court judgment (CCJ) or individual voluntary arrangement (IVA), including where a bankruptcy order has been applied for or a bankruptcy petition has been served, we are more likely to be satisfied if:

- the individual was discharged from bankruptcy, the CCJ or IVA more than five years before the authorisation application

- there is no pattern of bankruptcy, CCJs or IVAs

- the CCJs do not indicate a persistent failure to settle outstanding debts

Mitigations – business matters

If an individual was a director or partner of, or concerned in the management of, a business that went into insolvency, liquidation or administration either at the time of the insolvency event or during the 12 months before it occurred, we are more likely to be satisfied if:

- they can show that their action or inaction was not significantly responsible for the failing of that business

- there was only one such failure

- the event occurred more than five years before the application for authorisation

Mitigations – criminal matters

If an individual has an unspent criminal conviction which is not related to dishonesty, fraud or financial crime, we are more likely to be satisfied if:

- the conviction relates to a minor offence, depending on the circumstances of the offence and any mitigating factors

- there has only been one conviction

- the conviction is not relevant to the role being undertaken in the CDC scheme

Mitigations – judgments and settlements

If an individual has been the subject of any adverse judgments or settlements in civil proceedings, particularly in connection with investment or other financial business, misconduct, fraud or the formation or management of a corporate body, we are more likely to be satisfied if:

- there is no pattern of recurrent proceedings or settlements for breach of contract, or failure to fulfil obligations or duties

- the individual being assessed did not have a significant role in the events that led to proceedings being brought

- the impact of their action or inaction on other individuals or organisations was relatively limited

- the proceedings related only to family or private matters

Trustee competence

We will assess individual competence as well as the overall skills and experience possessed by the trustee board34.

The following matters are more likely to satisfy us that an individual has the required level of knowledge.

- They have undertaken training to a basic level of knowledge before or at the time of their appointment as trustee. This training should cover what occupational pensions are, understanding DB and DC schemes, the role of the trustee, running a scheme, pension law basics and pension investment basics. This training could be undertaken through our Trustee Toolkit or alternative provision.

- They have received scheme-specific training on CDC schemes. This should ensure that trustees understand what is being offered to members, the scheme design and key tasks in running the scheme. All trustees should receive training on CDC-specific matters.

- They have gained sufficient equivalent knowledge through previous experience as a trustee or in a senior role in a comparable scheme.

- They have gained sufficient experience through the Association of Professional Pension Trustees (APPT) or Pensions Management Institute (PMI) trustee accreditation.

- They continue to have the relevant knowledge, skills and experience throughout supervision.

By senior role we mean a role with accountability and responsibility for the day-to-day running of a company or organisation, including management, supervisory, technical or compliance oversight roles.

By comparable scheme we mean an occupational scheme of similar size and complexity, but not necessarily a CDC scheme.

The trustee board must:

- demonstrate how competency will be maintained

- demonstrate how they will identify address skills gaps and increase knowledge

In assessing the trustee board, we are more likely to be satisfied if the board:

- has the skills, knowledge and experience appropriate for governing their CDC scheme

- has a balance of skills and experience across its members

- has a range of diverse skills and experience in senior roles, to include pensions, trusteeship, investment, administration, actuarial work and communications

- has a plan for maintaining and developing the board’s knowledge

- has a plan to address any skill gaps

- has processes and standards to ensure that individuals subject to contract, employment or delegation themselves have relevant skills, knowledge and experience

- ensures that any service provider’s staff have the necessary skills, experience and integrity

Conduct of individuals involved with the scheme

In assessing conduct, we will consider all relevant circumstances. We must take into account a person’s conduct in the five years before the authorisation application, and continuously after authorisation, in relation to any role held that is relevant to the assessed role35.

We are more likely to be satisfied of an individual’s conduct if:

- they act in an open, honest and transparent manner

- they are responsive to issues that may arise in their scheme

- they seek to improve outcomes for their members

- they have acted to reduce the likelihood of an adverse event recurring

- there are mitigations to any adverse events with relevance to the role, including frequency, severity, impact, and explanation offered

We are less likely to be satisfied of an individual’s conduct if:

- they are, or have been, under investigation by a regulatory authority (including TPR), government agency or professional body

- they are, or have been, subject to disciplinary action by a regulatory authority (including TPR), government agency or professional body

- they have had action taken against them or had permissions or licences removed by a regulatory authority (including TPR), government agency or professional body for reasons of misconduct

- they are subject to disciplinary or criminal proceedings

- they have been notified of potential proceedings, including investigations

- they have been dismissed or forced to resign due to negligence or misconduct from employment or a role involving a fiduciary duty

- they have been dismissed or forced to resign over poor management or failure to resolve a conflict of interest

- there are aggravating factors to any adverse events relevant to the role, including their frequency, severity, impact, and explanation offered

