Our climate adaptation report sets out the risks from climate change that are most relevant to occupational pensions schemes and the approaches we are taking to tackle them both as a regulator and an organisation.

Published: 28 October 2021

1. Introduction

1. This report is the contribution of The Pensions Regulator (TPR) towards the drive to assess the resilience of the UK to climate change.

2. That work is part of the National Adaptation Programme (NAP). The NAP harnesses a wide range of evidence and analysis to propose actions for the UK government and others to adapt to the challenges of climate change in the UK.

3. At TPR, our climate change strategy aligns with our corporate strategy, where our work on climate changes sits under our strategic goal of ensuring that decisions made on behalf of savers are in their best interests.

“Savers’ outcomes are greatly influenced by the decisions that others make on their behalf. We will monitor those who make these decisions across all scheme types, scrutinising any that pose a heightened risk to the quality of outcomes. We will increase our focus on managing savers’ exposure to economic risks, including environmental, social, and governance risks.”

4. We recognise that climate change is systemically significant to pensions, our regulatory regime, and our statutory objectives. These include objectives to protect member benefits, reduce calls on the Pension Protection Fund (PPF), and promote good administration of schemes. If trustees of occupational pension schemes fail to consider risks and opportunities from climate change or fail to exercise effective stewardship, they face the risk that investment performance will suffer and savers with defined contribution (DC) schemes will miss out on good outcomes. Meanwhile, defined benefit (DB) schemes are sponsored by employers whose future prospects depend to varying extents on how they respond to climate change.

5. This is the first time that TPR has reported into the NAP. The report covers the risks from climate change that are most relevant to occupational pension schemes and the policies and practices to address them. It approaches this in regard to (i) those we regulate and (ii) TPR as an organisation.

6 As we said in our climate change strategy, we do not underestimate the scale of the challenge that climate change poses for occupational pension schemes. We know that many schemes have considerable work to do to build resilience and to assess climate-related risks and opportunities, as demonstrated in the surveys covered in this report. We do not shy away from the acknowledgement that those figures are not good enough. However, we recognise that practices are rapidly evolving, and trustees – and pension savers – are increasingly more engaged with the need to consider climate-related risks and opportunities. We remain convinced that a landscape of resilient pension schemes where climate risk is managed and the opportunities from moving to a net zero economy are taken in the best interests of savers is achievable.

Charles Counsell, Chief Executive

The Pensions Regulator: what we do

7. TPR is the public body that protects workplace pensions in the UK. Our statutory objectives are to:

- protect the benefits of members of occupational pension schemes

- protect the benefits of members of personal pension schemes (where there is a direct payment arrangement)

- promote and to improve understanding of the good administration of work-based pension schemes

- reduce the risk of situations arising which may lead to compensation being payable from the PPF

- maximise employer compliance and employer duties and the employment safeguards introduced by the Pensions Act 2008

- minimise any adverse impact on the sustainable growth of an employer in relation to DB scheme funding

8. Read more about our responsibilities, priorities, our approach to regulation and the values we hold that enable our vision of being a strong, agile, fair and efficient regulator.

The National Adaptation Programme

9. The NAP was established by the Climate Change Act 2008. It includes ongoing policies and voluntary agreements that will help build the UK’s resilience to the risks of climate change. The NAP is based on a wide range of evidence and analysis, including five-yearly Climate Change Risk Assessments.

10. As part of this, the UK government invites or requires organisations to produce reports on the current and future predicted effects of climate change on their organisation and their proposals for adapting to climate change. The objectives for reporting are to:

- support the integration of climate change risk management into the work of reporting organisations

- contribute to government understanding of the level of preparedness of important sectors to climate change

11. In March 2017, a subcommittee of the independent statutory Committee on Climate Change (CCC) recommended widening the scope of adaptation reporting across the financial sector, including occupational pensions. In November 2018, we were invited by the Department for Environment, Food and Rural Affairs to produce our first report.

Cross-regulator approach to climate change

12. We are delighted to have the opportunity to publish this report alongside the reports from the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA). Our functions are closely linked, and we welcome the chance to work together to improve our understanding of systemic risks and contribute to an assessment of whether the UK financial sector is resilient in the face of climate change.

13. Our coordinated reporting builds on existing work, such as our input to the government’s 2019 Green Finance Strategy, where we established a shared understanding of the financial risks and opportunities presented by climate and environmental factors. We recognise the relevance of climate-related financial factors to our mandates and the importance of a collective response.

