You can save the contents of this page as a PDF using your web browser. Open the print options and make sure the destination/printer is set as 'Save as PDF':

A new regulatory approach

In this section we provide an overview of our new regulatory approach and how we have developed our thinking in the following areas:

- Our approach to risk when developing the regulatory approach.

- Our twin track regulatory approach – Bespoke and Fast Track.

- How we plan to assess and regulate DB funding in the future.

Our regulatory approach has evolved since our first consultation in light of several factors:

- The likely shape of legislation – the Pensions Schemes Act 2021 and the draft Occupational Pension Schemes (Funding and Investment Strategy and Amendment) Regulations 2023.

- Consultation responses – there was broad support for our regulatory approach and some concerns, which we have highlighted in our consultation response document (National Archives).

- Modelling and analysis – assessing the potential impacts on schemes and balancing risk to members, employers and the Pension Protection Fund (PPF) to help set Fast Track parameters.

- Our corporate strategic goals and objectives – the approach has been designed to support our strategic aims and is underpinned by our objectives to ensure savers’ money is secure and decisions are made in savers’ interests.

1. Our new twin track regulatory approach

We are proposing a twin track approach to assessing valuations – Bespoke and Fast Track. Both Bespoke and Fast Track are equally valid, following one or the other does not automatically equate to compliance. The legislation and code principles will need to be followed.

Where the draft code sets out our expectations for compliance with the legislation, Fast Track will provide more direction and clarity on our view of a level of risk that we will tolerate.

The Fast Track approach will act as a filter for our assessment of actuarial valuations that are submitted to us. If a valuation submission meets a series of Fast Track parameters, we are unlikely to scrutinise it further and it is less likely that we will engage with trustees.

The Bespoke approach is intended to allow trustees to still have the flexibility to select scheme-specific funding solutions if the funding approach and actuarial valuation meet legislative requirements and follow code principles.

New legislative requirements mean all trustees have to submit a certain amount of quantitative and qualitative information to us in a statement of strategy. The complexity of the risks being taken will determine the level of evidence and explanation required.

If the statement of strategy clearly evidences and explains how the approach meets legislation and key code principles, trustees can expect minimal scrutiny and engagement with us, if any.

2. Bespoke

Bespoke offers trustees greater flexibility and scope to select an approach that suits the specifics of their scheme. Bespoke submissions are principles-based but with clear boundaries based on the legislative requirements and expectations in our code.

Bespoke valuation submissions are available for all schemes if legislation and key code principles are followed. Trustees may submit a Bespoke submission if they:

- want to take more risk than available under Fast Track and can demonstrate that the total risk run by the scheme is supportable by the employer covenant and in line with the maturity of the scheme

- cannot meet the Fast Track recovery plan length based on demonstrable employer affordability constraints

- have genuinely unique employer circumstances that necessitate a different approach

If trustees submit a Bespoke valuation, the level of evidence and explanation required in the statement of strategy will depend on the level and complexity of the risk being taken. We would expect a key focus to be on:

- the funding and investment risk being supportable by the employer covenant and in line with the maturity of the scheme

- the recovery plan, including deficit repair contributions (DRCs), meeting the ‘reasonably affordable’ principle

- if the scheme or employer’s circumstances are unusual or complex, the reasoning for this and how that is reflected in the plan

- the long-term strategy being appropriate and in line with the legislation

3. Fast Track

Fast Track is one possible approach that aims to provide trustees with a simpler path to demonstrating compliance.

Fast Track is not risk-free for trustees. It represents our view of tolerated risk for a scheme and sets out a series of quantitative parameters that need to be met. If a scheme meets all the Fast Track parameters, we are unlikely to scrutinise the valuation submission further. Where they do not meet individual parameters, the scope of our engagement will likely be limited to those areas.

The Fast Track parameters cover:

- the low dependency funding and investment strategy

- technical provisions (TPs)

- investment risk

- recovery plans

There is one set of Fast Track parameters for TPs and investments, set by reference to the maturity of the scheme. There will also be a set recovery plan length dependent on whether a scheme has or has not reached significant maturity.

Fast Track does not mirror the minimum level of compliance. In some instances, the Fast Track parameters are set above the minimum level of compliance. Some trustees may find Fast Track a useful tool when negotiating with their sponsoring employers.

Fast Track represents our view of tolerated risk, it does not represent minimum compliance. However, in some instances, adopting Fast Track may not be the most appropriate route and trustees should think carefully about whether Fast Track is right for their scheme.