Footnotes for this section

- [27] Sections 9(3) and 11 of the Act

- [28] Regulation 8 and Schedule 1 to the Regulations

- [29] Regulation 6(2)(a)(v) of the Regulations

- [30] Section 11(3)(b) of the Act

- [31] Regulation 6(2)(a) and (b) of the Regulations

- [32] Regulation 8 and Schedule 1 to the Regulations

- [33] Paragraph 2 of Schedule 1 to the Regulations

- [34] Paragraph e of Schedule 1 to the Regulations

- [35] Paragraph 1(j) of Schedule 1 to the Regulations

Systems, processes and member communications

IT functionality and maintenance

The trustees of a CDC scheme must satisfy us that it has sufficient systems and processes to run effectively in respect of administration, scheme governance and member communications36.

For us to be satisfied, we will assess three main areas:

- The functionality and maintenance of the IT systems used in scheme administration, governance and member communications

- The structures for governing the scheme

- The processes for supporting the different functions to administer and govern the scheme effectively

While we recognise that a scheme will not have begun administration before authorisation, we will expect its systems and processes to be fully developed and ready to go live at the point of application.

We recognise that in some matters, trustees may rely on a third party to give them information about how a scheme will be administered. In these circumstances, while the activity itself can be delegated, accountability cannot be delegated, so the trustees must assure themselves of how the requirements are met.

The application should explain how trustees have assessed that the scheme meets the systems and processes requirements.

This could be demonstrated through independent checks, such as agreed-upon procedures, internal audits and scheme documentation, particularly in respect of the functionality and maintenance of IT systems.

If the trustees do not have access to internal expertise to assess systems and processes, the authorisation application should include evidence that the scheme has had an independent external assessment, particularly in respect of the functionality and maintenance of IT systems.

Functionality of IT systems

The Regulations set out the matters we must take into account in deciding whether we are satisfied that a CDC scheme has sufficient IT systems to ensure that it is run effectively37.

System functionality is important as it provides a basis for good administration and ensuring that members receive the correct benefits at the right time. It will be difficult for us to be satisfied that a scheme has sufficient IT systems to ensure it is run effectively if the required functionality is not in place and its effective use cannot be demonstrated.

We are more likely to be satisfied where the IT system has the following features:

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Transactions and annual events |

|

| Member records |

|

| Administration system payments |

|

| Member communications |

|

Maintenance of IT systems

Having put the appropriate functionality in place, it is important that the IT system is maintained to reflect the scheme’s current needs and legal requirements, including the need to protect data appropriately. We are more likely to be satisfied where:

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Planning for change |

|

| Protecting data |

|

Scheme governance

Good governance is important as it ensures that a scheme is well-run and that issues are managed effectively. Effective governance provides the trustees with oversight of the day-to-day running of the scheme, clear accountabilities and delegations, and a basis for assessing that the scheme is meeting all legal requirements over time.

We expect to see evidence that a CDC scheme has a coherent governance structure with clear accountabilities and delegations. We are more likely to be satisfied where the matters set out below are addressed:

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Governance map |

|

| Accountable persons |

|

| Objectives |

|

Processes

The Regulations set out the matters that we must take into account in deciding whether we are satisfied that a CDC scheme’s processes are sufficient to ensure that it is run effectively38. By processes, we mean policies, processes and procedures. These processes underpin the governance framework, and we expect to see them reflected in that framework.

If a CDC scheme does not have all the relevant processes, we are unlikely to be satisfied that the authorisation criteria have been met. Once the scheme has entered live running, we expect to see evidence that the processes are used in running the scheme and that they are effective.

We expect to see provision for processes to remain sufficient and for it to be clear how and when they will be reviewed.

In assessing processes we are more likely to be satisfied where:

Managing the Trustee Board

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Trustee recruitment |

|

| Diversity and inclusion |

Trustee boards benefit from access to a range of skills, views and expertise as that supports robust discussions and decision-making. We expect to see that:

|

| Trustee governance |

There is clarity about:

|

| Managing service providers |

|

| Planning resources |

|

Administration

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Record- keeping |

|

| Member events |

|

| Annual exercises |

|

| Contributions |

|

Investment

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Investment governance |

The trustees, on an ongoing basis:

|

| Managing people |

It is clear who manages the key investment functions and who is accountable for:

|

| Data |

There is sufficiently detailed information to enable trustees to monitor investments effectively, including:

|

Risk

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Risk management |

|

Actuarial

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Annual exercises |

There must be effective processes for actuarial matters. The annual valuation is the backbone of annual scheme work and we expect to see:

|

Member communications

It is well understood that effective communications are critical to the success of a CDC scheme. It is imperative that members understand the risks and benefits of the scheme. Clear and accessible information for members on how their benefits may increase or decrease will be crucial. We expect there to be a focus on producing member communications as well as the IT functionality needed. [Note that we will assess the functionality, quality and maintenance of the IT systems used for member communications on the same basis as the IT systems more generally.]