14. This work has been taken forward by the 2020 roadmap towards mandatory climate-related disclosures. As financial regulators and our sponsoring government departments, we set out an indicative path towards comprehensive and high-quality information on how climate-related risks and opportunities are being managed across the UK economy. This coordinated approach together with developing global initiatives to harmonise international disclosure and reporting, will help to ensure that the right information on climate-related risks and opportunities is available across the investment chain – from companies in the real economy to financial services firms, to end-investors.

2. Those we regulate

Climate-related risks for occupational pension schemes

1. All the schemes that we regulate are exposed to climate-related risks through their investment arrangements. Many DB schemes are supported by employers or sponsors whose prospects depend on current and future developments in relation to climate change.

2. Climate change has distinct characteristics that make it different from other sources of structural change. TPR was involved in cross-government and regulator discussions which articulated these characteristics in the 2019 Green Finance Strategy.

Distinct characteristics of climate change that require a different approach

3. Far-reaching impact in breadth and magnitude

Climate change will affect all actors in the economy across all sectors and geographies. The risks will likely be correlated with, and potentially aggravated by, tipping points in a non-linear fashion. This means the impacts could be much larger, more widespread, and more diverse than those of other structural changes.

4. Foreseeable nature

While the exact outcomes, time horizon and future pathway are uncertain, there is a high degree of certainty that some combination of physical and transition risk will materialise in the future.

5. Irreversibility

The concentration of greenhouse gas emissions determines the impact of climate change in the atmosphere, and there is currently no mature technology to reverse this process. Above a certain threshold, scientists have shown with a high degree of confidence that climate change will have irreversible consequences on our planet, though uncertainty remains about the exact severity and horizon.

6. Dependency on short-term actions

The magnitude and nature of the future impacts will be determined by the actions taken today, which thus need to follow a credible and forward-looking policy path.

The risks arising from climate change

7. The risks that arise from climate change split broadly into physical risks, transition risks and litigation risks.

8. Physical risks are the impacts that occur as the global average temperature rises. For example, flooding and fires, which are more frequent and severe in a rapidly warming world, threaten physical assets and disrupt supply chains.

9. Transition risks arise from a shift towards a low-carbon economy, as is required to meet climate policy goals. For occupational pension schemes with investment strategies or funding plans that cross borders, these policy goals encompass both international targets, such as those of the Paris Agreement, and national targets, such as the government’s commitment to reach net-zero greenhouse gas emissions by 2050.

10. Litigation risks may also arise when businesses and investors fail to account for the physical or transition risks of climate change. Risks arise not just for pension schemes with sponsor companies that do not plan and adapt adequately but also for the pension funds that hold companies’ equity and debt.

11. Perhaps of greatest concern is the risk that climate policies do not achieve their goals or that they are unable to achieve them in a sufficiently timely and orderly fashion, leading to temperature rises and policy dislocations that would have large and detrimental impacts on global economies, society and investment portfolios.

12. Trustees in the schemes that we regulate may find that embedding consideration of climate change in their investment and scheme governance could have a positive impact on expected returns or the capacity to reduce risk. For example, there may be opportunities to access new markets and new technologies related to the transition to a low-carbon economy.

Policies: what regulations do schemes face on climate change?

13. As part of their fiduciary duties, trustees of occupational pension schemes will already manage any financially material risks that arise for their scheme as a result of climate change.

14. Trustees also face specific requirements in relation to climate change.

15. Policies in the Statement of Investment Principles (SIP)

- Trustees who are required to prepare a SIP should include a policy on environmental considerations (including climate change), which they consider financially material. This must cover the appropriate time horizon of the investments and how these considerations are taken into account in investment decisions.

- The SIP must include trustees’ stewardship policy on the exercise of the rights (including voting rights) attaching to the investments, and on undertaking engagement activities (including those concerning environmental impact) in respect of the investments (including the methods by which, and the circumstances under which, trustees would monitor and engage).

- The SIP must also include trustees’ policy on how non-financial considerations, including members’ views on environmental impact and present and future quality of life of the members and beneficiaries, are taken into account in investment decisions.

- The SIP should set out the trustees’ policy on engaging with asset managers, including how their arrangements with asset managers incentivise the managers to align their investment strategy with the trustees’ SIP and how the method and evaluation of the asset manager’s performance, and their remuneration, is in line with these policies.

16. Implementation statements

Trustees of schemes that provide money purchase benefits must describe how they’ve put SIP policies into practice in their implementation statement. Other schemes required to produce a SIP must report on how their stewardship policy was followed and describe trustees’ voting behaviour.

17. TPR’s code of practice

Our code of practice includes a climate change module. This includes the requirement that governing bodies assess climate-related risks and opportunities as part of their system of internal controls.