Trustees submitting a Bespoke valuation submission may need to provide a greater level of evidence and explanation than expected in a Fast Track submission. Legislation requires trustees to explain their approach to setting their funding and investment strategy and managing risk in their statement of strategy.

We may also check compliance with Fast Track through sampling submissions. We will use this information to understand behaviours and risks across the landscape to inform setting parameters in the future.

Fast Track guidance will set out the information trustees will be expected to submit as part of Fast Track valuation submission.

4. Our approach to risk in Fast Track

In developing Fast Track, we have carefully considered the balance of risk between members, the PPF and employers and the trade-offs different approaches may bring.

We have looked to:

- set a tolerated level of risk that focuses on member protection via a series of quantitative parameters

- mitigate the risk to the PPF by improving schemes’ long-term funding position rather than focusing on short-term insolvency risk

- recognise the role of the employer and the need for them to have room to invest in sustainable growth

- give room for trustees to take a higher risk approach that complies with legislation (supportable risk taking) but requires more evidence and explanation as to how it is compliant

- recognise that higher risk assets have a significant role to play for immature schemes that have time to ride out economic cycles

We have also focused on the areas we see as having the greatest risk to our objectives:

- Schemes with an overlong recovery plan relative to how quickly the employer could recover the deficit based on affordability.

- Schemes with TPs that are too weak and/or investment risk that is too high relative to what the covenant and maturity profile can support.

- Schemes with a weak covenant and a high risk of insolvency in the short to medium-term.

These areas of focus are not new. They have featured in past cases and recent messaging around our expectations.

We provide more detail on Fast Track parameters in Appendix 1.

5. Why Fast Track is not in the draft code

In our first consultation, we proposed our regulatory approach would be embedded into our code of practice.

However, we now propose to keep Fast Track separate from the code for the following reasons.

- Fast Track is not in the legislation itself and a code of practice must set out expectations for compliance with the legislation.

- This approach provides greater flexibility to change Fast Track without requiring an amendment to a code of practice. In instances where a quick change to Fast Track is required, the process will need to work efficiently to avoid unintended consequences.

- Fast Track will provide a filter for TPR interventions where we are less likely to engage with trustees in respect to their valuation, as it reflects our view of a tolerated level of risk.

A summary of the Fast track requirements can be found in Appendix 1.

6. Assessing covenant

Employer covenant support is recognised explicitly in legislation as a key element for assessing supportable risk. Our draft code and this consultation document provide clear expectations for how we expect trustees to assess covenant.

One of the challenges of the current system is the subjective nature of what constitutes varying covenant grades. Detailed intervention discussions invariably turn to value of cash flow, the value of contingent assets and prospects of the employer and wider group. We will be moving away from an internal assessment based purely on covenant grades to one that better considers the three fundamental covenant pillars of cash, contingent assets, and prospects.

We have not made fundamental changes to what covenant is, or the key areas of assessment. However, we will aim to better reflect how the relevant elements of covenant tie into decisions around funding, investment and recovery plans. We are reviewing and expanding our existing guidance and will add more examples. We plan to consult on our proposed changes to the covenant guidance in 2023.

7. Engagement

We plan to review our approach to the regulation of DB scheme funding, including our enforcement approach. This section outlines our initial proposal regarding the practical operation of the new funding approach.

We are evolving the way we regulate so we can be more effective and efficient, more proactive in identifying and mitigating risks, and improve our regulatory oversight.

We have been careful to ensure our regulatory approach builds on the following opportunities provided by the legislation and draft DB funding code to support the use of our range of regulatory tools, engagements and funding enforcement powers:

- Providing increased and appropriate data upfront will enable TPR to identify and respond to emerging risks more effectively and efficiently.

- A consistent and common approach to measuring risk and assessing supportable risk across all schemes will help enable us to improve our understanding of risk and filter schemes for engagement.

- Greater clarity for schemes around risk and planning will help them move progressively to a position of low dependency by significant maturity and encourage an active focus on risk management.

- Improved data in relation to schemes reporting a surplus on a TPs basis allowing for a more complete view of the DB universe.

- Greater clarity will support effective and efficient use of our funding enforcement powers (s231) and improvement notices (s13).

All trustees, including those of schemes in surplus, will be required to submit their valuation documents to us, including the statement of strategy.