To produce effective communications, there must be individuals who have appropriate skills to undertake the planning and assessment work39. In assessing the scheme, we will expect to see the following:

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| People |

|

| Communications Plan |

|

| Quality Assurance |

|

| Members |

|

| Reporting |

|

Footnotes for this section

- [36] Sections 9(3)(d) and (e), 15 and 16 of the Act, and Regulations 13 and 14 and Schedules 4 and 5 to the Regulations

- [37] Regulation 14 and Schedule 5 to the Regulations

- [38] Regulation 14 and Schedule 5 to the Regulations

- [39] Paragraph 4 of Schedule 4 to the Regulations

Financial sustainability

Trustees must satisfy us that they have access to sufficient financial resources to operate their scheme before and after a triggering event40. This can be demonstrated in different ways. We will expect schemes to provide relevant evidence to support their calculations of running costs.

Our assessment of the scheme’s financial sustainability will also take account of the evidence presented in relation to systems and processes, and the continuity strategy.

The evidence required will depend on the circumstances of the scheme and will include the costs, assets and liquidity plan (CALP) and any other evidence necessary to demonstrate a scheme’s financial resources.

Where a scheme relies on employer support, the trustees and each relevant employer must demonstrate that together they can meet the financial sustainability requirements41.

A scheme that cannot meet the financial sustainability requirements at any point may not satisfy us that it should remain authorised.

Matters we must take into account in assessing a scheme’s financial sustainability42

We require sight of, and will consider:

- the scheme’s CALP

- evidence of any reserves held for supporting the activities of the scheme

- documentary proof of any support offered by the employer(s)

- details of any joint bank account or escrow held by or on behalf of the trustees and employer

- relevant extracts of the scheme’s trust deed and rules, which govern expenses and winding-up arrangements

- details of service contracts and insurance policies held by the trustees

- any other documents that the scheme can show to be relevant

Running costs43

Running costs are the costs of setting up and running the scheme on an ongoing basis, whether in-house or outsourced.

We do not require trustees to maintain a reserve for running costs, although they may do so. We will focus on the expected and realised costs of the scheme, the ability of the scheme and employer to cover them, and the enforceability of any commitment of support.

Financial reserves

To satisfy us that they meet the financial sustainability criterion, all schemes should maintain reserves to meet the costs following a triggering event identified in their CALP.

Financial reserves must be sufficient to keep a scheme running after a triggering event, while that triggering event is resolved, and if the scheme is wound up and members transferred out. The reserves calculated should be broken into two separate strands:

- An amount sufficient to allow the scheme to continue to operate for a period of two years following a triggering event (the run-on period).

- An amount sufficient to cover the additional costs following a triggering event (the costs of compliance).

Run-on period44

We can set the length of the run-on period and trustees should assume a run-on period of 24 months. Trustees may be able to show that a shorter period is appropriate in some situations.

When calculating the reserves for the run-on period, trustees should make reasonable allowance for variations in staffing or overhead costs throughout the period of the continuity option.

Costs of compliance45

The costs of compliance relate to the specific costs arising from a triggering event.

In calculating the costs of compliance, trustees should, as a minimum, make allowance for:

- additional spending on member communications

- data cleansing

- professional services, including actuarial, legal and accountancy advice

- contract break clauses

- staff termination or redundancy payments

- contracting staff

- additional work and communication from members who choose not to follow the default

Calculation of financial reserves46

In relation to financial reserves, trustees should:

- have first call on any assets, including any held by an employer for the scheme47

- be able to provide evidence that they have first call on the necessary support

- be able to access the necessary support if there is a triggering event of any type

- be able to show that any guarantor can provide the support they are committed to

- regularly review and adjust the value of the financial reserves they hold to account for their liquidity, scheme membership and demographics, and possible market movements

- maintain reserves greater than those required by this code as a prudent measure

- be able to show that they have sufficient financial reserves at all times

- perform their own prudent calculations of the costs arising from a triggering event

- base their calculations on what they calculate to be the more expensive of continuity options 1 and 248

- expect us to ask additional questions about the assumptions used in calculations before we are satisfied

- calculate their required reserves based on a triggering event occurring between three and five years in the future

- when deciding the forecast period, consider various factors including the growth and demography of scheme membership

- ensure any estimates are consistent with the figures used in their CALP

- regularly, and at least annually, revisit their calculations to ensure they contain appropriate cost estimates

- continuously monitor and maintain their forecast financial reserves

Trustees may rely on legally enforceable guarantees from employers or group companies in lieu of maintaining financial reserves. In these situations, they should ensure that the necessary support is always available.