18. Pension Schemes Act 2021

This act writes climate change into pensions law in the most comprehensive way to date. Regulations under the act adapt the recommendations for trustees from the Taskforce for Climate-related Financial Disclosures (TCFD).

19. For example, a TCFD recommendation under the heading of ‘governance’ translates into a requirement for trustees to have oversight of climate-related risks and opportunities. Under the heading of ‘metrics and targets’, trustees will be asked to work out the scheme’s carbon footprint by calculating the greenhouse gas emissions of the investment portfolio. Trustees will also have to set a climate-related target and publish a report on their work.

20. Climate-related regulations under the Pension Schemes Act 2021 initially apply to larger DB and DC schemes and all master trust and collective DC schemes. By the end of 2023, 81% of occupational pension scheme assets are expected to be in schemes making disclosures in line with the TCFD recommendations.

Practices: are schemes adapting to climate change?

21. We are taking our insight from the DC and DB surveys conducted in 2020. The pandemic delayed the equivalent research in 2021. The surveys were conducted by OMB Research, an independent market research agency, on behalf of TPR.

DC pension scheme research

22. This section summarises results from climate change questions in TPR’s annual survey of DC1 schemes. The research took place before the Department for Work and Pensions (DWP consulted on climate-related proposals that would result in regulations under the Pension Schemes Act 2021.

23. The climate change questions were directed to schemes with more than 100 members, or which are used for automatic enrolment. Together, these schemes cover 95% of DC members.

24. Summary of results

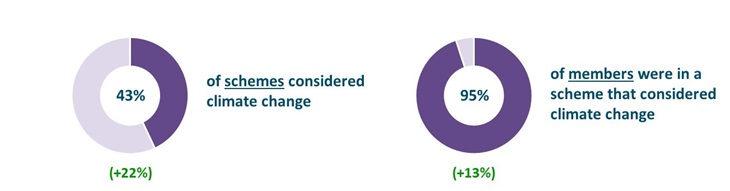

The survey showed some progress since 2019. However, too few trustees and managers of DC schemes are paying proper attention to climate-related risks and opportunities. For example, while the number of DC schemes whose trustees are considering climate change in their investment strategies had doubled since the previous year, it still stood at just 43%.

25. Does the scheme take climate change into account when formulating your investment strategies and approach?2

26. As illustrated above, two-fifths of schemes (43%) took account of climate change when formulating their investment strategies and approaches, but 95% of all members were in a scheme that did so. This is because the vast majority of members are in master trusts, and 94% of master trusts took account of climate change (compared with 70% of large schemes, 49% of medium schemes and 8% of small and micro schemes used for automatic enrolment).

27. Schemes that took account of climate change were asked what actions they had taken.

28. Table 1: actions taken in relation to climate change3

| Action | Taken the action | Change since 2019 |

|---|---|---|

| Discussed at a board meeting or with the trustees | 97% | +22% |

| Discussed with an adviser | 92% | +30% |

| Discussed with the administrator or service provider | 54% | -4% |

| Added climate-related risks to your risk register | 48% | +5% |

| Engaged with members on how the scheme is responding to climate change and its implications | 26% | -5% |

| Assigned responsibility for climate-related issues to trustee or sub-committee | 22% | -2% |

| Any other actions | 26% | +7% |

| Don't know | 2% | -14% |

29. Those schemes that did not take account of climate change in their investment strategies were asked for their reasons.

30. Table 2: reasons for not considering climate change in the scheme’s investment strategies4

| Reason | Percentage giving that reason | Change since 2019 |

|---|---|---|

| Not relevant to our scheme | 21% | -14% |

| Preparing/planning to review this | 19% | +12% |

| Not thought about it | 9% | 0% |

| Other priorities / not enough time | 5% | -9% |

| No demand from members to consider it | 5% | +3% |

| Not an option for our scheme (e.g. investment choice too narrow) | 4% | +2% |

| Not required to do this | 4% | -11% |

| Would provide lower return on investment for members | 3% | -1% |

| Other reason | 26% | +18% |

| Don't know | 7% | -1% |

31. The main reason given for not considering climate change was that it was not felt to be relevant to their scheme (mentioned by 21%). However, a similar proportion (19%) stated that they were planning to review whether they should start taking account of climate change. This suggests that the next survey should show more schemes considering climate change as part of their investment strategies.

DB pension scheme research

32. This section summarises results from climate change questions in a 2020 survey of DB pension schemes. This survey took place after the DWP consulted on climate-related proposals that would result in regulations under the Pension Schemes Act 2021.