The level of evidence and explanation required in the statement of strategy will depend on the trustees’ valuation approach and complexity of the risk taken.

Once we have received the valuation submission, we will undertake a high-level review to:

- verify Fast Track valuation submissions meet the parameters

- determine next steps of engagement with Bespoke valuation submissions, if required

We will take a risk-based approach and we expect many Bespoke valuation submissions will not result in detailed scrutiny or engagement.

Analysis of Bespoke valuation submissions will follow the key principles set out in the legislation and our code.

If a Bespoke valuation submission is selected for further scrutiny, we will use our regulatory tools proportionately across a range of low to high intensity engagements. Our aim is to facilitate the most effective and efficient resolution.

We anticipate that most of our engagement will be at a low and medium intensity level.

8. Enforcement – our powers

Although enforceability is an important objective of our approach, we envisage a small number of cases may proceed to enforcement.

The new framework provides significant opportunities for improved outcomes and regulation. In the practical operation of the new funding approach, we propose to:

- be proportionate, taking a risk-based outcome-focussed approach

- use data to more effectively identify and respond to emerging themes across the DB pensions landscape

- be transparent in our approach

- improve our evidence-informed approach

9. Fast Track submissions

One of the criteria for Fast Track is that the scheme actuary must confirm that the submission meets the Fast Track parameters.

This will require the actuary to confirm that the tests and conditions described in this document and summarised in Appendix 1 are met. These should be factual matters and the actuary is not being asked to confirm as to whether, in their opinion, the legislation and principles in the code are being complied with.

If the actuary is not able to provide that confirmation, the valuation submission will need to be Bespoke.

The requirement for a professional to provide this confirmation gives us additional reassurance that the requirements of Fast Track are met and therefore that, generally, we should not have to engage with schemes following a Fast Track valuation submission.

10. Smaller schemes

We recognise that in many instances the additional costs of compliance will be significantly larger for smaller schemes when considered as a percentage of scheme liabilities. This is why we encourage a proportionate approach to complying with the principles set out in the code.

Smaller schemes also have different characteristics to larger schemes, for example they are more likely to be prone to 'concentration risk' where a high percentage of the liabilities relate to a small number of individuals making future cash flows less reliable as a forecast. The variability in any projected cash flows is also likely to be higher.

For these reasons, we have allowed some simplification of our requirements for smaller schemes using Fast Track. These are as follows:

- In the calculation of projected duration, allowing the use of a specified proxy.

- Allowing the use of a specified single equivalent discount rate rather than the yield curve methodology.

For these purposes we have defined smaller schemes as those with 100 members or less, consistent with other legislation.

Full details of these simplifications are shown in Appendix 1.

11. Have your say on the new valuation submission portal

We are updating how valuation documents will be submitted to us. We have commenced a thorough engagement programme and would like to hear from those of you who are involved in the valuation submission process. This engagement programme is part of ongoing research, ensuring that we respond to the needs of pensions professionals as we develop our services.

Please complete a short questionnaire (maximum five minutes) if you would like to be involved.

Fast Track parameters

12. Introduction

This section of the consultation document summarises how we arrived at the parameters for Fast Track and why we think they are appropriate.

It is important to understand that our Fast Track solution is not trying to be the optimum solution, nor are we suggesting it is the appropriate approach for all schemes. It is not a risk-free position, nor does it guarantee that the scheme will be able to pay all benefits as they fall due.

The pension system has been designed so that occupational DB pension schemes are expected to take some risks, but Fast Track represents a position of ‘tolerated’ risk in our view. If schemes were to meet these parameters, then we are unlikely to scrutinise their submission further.

The setting of the Fast Track parameters requires a balanced judgement, based on a combination of overall risk to members’ benefits, simplicity versus complexity of the approach for the trustees, and the cost to the employer.

In our view, Fast Track represents a justifiable, prudent position that most stakeholders would recognise as within the range of reasonable outcomes that balances these competing priorities.

It is also important to note that it is not necessary to meet the Fast Track parameters to comply with the scheme funding regulations. Trustees who wish to take a different scheme-specific approach, where risk is shown to be supportable, can go down the Bespoke route.