Other ways of meeting scheme costs

Some trustees will rely on support from their participating employers to meet some, or all, of the costs of the scheme. Others will maintain reserves to meet or contribute towards scheme costs – particularly those arising after a triggering event. This module details other financial arrangements we will consider in assessing the financial sustainability of the scheme.

Indemnities, insurance and compensation

We will consider any insurance policies or indemnities held by trustees in relation to running costs or financial reserves that provide cover for certain costs49. We will need to be satisfied of:

- the details of the policy or indemnity

- the provider

- the policy holder

- the beneficiary

- any limitations of the insurer’s liability

- the security, strength and enforceability of the indemnity

- the ability of the person providing it to deliver that indemnity

- the likelihood of any insurance paying out

- the likely time needed to settle any claim

If the beneficiary of the insurance or indemnity is not the trustee, we may place less weight on its value. We will also consider the cost of any policy in assessing whether it remains a viable part of a scheme’s financial sustainability.

Fixed cost and compensation arrangements

If the scheme has a fixed-cost arrangement with a service provider to provide services regardless of the actual cost to the provider, we will take this into account50. We will need to be satisfied that trustees have considered any services that might fall outside the agreement and the terms on which it may be reviewed, varied and renewed.

We will also consider any compensation that might be payable to scheme members after a triggering event51. We will need to be satisfied of the compensation provider, the basis and timescale over which compensation may be payable, and any limits on the compensation available.

We will not consider any cover provided by the Financial Services Compensation Scheme (FSCS) as part of the scheme’s financial reserving requirement. If trustees believe their treatment by the FSCS is likely to be different from other schemes, they should draw this to our attention.

Employer support

An employer may put in place a suitable financial vehicle or contract guaranteeing the trustees access to sufficient funds to run the scheme and/or to replace the scheme’s financial reserves. Any such support will need to ringfence and guarantee the necessary resources for the financial sustainability of the scheme52.

Financial reserves are not required where there are legally enforceable commitments or guarantees in place from employers or group companies to cover the costs arising from a triggering event.

We will expect to see evidence that the trustees have first call on the necessary support. In all cases, we will need to be satisfied that the trustees will be able to access the necessary support, and that the employer or guarantor can provide it54, if there is a triggering event of any type.

Information about the employer

Where a participating employer has agreed to provide support for the ongoing costs of the scheme or the financial reserves trustees must provide the following financial information about the employer55:

- a cash flow statement for the previous 12 months, including any undrawn overdraft facility or revolving credit facility

- forecast and actual profit and loss for the previous 12 months

- budget for the year to date and any variation from that budget

- cash resources

- cash flow forecast for the following four quarters

- operating costs

- inter-company loans and other forms of funding

- the employer’s most recent accounts

- details of any significant risks the employer is exposed to and its strategy for mitigating them

- the accounts of any third-party providing material financial support to the employer

- where any item in this list is unavailable, an explanation of why it cannot be provided

In addition, we are more likely to be satisfied that this criterion is met if you provide:

- any additional information that we ask for to be satisfied that the employer or group can provide adequate financial support to the scheme

- any further evidence from trustees that supports an application

We are not obliged to consider evidence that we have not asked for, but we will not reject it unreasonably.

Where the supporting employer is part of a corporate group, the financial information above must be provided at a level appropriate to the employer’s position in the group56. We may also ask for information about other group companies if we feel their operations or liabilities may affect the scheme or limit the ability of the employer to support it.

We do not require this financial information where an employer’s only commitment is to pay contributions for the members it employs.

A scheme may be supported by more than one employer, and we will consider the financial position of each employer that we consider relevant57. We may choose to accept any case made by the trustees that stronger employers can absorb more potential costs. We will require evidence of the legal enforceability of a debt on any such employer58.

Accounts

Where a supporting employer’s accounts are qualified or are subject to emphasis on a matter that we consider significant or relevant, we will consider whether they are able to support the scheme.

Any supporting employer should disclose any reliance on third-party financial support. We will need to see the accounts of any such third party.

Cost Assets and Liquidity Plan

The CALP gives key financial information to help us assess whether the scheme meets the financial sustainability requirements. We expect the CALP to be consistent with the other information presented by the scheme, especially the continuity strategy.

The trustees should produce the CALP with the co-operation of any sponsoring employers.