33. The questions explored how prepared schemes were for relevant activities. The survey questions on climate change were raised with 250 individuals, primarily lay and professional trustees, involved in managing DB pension schemes5.

34. Summary of results

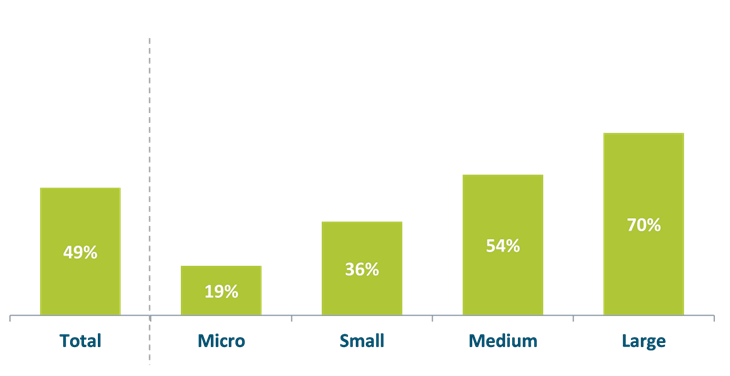

Like the DC survey, this survey indicates that too few DB schemes are giving enough consideration to climate-related risks and opportunities. There is limited ownership of stewardship policies, even though active stewardship can help trustees manage climate-related risks and deliver climate-related objectives. DB trustees, in particular, need to get to grips with the way climate-related risks and opportunities affect the employer’s covenant and need to include climate change in their integrated risk management framework.35. Has the scheme allocated time or resources to assessing any financial risks and opportunities associated with climate change?

Half (49%) of all DB schemes had done so, and this increased with scheme size (19% of micro, 36% of small, 54% of medium and 70% of large schemes).

36. Figure 2: proportion allocating time or resources to assessing any financial risks and opportunities associated with climate change6

37. Table 3: actions taken on climate change7

The 51% of schemes that had not allocated time or resources to assessing the financial risks or opportunities associated with climate change were not asked this question and are shown separately in the table.

| Action | Total | Micro | Small | Medium | Large |

|---|---|---|---|---|---|

| Assessed the risks and opportunities for your scheme from particular climate-related scenarios | 20% | 13% | 12% | 18% | 41% |

| Assessed your schemes portfolio’s potential contribution to global warming | 13% | 6% | 6% | 14% | 22% |

| Tracked the carbon intensity of your scheme’s portfolio | 8% | 6% | 5% | 8% | 15% |

| None of these (or don’t know) | 24% | 6% | 18% | 30% | 26% |

| Not allocated any time/resources to climate change | 51% | 81% | 64% | 46% | 30% |

38. Large schemes were most likely to have taken each of the actions listed above.

39. Table 4: processes used to manage climate-related risks and opportunities8

Schemes were also asked about the processes they used to manage climate-related risks and opportunities.

| Process | Total | Micro | Small | Medium | Large |

|---|---|---|---|---|---|

| Add climate-related risks to your risk register | 21% | 13% | 13% | 24% | 30% |

| Include climate-related issues as a regular agenda item at trustee meetings | 19% | 0% | 11% | 24% | 26% |

| Include, monitor and review targets in the scheme’s climate policy | 16% | 6% | 6% | 19% | 30% |

| Assign responsibility for climate-related issues to a trustee or sub-committee | 12% | 19% | 7% | 12% | 19% |

| None of these (or don’t know) | 15% | 0% | 15% | 14% | 22% |

| Not allocated any time/resources to climate change | 51% | 81% | 64% | 46% | 30% |

40. These processes were generally more widespread among large and medium schemes, except for assigning responsibility to a trustee or sub-committee. This process was equally prevalent among micro schemes as large schemes.

41. Table 5: consideration of climate change in investment and funding strategy9

Schemes were asked about the extent to which they considered climate change in specific ways in their investment and funding strategies.

Scores range from 5, which means very significant consideration, to 1, which means do not consider at all.

| Consideration | 5 | 4 | 3 | 2 | 1 |

|---|---|---|---|---|---|

| The sponsoring employer's exposure to climate-related factors | 12% | 18% | 23% | 20% | 23% |

| Climate-related opportunities such as improved creditworthiness of the low-carbon sector or investments in new technologies | 6% | 14% | 31% | 24% | 23% |

| Transition risks such as increased pricing of greenhouse gas emissions and moves towards low-carbon policies and technologies | 6% | 13% | 32% | 22% | 26% |

| Physical risks such as weather events, sea level exposure, heat wave exposure and drought risk | 4% | 9% | 23% | 27% | 35% |

42. Many schemes devoted little or no thought to these issues. 62% scored 1 or 2 out of 5 for the extent to which they considered physical risks. Between 44 and 38% gave the same score for their consideration of transition risks, climate-related opportunities and the sponsoring employer’s exposure.