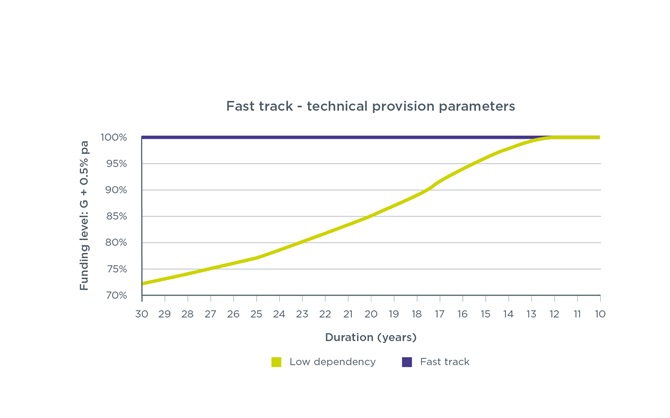

13. Funding target – discount rate

We consulted on a discount rate in the region of Gilts+0.25% and Gilts+0.5% at significant maturity and set out our reasons for why we felt that a rate within this range was appropriate for Fast Track purposes (see our previous consultation (National Archives)).

Responses supported the range we set out with a preference for the upper end (Gilts+0.5%). We agree that Gilts+0.25% is likely to be too prudent a basis for Fast Track purposes and that something towards the upper end of the range would be more appropriate. Given the nature and uncertainty around long term modelling, and that Fast Track aims to be a regulatory line rather than a set benchmark for compliance, we see little benefit in trying to set the discount rate at a point within that range.

Based on the analysis set out in our previous consultation, the responses received and some of the following analysis in this section, we believe that a discount rate at the Gilts+0.5% level meets our key objectives of providing for sufficient independence from the covenant, does not represent too prudent a basis and sets a clear basis for schemes.

We recognise that market conditions have materially changed since our last consultation – most notably the increase in yields on government bonds. However, we continue to believe that the discount rate for Fast Track set at this level represents an appropriate long-term target. Where schemes are at, or close to, significant maturity and believe they are able to achieve a higher yield than is reflected in Fast Track while still meeting the principles of the legislation and code, then the Bespoke route offers them the opportunity to show they can achieve this. This specific issue is discussed in our consultation documents and draft code.

We agree with respondents that it is important the discount rate is kept under review and is linked to an appropriate investment strategy and the prudent expectation on the long term returns it could deliver. We also agree that it should be dynamic with market conditions under certain circumstances. We have built these principles and approaches in to how we will approach reviewing and adjusting as necessary the discount rate for Fast Track.

The investment strategy at the long-term objective is discussed in the section Investment strategy underpinning our Fast Track approach and we have also set proposals for how we plan to review our approach to take account of market conditions.

14. Funding target – other assumptions

In our first consultation, we consulted on three approaches to how we should deal with assumptions other than the discount rate relevant to calculating the low dependency funding basis for Fast Track. In brief for all other assumptions the three options were:

- they would be at ‘best estimate’ decided by schemes

- we would define the less ‘scheme-specific’ assumptions with the remainder as per option a

- we would define all the assumptions

We don’t believe it is appropriate at the current time for us to define all the other assumptions for Fast Track. Many assumptions are too scheme-specific so that the use of a defined assumption for Fast Track could have the effect of producing an unrealistic assumption for an individual scheme. This would be counter to the intent.

However, we also do not think it is appropriate to leave all the other assumptions in Fast Track to be decided scheme-by-scheme, particularly the financial assumptions. This would make comparisons between schemes more difficult and leave the potential for a combination of a lack of prudence in each assumption, which one-by-one may not be material, but could add up to an overall material impact and undermine the principle of low dependence. Many of the responses we received supported some assumptions, particularly financial assumptions, being set by us.

We have therefore decided on an approach that aims to balance these competing elements. In the code, we set out principles and guidance for setting all other assumptions whether a scheme is in Fast Track or Bespoke. However, we have included additional and more directional guidance for Fast Track, specifying those assumptions that lend themselves more to such an approach and minimise the risk of results not being comparable or realistic while still being appropriate for the specific circumstances of the scheme.

Many respondents identified inflation and related assumptions as key assumptions that could be specified. Our proposal is to specify the retail price inflation (RPI) and consumer price inflation (CPI) assumptions. These will be set to be consistent with the discount rate specified for Fast Track. Our intention is to extend the specification to inflation-linked pensions increases with caps and collars in the future. However, initially, this is an area where the code offers guidance only. We recognise there are several different approaches in the market, and we would like to explore later how we could introduce specificity in this area without unduly affecting the diversity of the approach.