The CALP should:

- cover a period of three to five years from the point the trustees agree it

- include an estimate of the trustees’ risk appetite for their financial reserves

- contain a statement about the level of prudence in their estimates

- include an assessment of the different levels of liquidity needed throughout the period covered by the CALP and continuity strategy

- identify the reserves allocated to each section separately where there is more than one section

- include an explanation of assumptions and levels of prudence adopted in various elements of the document

- give a range for any variable items, explaining how it was reached

- explain why any element omitted from it cannot be provided

The information in the CALP is grouped into four sections:

- Costs in relation to benefits

- Income in relation to benefits

- Assets held to meet costs in relation to benefits

- Liquidity of those assets

Costs in relation to benefits

The CALP must include the following information in relation to the costs of running the scheme:

a. The estimated cost of running the scheme for each year of the period covered by the CALP, including59:

- the costs paid to asset managers or an in-house team to manage the scheme’s funds

- the costs incurred to implement the investment strategy

- the costs of advice taken on investments

- the remuneration and overheads associated with paying trustees and staff

- the cost of professional services commissioned by the trustees, such as actuarial, audit and legal advice

- the cost of scheme administration, activities associated with receiving and reconciling payments, compliance and communications to members

- any costs incurred by the employer, including planning, communication, marketing and any dedicated support provided by them to the scheme

b. Details of any actual or potential financial liabilities arising from any contract between the trustees or sponsoring employer and any service provider to the scheme.

c. The estimated costs arising from the scheme’s compliance with the duties in its continuity strategy, including:

- a breakdown of the activities required to discharge the duties in the continuity strategy

- an estimate of the compliance cost for each activity identified

- the amount of assets required for the scheme to meet those costs

d. The estimated cost of running the scheme for two years60 after a triggering event, or any shorter period agreed by us, including:

- an estimate of the length of time needed to run the scheme in accordance with its continuity strategy after a triggering event

- an estimate of the monthly gross cash cost of running the scheme

- an estimate of the gross cash run-on costs for two years after a triggering event

- the assumptions used in those estimates

e. Details of the following costs, and the strategy for ensuring that the scheme’s financial reserves are sufficiently liquid to meet them as they fall due:

- the estimated costs of complying with the continuity strategy during a triggering event period

- the estimated cost of closing and winding up the scheme after the transfer of assets

- the maintenance of reserves if the scheme is following continuity option 3

f. Any provision made by the trustees and employers to fund contingent liabilities in respect of the scheme.

g. Details of the expected cash flows into and out of the scheme for every year of the period covered by the CALP.

h. Details of any existing or expected borrowing by the trustees, including the identity of the lender, the loan amount, the interest rate, the repayment date, and any security taken by the lender.

i. For new schemes, or sections of them, the estimated, projected or actual cost of setting up the scheme or section.

Income in relation to benefits

The following items must be detailed61:

a. The anticipated scale of the scheme at milestones set at least annually for the period covered by the CALP. The choice of details provided at each milestone is at the discretion of the trustees, but should as a minimum include:

- the number of members in the scheme, including estimates of those accruing benefits, deferred and drawing benefits

- any income from contributions paid to the scheme

- the assets under management or administration in respect of benefits

- any income from charges on assets under management or administration in respect of benefits

- any income from charges paid by participating employers

- any income from assets not designated to providing benefits

- the number of participating employers in any sections of the scheme providing CDC benefits

- the assumptions and dependencies on which the information presented at each milestone depend, together with a sensitivity analysis of those assumptions.

b. Any sources of income for the scheme, including the estimated income from each source, for each year of the period covered by the CALP.

c. The principal sources of income of each participating employer, as detailed by that company’s strategic report, to the extent that the income is available to the scheme.

d. An estimate of the monthly gross income due to the scheme for two years after a triggering event, or any shorter period determined by us, with reference to:

- the number of members accruing, retaining or being paid benefits

- any income from contributions paid in respect of benefits

- the assets under management or administration

- any income from charges on assets under management or administration

- any income from charges paid by participating employers

- the number of participating employers in any sections of the scheme providing CDC benefits

- the assumptions used in arriving at these estimates

Assets

The CALP must include details of the assets held by the trustees to meet the financial sustainability requirements, including62:

- a description, including values, of any haircuts applied to the assets at the effective date of the CALP

- the percentage of the scheme’s financial sustainability requirement met by the assets

- the strategy for meeting any shortfall between the scheme’s income and the costs it will experience during the period covered by the CALP

- details of any escrow agreement, bank guarantee, letter of credit, guarantee, commitment, indemnity, legally binding agreement or insurance policy held by the trustees intended to cover any aspect of the financial sustainability requirement

- the strategy for maintaining the short-term solvency of the business operations supporting the scheme. This includes information about the scheme’s ability to pay for services as those liabilities fall due

- the text of any provision in the trust deed and rules providing that trustees, employers or third parties must pay the amounts shown in the ‘Costs in Relation to Benefits’ section of the CALP

- the text of any provision in the trust deed and rules that empowers any person to change the rule about who is liable to meet the costs of the scheme

- details of any existing or expected lending by the trustees, including the identity of the borrower, the loan amount, the interest rate, the repayment date, and any security taken by the trustees

- where the scheme is reliant on an employer, or employers, to support the costs of the scheme the information set out in the Employers section

Liquidity

A triggering event can lead to immediate costs at short notice. Trustees must be able to show the high liquidity of at least half of the resources supporting their projected running costs for 12 months from the date of their most recent CALP63.