43. Where schemes did consider these issues (indicated by a score of 4 or 5 out of 5), it was most likely to relate to the sponsoring employer’s exposure to climate-related factors (30%). It was least likely to focus on physical risks (13%).

44. Table 6: consideration of climate change in investment and funding strategy by scheme size10

| Net: Significant consideration (4-5) | Micro | Small | Medium | Large |

|---|---|---|---|---|

| The sponsoring employer’s exposure to climate-related factors | 31% | 23% | 29% | 41% |

| Climate-related opportunities such as improved creditworthiness of the low-carbon sector or investments in new technologies | 25% | 14% | 17% | 33% |

| Transition risks such as increased pricing of greenhouse gas emissions and moves towards low-carbon policies and technologies | 25% | 8% | 15% | 37% |

| Physical risks such as weather events, sea level exposure, heat wave exposure and drought risk | 6% | 9% | 13% | 22% |

45. Larger schemes were typically most likely to have considered these issues in their investment and funding strategies.

Stewardship

46. Savers trust pension schemes to look after their savings. The investment chain is intermediated, but trustees can still monitor, engage and intervene on matters that may affect the outcome for pension savers.

47. Again, those schemes that had not allocated time or resources to assessing the financial risks/opportunities associated with climate change were not asked this question but have been included in the analysis base.

48. Table 7: stewardship actions taken to help manage climate risks11

Schemes were asked whether they had taken various actions on stewardship to help with their management of climate risks. Those schemes that had not allocated time or resources to assessing the financial risks or opportunities associated with climate change were not asked this question but have been included in the analysis base.

| Actions | Total | Micro | Small | Medium | Large |

|---|---|---|---|---|---|

| Talked to advisers and asset managers about how climate-related risks and opportunities are built into their engagement and voting policies | 41% | 19% | 22% | 46% | 67% |

| When appointing new asset managers, asked the prospective manager how they include climate factors in engagement and voting behaviour | 34% | 13% | 24% | 38% | 52% |

| When outsourcing activities, set out in legal documents your expectations on climate stewardship and approaches | 17% | 6% | 7% | 20% | 30% |

| Joined collaborative engagement efforts on climate change | 9% | 13% | 6% | 7% | 19% |

| Signed the UK Stewardship Code | 9% | 6% | 5% | 13% | 7% |

| None of these (or don’t know) | 5% | 0% | 8% | 5% | 4% |

| Not allocated any time or resources to climate change | 51% | 81% | 64% | 46% | 30% |

49. Approaching one in five schemes (17%) set out their expectations on climate stewardship and approaches in legal documents when outsourcing activities, and around one in ten had participated in collaborative engagement efforts on climate change (9%) and signed the UK Stewardship Code (9%).

50. Large schemes were most likely to have taken any of these stewardship actions, except for those signing the UK Stewardship Code where there was little difference by scheme size.

Taskforce on Climate-related Financial Disclosures

51. At the time the DB survey was carried out, a government consultation on proposals for disclosure in line with the recommendations of the TCFD had recently closed. Respondents were asked if they were aware of the work of the taskforce and, if so, whether their scheme made disclosures as recommended by the TCFD.

52. Table: awareness of the TCFD and uptake of their recommended disclosures12

| Awareness | Total | Micro | Small | Medium | Large |

|---|---|---|---|---|---|

| Aware of TCFD | 29% | 25% | 23% | 29% | 41% |

|

8% | 6% | 8% | 9% | 7% |

|

16% | 6% | 10% | 16% | 30% |

|

5% | 13% | 5% | 4% | 4% |

| Not aware of TCFD | 71% | 75% | 77% | 71% | 59% |

53. Almost three-quarters were unaware of the TCFD, and around a quarter of those aware were already making the recommended disclosures.

Lack of climate related data is a barrier to adaptation by occupational pension schemes

54. While we have not explored all the potential barriers to adaptation for occupational pension schemes, we know from feedback from our Supervision team and from the industry that the availability of climate-related data can be a significant issue for trustees, and this may be a barrier to developing plans to make schemes more resilient. The data needed to assess climate risk can be limited, and there can be a lack of consistency in how the information is presented.