We recognise the expertise of the pension industry in being able to adapt and react in a timely way to changing events, for example, mortality and the impact of COVID-19. We are not proposing to introduce specific assumptions for future mortality improvements.

Full details of the additional guidance and specification for assumptions can be found in Appendix 1.

Point of significant maturity

We are proposing for the code to use duration as the definition for maturity as that is in line with the Department for Work and Pensions’ draft regulations. We have proposed a duration point of 12 for the purposes of defining the point at which the scheme is deemed to have reached significant maturity.

For Fast Track, we are not proposing defining a different duration point. We will use 12 for the purposes of Fast Track as well. However, we have included a consultation question in our code consultation document in relation to this and whether we should leave some ‘space’ between Fast Track and minimum compliance with the legislation and principles in the code.

Given the single end point at significant maturity is not expected to reflect an allowance for covenant support, we have adopted the same assumption irrespective of the existing covenant strength.

It should be noted that having a single target irrespective of current covenant strength limits the degree that it is possible to allow for scheme specificity by covenant strength, particularly the closer the scheme becomes to significant maturity. We are aware that the DWP is consulting on potential allowances for additional risk taking post significant maturity. When further details are known, we will look to adjust our Fast Track approach accordingly.

Pre-significant maturity

One supportable risk principle is that, subject to the strength of the covenant, trustees can take more risk based on their schemes’ maturity prior to significant maturity. Linked to this, there is also a balance between the level of return required to be able to provide the necessary upside potential to achieve full funding on a low dependency basis by the time the scheme reaches significant maturity, with the balance against the downside risks, which would require employer covenant support.

Irrespective of the strength of the employer covenant, the investment strategies underlying the Fast Track approach can have an element of growth assets in order to provide the expected higher long-term returns. It should also be noted that, even with material levels of growth assets, the funding risks associated with interest rate and inflation risks for less mature schemes can still be mitigated through the use of leverage on the bond portfolio, also known as liability-driven investment (LDI) assets.

Even for more immature schemes, given the need to allow for the possibility of a material level of growth assets and the use of leverage to mitigate interest rate and inflation risks, when deriving our Fast Track parameters, there is a limit to the level at which it is possible to apply different factors for funding purposes based on employer covenant strength only. Any differences also decrease when moving towards significant maturity.

Practical considerations

One of the key benefits of implementing a Fast Track approach is to provide greater transparency and certainty to trustees and employers in being able to assess whether their funding arrangements reduce the likelihood of regulatory engagement.

We highlighted in our initial consultation that a Fast Track regime which applied the same set of Fast Track parameters for all schemes irrespective of covenant assessment, could have significant benefits, in particular simplifying the approach for TPs and providing greater transparency on the balance between cash funding and investment risk. We noted that the downside of such an approach is that this could be seen as a departure from our current guidance and approach.

However, when it comes to practice, we note that the link between covenant grading and risk within the funding approach appears materially less interrelated. There are many reasons why this might be. For example, schemes with strong employers, where the trustees and employer want to remove scheme funding volatility, may adopt a low-risk funding and investment strategy. Conversely, trustees of schemes with relatively weak funding levels and weak sponsoring employers may need to take moderately higher levels of investment and funding risk in the short term with the aim of being able to reach an appropriate low dependency funding target over the longer term.

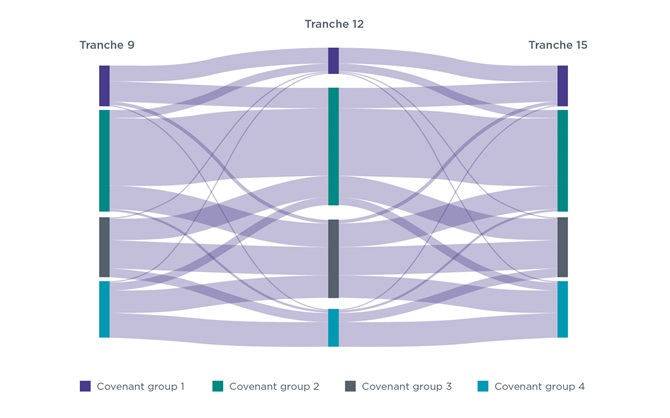

This can be seen from our annual analysis of recovery plan submissions, the most recent scheme funding analysis publication being for Tranche 15 scheme valuation submissions.