The way funds are held in each scheme is likely to be different and in keeping with the way it is funded and operated. However, we are unlikely to be satisfied by a scheme:

- with cash, or near cash, assets that are less than 25% of projected running costs (if reserved for)

- with cash, or near cash, assets that are less than 15% of the calculated financial reserves

- that holds a significant level of non-marketable or illiquid assets in its financial reserves

- with marketable assets held as part of the financial reserves that are not admitted to trading on regulated markets

- that relies on the sale of directly held physical assets, for example property, as an element of its financial reserves

Financial reserves and haircuts

Apart from a minimum amount for liquidity, we do not prescribe the assets that a scheme must hold in any reserves that it maintains. However, trustees must apply a discount, or “haircut”, to the current or book value of the assets held for reserving purposes64. The haircuts described below may influence the choice of assets that the trustees include in their financial reserves.

The haircut modifies the present value of an asset or holding. For example, an asset with a current value of £100 and a haircut of 20% would be valued at £80 for the purposes of the financial reserves. This means that the current value of assets held by, or guaranteed to, the trustees in their financial reserves will be greater than that set out in the CALP.

There are different haircut values for each class of asset, reflecting different levels of risk depending on the length of time before they are expected to be called on. Trustees should consider this when assessing the assets they hold and the liquidity they require. Trustees should choose the haircut that most closely represents each type of asset in its financial reserves.

Unless otherwise stated, we assume all asset prices are in pounds sterling. If they are not, we will expect trustees to have assessed the currency risk that the asset is exposed to, or to have included the costs of hedging activities in the CALP.

Schemes may hold their entire reserves in cash but should ensure that the CALP allows for the effects of inflation.

We will expect any debt instruments the scheme holds in its financial reserves to be of investment grade, as determined by a recognised ratings agency.

Financial commitments or guarantees issued by participating employers or group companies will be assessed for the ability of the relevant entity to support that commitment or guarantee, and the time that will be needed to deliver that support.

Schemes with financial reserving requirements met by employer guarantees should aim to build the assets they hold to a point where they fully meet the financial reserves they require. Trustees building their assets in this way should regularly monitor their progress towards holding their full financial reserves.

| Asset class | Description | Haircut | ||||||

|---|---|---|---|---|---|---|---|---|

| Running costs | Financial reserves for costs arising | |||||||

| within 1 month of a triggering event | between 2 and 12 months of a triggering event | >12 months of a triggering event | ||||||

| Scheme funds | Assets not attributable to members that are available to pay scheme costs | As underlying assets | ||||||

| Cash | Cash including fixed-term deposits from eligible counterparties and money market funds | 0% | 0% | 3% | 6% | |||

| PRA regulated participating employer guarantee | Legally enforceable guarantees issued by a PRA-regulated participating employer or parent company which are not considered as debt instruments | 0% | 0% |

5% | 5% | |||

| Participating employer guarantee | Legally enforceable guarantees issued by participating employer or group company which are not considered as debt instruments | 0% | 25% | 10% | 10% | |||

| Scheme revenues | Revenues generated by the scheme from charges on assets (annual management charge) or members, based on most recent audited accounts | 10% | 10% | 20% | 30% | |||

| Scheme income | Income received from participating employers for covering costs, based on most recent audited scheme accounts | 10% | 10% | 20% | 30% | |||

| Government and public sector debt | Government debt (eg bonds, gilts), debt issued by central banks, government agencies, local government etc | 5% | 5% | 5% | 5% | |||

| Supranational institution debt | Debt issued by the European Investment Bank, World Bank etc | 10% | 10% | 10% | 10% | |||

| Corporate debt | Corporate bonds, including bonds issued by banks or credit institutions | 25% | 25% | 25% | 25% | |||

| Asset-backed securities | Bonds or notes backed by financial assets, excluding mortgage loans | 25% | 25% | 25% | 25% | |||

| Equities |

Shares listed on a regulated market | 50% | 50% | 25% | 10% | |||

| Gold/precious metals | Certifications and bullion | 75% | 75% | 75% | 75% | |||

| UK government issued loans | Guarantees issued by government departments (eg the Department for Work and Pensions) which are not considered as debt instruments | 0% | 0% | 0% | 0% | |||

| Property assets | Scheme office premises or other property available on first call | 90% | 90% | 70% | 50% | |||

| Insurance | Policies held by trustees to cover normal scheme running costs | 0% | 0% | 3% | 6% | |||