55. We expect to see improvements in data quality and modelling capabilities as the financial system moves towards mandatory reporting of climate-related risks and opportunities. In the meantime, as the DWP clarified in 2021 guidance on governance and reporting of climate risk:

“Limitations in data should not deter trustees from taking steps towards quantifying and assessing their scheme’s exposure to climate-related risks and opportunities more effectively through the use of metrics, and managing that exposure through the use of targets. Even estimated or proxy data can help identify carbon-intensive hotspots in portfolios, which can help to inform their investment and funding strategies.”

56. Availability of stewardship-related data can be a barrier in this work too. For example, if trustees are unable to compile data on activity, such as voting, that service providers undertake on their behalf, then it becomes more difficult to develop effective engagement and disinvestment strategies to improve scheme resilience in the face of climate change. As such we welcome proposals to extend TCFD reporting to other parts of the financial sector.

Our regulatory approach

57. We drive up standards and tackle risk by engaging with the pension schemes we regulate.

58. Our regulatory approach focuses on four areas:

- setting clear expectations

- identifying risk early

- driving compliance through supervision and enforcement

- working with others

Setting clear expectations

59. We work with those we regulate to ensure that the standards we set out are clear and easily adopted.

60. Schemes have existing obligations to consider and manage climate-related risks. We will outline our approach to the most recent climate change regulations under the Pension Schemes Act 2021 by publishing guidance that clarifies what we will be looking for from schemes as they assess, manage and prepare to report.

61. When the regulations are reviewed in 2023, we will work with the DWP to share best practice examples from TCFD reports. More broadly, we will review guidance and fill gaps where regulation has moved on.

62. Measures in the Pension Schemes Act 2021 initially apply to master trusts and larger schemes. By the end of 2023, we anticipate that approximately 90% of DC scheme memberships will be in schemes that are reporting in line with the TCFD recommendations. However, although around 75% of DB scheme assets will be in schemes complying with the regulations, the figure for DB memberships is lower, with approximately 60% expected to be covered by the end of 2023.

63. The impact of climate change on some employers could be very significant, and integration of covenant, actuarial and investment risk is an important factor to achieve successful saver outcomes for DB schemes. We will publish further guidance on how to consider climate-related risks and opportunities as part of the covenant assessment.

64. We expect the impact of climate change on some superfund models, particularly those targeting long-term run-off, could be very significant. We believe that a proactive approach to assessing, mitigating and monitoring climate risk for those models is an important part of achieving successful saver outcomes.

65. As the DB superfund market evolves, we will seek to ensure that DB superfunds meet our requirement for a 'climate risk management plan' and that the plan is effectively implemented. We will do this as part of our initial assessment of individual superfund models, as ceding schemes transfer in and during ongoing supervision.

Identifying risk early

66. Once schemes start reporting as required in the regulations under the Pension Schemes Act 2021, we will carry out a thematic review on scheme resilience to climate-related scenarios. This will help us improve our understanding of how savers investments could be affected by climate change. We will publish our findings and use these to inform any revisions to our guidance.

67. Stewardship activities help trustees to allocate capital and monitor its deployment to create long-term value for savers, and stewardship has an important role to play in ensuring that an investment portfolio is resilient in the face of climate change.

68. We recommend trustees sign up to the 2020 UK Stewardship Code. The code outlines best practices for companies to improve their investment governance and risk management while driving long-term success and for communicating activity and progress towards addressing systemic risks such as climate change.

Improving compliance through supervision and enforcement

69. Monitoring schemes through our ongoing supervision activity helps prevent problems from developing in the first place.

70. Our supervision approach helps us to build strong ongoing relationships, so we can monitor schemes more closely, outline our expectations, and prevent problems from developing. In this year’s annual report and accounts, we commit to using our supervisory work to encourage trustees to pay more attention to climate change when selecting investments, discussing covenant and working with their advisers.

71. We expect all schemes that are required to publish their SIP, implementation statement and TCFD report to do so. The quality of this reporting can be an indication of the quality of scheme governance.

72. To help identify instances of non-compliance with these disclosure obligations, scheme returns will include new questions, requesting the web addresses for these documents. We may take enforcement action where the requirements are not met.

Working with others

73. Our regulation is more effective – more comprehensive and more consistent – when we work with our regulatory partners and stakeholders. This is even more important in such a complex and interrelated area as climate change, where people need to coordinate work not only across different sectors in the UK but around the world.

74. Along with other financial regulators and our sponsoring government departments, we have produced a roadmap showing how the UK’s financial sector is moving towards information on climate-related risks and opportunities being available across the investment chain by 2025. The roadmap includes plans by the FCA for asset managers to report on climate change risks. This is crucial information for trustees as they prepare to report on climate risk and develop the portfolio-based climate metrics that are crucial for strategies to adapt to climate change.