| Wind-up insurance | Policies held by trustees to cover the costs of a triggering event | - | 90% | 3% | 6% | |||

| Loans | Loans provided by banks | 10% | 10% | 115% | 130% | |||

Footnotes for this section

- [40] Section 14(2) of the Act

- [41] Paragraph 4(c) of Schedule 3 to the Regulations

- [42] Regulation 12 and Parts 2 and 3 of Schedule 3 to the Regulations

- [43] Section 14(2)(a) of the Act

- [44] Section 14(2)(b)(ii) of the Act

- [45] Section 14(2)(b)(i) of the Act

- [46] Section 14(2) of the Act

- [47] Paragraph 4(b) of Schedule 3 to the Regulations

- [48] We do not expect schemes to reserve for Continuity Option 3 (running as a closed scheme) until there is a prospect of this being a viable option

- [49] Paragraph 1(a)(xi) of Schedule 3 to the Regulations

- [50] Paragraph 3(i) of Schedule 3 to the Regulations

- [51] Paragraph 3(k) of Schedule 3 to the Regulations

- [52] Paragraph 4(c) of Schedule 3 to the Regulations

- [53] Paragraph 4(b) of Schedule 3 to the Regulations

- [54] Paragraph 3(e) of Schedule 3 to the Regulations

- [55] Paragraph 1(a)(vi) of Schedule 3 to the Regulations

- [56] Paragraph 1(a)(vi)(ii) of Schedule 3 to the Regulations

- [57] Paragraphs 2(f) and 3(e) of Schedule 3 to the Regulations

- [58] Paragraph 2(h) and 3(f) of Schedule 3 to the Regulations

- [59] Paragraph 1(a)(ii) of Schedule 3 to the Regulations

- [60] Section 14(2)(b)(ii) of the Act and paragraph 1(b)(ii) of Schedule 3 to the Regulations; estimates of run-on costs must cover a period of between six months and two years, but we are less likely to accept periods of less than two years

- [61] Paragraph 1(a)(iii) of Schedule 3 to the Regulations

- [62] Paragraphs 1(b)(iv) and 3(c) of Schedule 3 to the Regulations

- [63] Paragraph 4(a)(i) of Schedule 3 to the Regulations

- [64] Paragraph 4(a)(ii) of Schedule 3 to the Regulations;

Continuity strategy

We must be satisfied that the scheme has an adequate continuity strategy65.

A continuity strategy is a document that must be prepared by the trustees66, setting out how members’ interests will be protected after a triggering event.

Trustees must send us the continuity strategy as part of the application for authorisation, within three months after it is revised, and whenever we ask for it67.

It must provide detail about all matters set out in regulations68 and include a statement of all levels of administration charge69 , which may be presented as a separate document.

We do not expect the continuity strategy to be exhaustively detailed. It should provide the principles and framework for identifying key actions, decisions and owners of actions required to deal with a triggering event.

The continuity strategy should be flexible enough to allow the trustees to tailor their approach in response to a specific triggering event. It should also give sufficient detail to allow calculation of the costs identified for the costs, assets and liquidity plan (CALP).

In addition to meeting the requirements set out in the Regulations, trustees should be clear about how they will:

- be adequately prepared in case of a triggering event occurring

- continue to operate the scheme during a triggering event period

- decide which continuity option to pursue

- meet the costs of dealing with a triggering event

- communicate with members

Preparing for a triggering event

Assessing the risk of a triggering event

We are more likely to be satisfied about a continuity strategy where the trustees have assessed and outlined:

- which triggering events are more likely to occur in relation to the scheme

- which continuity options are available to the trustee in each case

- where more than one continuity option is available, how the trustee will decide which one to follow

- any condition in the scheme’s deed and rules that would automatically cause a triggering event and pursuit of one of the continuity options

- the risk and potential impact on members following a triggering event

Planning initial response to a triggering event

We are more likely to be satisfied where the continuity strategy sets out:

- how the trustees will initially respond to a triggering event, including how and when they will first assess risks and impacts

- the process for making decisions, showing where they can be delegated in the absence of a key decision-maker

- the principles for identifying and managing conflicts of interest that may arise following a triggering event

- any role, function, or named person to be involved in producing the implementation strategy

Continuing to operate the scheme during a triggering event period

We would not be able to consider a continuity strategy unless trustees set out in the continuity strategy the matters required by regulations70, including how they would:

- manage triggering event notifications in line with requirements and statutory timeframes

- decide which continuity option to pursue, if there is more than one viable continuity option available

- continue to run the scheme while fulfilling duties arising from a triggering event

- meet the costs of operating the scheme during the triggering event

- communicate with members, employers and us

- maintain members’ records

- comply with any legal requirements

- meet actuarial requirements

- manage investments and make investment decisions

- deal with any contributions due from employers and members

- ensure administrative services would continue; including a summary of any arrangement or provision under contract for service that would continue during a triggering event and pursuit of any one of the continuity options

- ensure continuity of services, including that any arrangements for appointing key roles and advisers will continue to operate in the event of any roles being left vacant;

Trustees should explain the assumptions behind any estimates provided71.