75. We will continue to meet with other financial regulators to ensure that our work on climate-related risks and opportunities and stewardship practice is consistent. Where we are able, we will help align behaviours and incentives across the investment chain and share insights gathered through our relationships with trustees and industry experts. We recognise the critical role advisers and third-party providers play in supporting trustees and will continue to communicate with them and listen to their views.

76. We will include climate change in our dialogue with stakeholders through advisory panels, events and other formal and informal discussions on our regulatory approach and policy.

Footnotes for this section

[1] The survey population included hybrid pension schemes with DC members. A hybrid pension scheme includes both DB and DC benefits. For the purposes of the survey, hybrid schemes were instructed to answer questions only in relation to the DC sections of their scheme, excluding any sections offering DB benefits or DB benefits with a DC underpin.

[2] Base: all schemes with 100+ members or used for AE. Scheme total (140, 10%), Member total (140, 0%)

[3] Base: all that took account of climate change (87)

[4] Base: all that did not take account of climate change (46)

[5] The survey population included hybrid pension schemes, which include both Defined Benefit and Defined Contribution benefits.

[6, 7, 8] Base: total (250), Micro (16), Small (87), Medium (120), Large (27)

[9] Base: total 250 2% - 4%)

[10, 11, 12] Base: total (250), Micro (16), Small (87), Medium (120), Large (27)

3. TPR as an organisation

Our commitments

Climate change strategy

1. In 2021 we published our first climate change strategy, setting out our strategic response to climate change and making the commitment that, as an organisation, TPR will reduce its environmental impact, manage climate risks and adapt to new conditions.

2. In our climate change strategy, we set ourselves a challenging target of achieving net-zero greenhouse gas emissions by 2030. Over the next three years, we will set out our plans to achieve this.

3. We also committed to reporting in line with the TCFD recommendations where we can. By doing so, we are aligning ourselves with the approach used across the financial sector.

The Greening Government Commitments

4. We currently report annually on how we perform against the Greening Government Commitment targets to reduce our environmental impact.

5. These targets relate to:

- reducing our greenhouse gas emissions

- reducing the amount of waste that we generate

- reducing our water consumption

- ensuring we buy more sustainable and efficient products and engage with our suppliers to understand and reduce the impacts of our supply chain

Read a full summary of our performance against the Greening Government Commitments.

Read our most recent sustainability performance results in our Annual Report and Accounts.

7. The coronavirus (COVID-19) pandemic made a considerable impact on our sustainability performance figures. While most of our staff were working from home, there was very little use of our building and travel to and from the office as well as minimal travel for business reasons. The latest figures we published are based on the occupation of our office in Brighton. They do not currently take into account greenhouse gas emissions as a result of home-based working or our recent move to the Microsoft Azure cloud. We are yet to assess the impact of both on our overall carbon footprint. Where possible, we intend to include these figures in future reports.

What we are doing now

Hybrid working and accommodation

8. Our staff have been predominantly working from home since March 2020. From October 2021, we will be adopting a hybrid working model. We need to analyse the impact of this new working model on our sustainability and recognise that, while there may be some environmental benefits, there are also potential costs.

Sustainable technology

9. At TPR, we are taking steps to meet the outcomes defined in the Greening Government ICT and Digital Services Strategy. In this way, we will improve the environmental sustainability of our projects and programmes.

10. We took the following actions to improve the environmental performance of our data and systems.

- We migrated the majority of our systems into the Azure public cloud in 2020 from our previous private cloud provider. Therefore, our commitment to reducing our carbon footprint from our use of technology will be influenced by Microsoft's commitments to achieve carbon neutrality. We will continue to minimise our on-premises technology footprint.

- We have a cloud-first technology strategy covering the next three to five years. It includes turning off non-production environments when they are not needed, typically overnight.

- We recognise there will be duplicate datasets within TPR. In 2019, we started a programme of work that includes the introduction of a central data platform. This work is ongoing and we aim to complete it in 2022.

11. To improve the environmental performance of our digital communications, we are:

- minimising the use of energy-inefficient media such as videos where we have not identified a specific user need for it

- using HTML format for our published information and reducing our use of PDFs which generally take longer to load, and to read, which uses more energy

12. In addition:

- we introduced multi-function devices for printing and scanning that require staff to use their identification cards before they can print or scan in the office

- we have a decommissioning strategy for any systems that we replace

- we recycle our laptops and on-premises servers (without the hard drives as they are shredded for security reasons). Most of our servers are now owned by Microsoft via our use of the Azure cloud

13. We have been working with the DWP to ensure we’re aligned in how we address the requirements as outlined in Procurement Policy Note 06/21 and how we can increase awareness of this throughout the supply chain.