Choosing a continuity option

The continuity strategy must provide the framework and key steps on how the trustees will decide to pursue (or follow, where required) one of the following continuity options:

- Continuity option 1 (discharge liabilities and wind up)

- Continuity option 2 (resolve triggering event)

- Continuity option 3 (close the scheme to new contributions and/or new members)

We are more likely to be satisfied where the trustees can show they have considered each continuity option available to them for each triggering event, in conjunction with the general requirement to address how the trustees will protect members’ interests during a triggering event period.

We do not expect a new scheme to plan for continuity option 3 when it first applies for authorisation, unless there is a provision in the scheme rules meaning that this is the only viable continuity option open to the trustee.

Meeting the costs of dealing with a triggering event

The activities identified in the continuity strategy must be appropriately costed and assumptions clearly stated alongside estimate figures provided72. Trustees must explain how they will meet the costs, noting the prohibition on increasing or adding new administration charges during a triggering event period73.

Statement of administration charges

The continuity strategy must set out74:

- all levels of charges for each charge structure, for the current scheme year and on an annualised basis

- whether or not any additional, third-party or other types of administration charges apply

- the reasons for imposing any of the charges above

We are more likely to be satisfied where the charge levels provided are consistent with the financial information and assumptions provided for the financial sustainability criterion.

Continuity option 1 (discharge liabilities and wind-up)

We are more likely to be satisfied where the continuity strategy shows that trustees have considered each continuity option and addresses how they will protect members’ interests during a triggering event period.

Continuity option 1 is for the scheme’s liabilities to be discharged and for the scheme to be wound up.

Key issues to consider when pursuing continuity option 1 are set out in the table below. We are more likely to be satisfied that the continuity strategy is adequate if it addresses these points:

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| When choosing continuity option 1, details of how the trustees would75 |

|

| Details of scheme rules on how continuity option 1 is given effect77, including |

|

| A plan on how the trustees would implement the following actions, from the winding-up commencement date81 |

|

| Details of how the trustees will84: |

quantify the realisable value of each beneficiary’s accrued rights, on an actuarial basis, in accordance with regulations and scheme rules at the following timepoints:

|

| A plan for how the trustees will provide periodic income to pensioner beneficiaries during the wind-up period85 |

From the wind-up commencement date, until initial quantification of accrued rights has taken place

After initial quantification of accrued rights

|

| Data cleansing and member tracing86 |

|

| Dealing with investments87 |

|

| Transfers89 |

|

| Details of communication strategies90 |

How trustees would communicate with employers, beneficiaries and TPR, including:

|

Continuity option 2 (resolving triggering event)

We are more likely to be satisfied where the trustees’ continuity strategy shows that they have considered each continuity option, in conjunction with the general requirement to address how members’ interests will be protected during a triggering event period.

Continuity option 2 is for the triggering event to be resolved.

Key issues to consider when pursuing Continuity option 2

Key issues to consider when pursuing Continuity option 2 are set out in the table below. We are is more likely to be satisfied that the continuity strategy is adequate if it addresses these points:

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Identifying options for resolving a triggering event92 |

|

| Communications93 |

|

| Timescales for resolving the event94 and meeting costs95 |

|

Continuity option 3 (closing the scheme to new contributions or members)

We are more likely to be satisfied where the trustees’ continuity strategy shows that they have considered each continuity option, in conjunction with the general requirement to address how members’ interests will be protected during a triggering event period. We do not expect a new scheme to plan for continuity option 3 when it first comes to us for authorisation.

Continuity option 3 is for the scheme to run on as a closed arrangement.

Key issues to consider when pursuing continuity option 3

Key issues to consider when pursuing Continuity option 3 are set out in the table below. We are more likely to be satisfied that the continuity strategy is adequate if it addresses these points:

| Requirement | Matters more likely to satisfy TPR |

|---|---|

| Details of scheme rules on how continuity option 3 is given effect97 |

|

| Details of the strategy for operating a closed scheme and meeting costs98 |

|

| Communications100 |

|

Footnotes for this section

- [65] Section 9(3)(f) of the Act

- [66] Section 17(2) of the Act

- [67] Section 17(7) of the Act

- [68] Section 17(5) of the Act and regulation 15(1) of the Regulations

- [69] Section 17(3) of the Act

- [70] Regulation 15 of the Regulations

- [71] Regulation 15(2) of the Regulations

- [72] Regulations 15(1)(t) and 15(2) of the Regulations

- [73] Section 45 of the Act