Sustainability Network

14. TPR has a Sustainability Network led by volunteers from our staff, supported by senior management, and sponsored by our Executive Director of Regulatory Policy, Analysis and Advice.

15. The network has produced a report on greenhouse gas emissions from 2012 to 2020. We found an overall reduction during this period relating to our use of energy within our office in Brighton. However, it did not include other emissions such as commuting, home working and the move to cloud-based technology.

16. The network has also provided education on various climate change issues, provided information on how staff can help reduce their carbon footprint while working from home, and written articles on our internal website on a range of sustainability-related matters.

How we will report

Reporting in line with the TCFD recommendations

17. Recommendations drawn up by the TCFD have become an important framework for a coordinated approach that puts climate change at the heart of financial decision-making. They are intended to lead to clear, comprehensive, high-quality information for financial markets on the impacts of climate change.

18. The TCFD recommendations do not map directly onto TPR’s work. For example, we do not hold financial assets on which to report. However, we are part of a financial system for which TCFD is transforming climate risk management. We intend to work to the same standards as those that we regulate. Therefore, we will integrate TCFD practices where applicable, for example, with regards to governance.

19. We will align our reporting with what we expect from those that we regulate. We will disclose our work as a regulator as well as our operational performance.

20. We will report on the 11 disclosures recommended by the TCFD sitting under the following four headings.

21. Governance: disclose the organisation’s governance around climate-related risks and opportunities.

- Describe the board’s oversight of climate-related risks and opportunities.

- Describe management’s role in assessing and managing climate-related risks and opportunities.

22. Strategy: disclose the actual and potential impacts of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning where such information is material.

- Describe the climate-related risks and opportunities the organisation has identified over the short, medium and long term.

- Describe the impact of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning.

- Describe the resilience of the organisation’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario.

23. Risk management: disclose how the organisation identifies, assesses and manages climate-related risks.

- Describe the organisation’s processes for identifying and assessing climate-related risks.

- Describe the organisation’s processes for managing climate-related risks.

- Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation’s overall risk management.

24. Metrics and targets: disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

- Disclose the metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process.

- Disclose Scope 1, Scope 2, and if appropriate, Scope 3 greenhouse gas (GHG) emissions and the related risks.

- Describe the targets used by the organisation to manage climate-related risks and opportunities and performance against targets.

Conclusion: evolving our approach

25. As a society, we need to adapt to the challenges of climate change. As a regulator of pensions, we recognise that climate change is systemically significant to pensions. We need to support the UK government and others to adapt to these challenges and build resilience to climate change. We also recognise that we need to improve the resilience of our own organisation.

26. The steps and actions we have outlined in this report are a starting point. There is clearly more to do. By testing and learning through experience, we expect our approach to evolve and improve over the coming years as we continue to work with other regulators and organisations to gather best practise and share knowledge.

As a regulator

27. The world of green finance is rapidly evolving. There are likely to be more challenges for our regulated community as they adapt to this changing dynamic. The current TCFD reporting requirements alone are due to expand to cover a larger group of schemes in 2022, with a review planned by the DWP in 2023. Expectations for occupational pension schemes - both in terms of the steps they are required to take and the disclosures they will be required to make - are likely to change from what they are now.

28. We will continue to work with other financial regulators to improve our understanding of systemic risks and assess how resilient the UK financial sector is to climate change. We will also ensure that our work on climate-related risks and opportunities and stewardship practice is consistent.

29. We are concerned that industry surveys indicate that too few DB and DC schemes are giving enough consideration to climate-related risks and opportunities and that ownership of stewardship policies is too limited. Our job is to help schemes recognise the importance of climate change and help them adapt to changing requirements. We will do that by providing guidance, best practices, supervision and, where necessary, enforcement. As part of that process, we’ll continue to refine our approach as we learn and develop our own understanding.

As an organisation

30. We will continue to look for ways to effectively reduce our environmental impact and improve the environmental sustainability of our operations.

31. We need to fully understand the implications of our move to a hybrid working model.

32. We will continue to align ourselves with the approach used across the financial sector and are committed to reporting in line with the TCFD recommendations where we can. As we set out in our Climate change strategy, we will set a 2030 net-zero carbon emissions target for TPR, and by 2024, we will set out our plans to achieve this.