Table 1 shows the average discount rate by covenant grade. Although for tranches 7 through to 9 there was a link between the strength of the employer covenant and the funding target, since tranche 10 this relationship no longer seems to hold. The average nominal discount rate, ie the funding target, is broadly the same irrespective of covenant grade.

Table 1: Average nominal SEDR by scheme characteristics (tranches 1 to 7: schemes in deficit only, tranches 8 to 15: all schemes)

| 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | |

|---|---|---|---|---|---|---|---|---|---|

| Covenant group 1 | 4.41% | 4.13% | 4.71% | 3.37% | 3.22% | 2.74% | 2.63% | 2.47% | 1.85% |

| Covenant group 2 | 4.37% | 4.19% | 4.55% | 3.45% | 3.27% | 2.82% | 2.65% | 2.45% | 1.87% |

| Covenant group 3 | 4.33% | 4.15% | 4.54% | 3.47% | 3.34% | 2.77% | 2.62% | 2.39% | 1.79% |

| Covenant group 4 | 4.20% | 3.96% | 4.35% | 3.41% | 3.26% | 2.68% | 2.52% | 2.43% | 1.89% |

Similarly, table 2 shows that the level of DRCs, when calculated by reference to the level of TPs, are also not linked to the employer covenant strength, and the level of DRCs are broadly the same irrespective of the covenant grade.

Table 2: Average annual contributions as a percentage of TPs liabilities by scheme characteristics (schemes in deficit only)

| 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | |

|---|---|---|---|---|---|---|---|---|---|

| Covenant group 1 | 2.9% | 2.4% | 2.1% | 2.0% | 2.3% | 2.4% | 2.0% | 2.1% | 2.0% |

| Covenant group 2 | 2.6% | 2.3% | 2.2% | 2.3% | 2.4% | 2.1% | 2.4% | 2.2% | 1.9% |

| Covenant group 3 | 2.5% | 2.1% | 2.1% | 2.1% | 2.2% | 1.8% | 2.0% | 2.1% | 1.9% |

| Covenant group 4 | 2.5% | 2.2% | 2.6% | 2.6% | 2.4% | 2.2% | 2.4% | 2.4% | 2.0% |

Employer covenant strength itself is volatile and changes over time. The scheme funding publication provides details of the distribution of the employer covenant using various metrics, with the majority of employers being within the CG2 category.

Table 3: Distribution of members and liabilities across covenant groups (schemes in deficit only)

| Tranches 13, 14 and 15 | |||||

|---|---|---|---|---|---|

| Covenant groups (schemes in deficit only) | Members (%) | Assets (%) | Technical provisions (%) | Buyout liabilities (%) | s179 liabilities (%) |

| Covenant group 1 (strong) | 20% | 20% | 20% | 21% | 21% |

| Covenant group 2 (tending to strong) | 49% | 55% | 54% | 52% | 54% |

| Covenant group 3 (tending to weak) | 20% | 19% | 19% | 21% | 19% |

| Covenant group 4 (weak) | 11% | 6% | 6% | 7% | 6% |

However, further details of the transition of the employer covenant grading can be seen in the analysis in the following paragraphs, which was not produced as part of the scheme funding publication.

There were estimated to be 1,713 schemes with a Tranche 15 valuation date, of which 813 have covenant grade ratings data in all three data points, Tranches 9, 12 and 15. The missing data is mainly due to schemes not submitting valuations in all three of the data points and that covenant assessments are not usually undertaken for schemes in surplus, given that such schemes are not required to provide a valuation submission to us.

Figure 1: Covenant group transition for schemes in Tranches 9, 12, 15

Table 4: Transition matrix from tranche 9 to tranche 15, based on covenant assessment of Tranche 9

| Starting covenant (Tranche 9) | Ending covenant (Tranche 15) | |||

|---|---|---|---|---|

| Covenant group 1 | Covenant group 2 | Covenant group 3 | Covenant group 4 | |

| Covenant group 1 | 44% | 45% | 9% | 2% |

| Covenant group 2 | 19% | 50% | 22% | 8% |

| Covenant group 3 | 10% | 37% | 33% | 20% |

| Covenant group 4 | 3% | 24% | 25% | 47% |

For example, of those schemes with a strong covenant grading (for example covenant group 1) in tranche 9, only 44% of those schemes were assessed as having a strong covenant rating at the time of their tranche 15 valuation. The remaining 56% of those schemes had their covenant strength downgraded over these two valuation cycles, with 11% of those schemes having their covenant rating downgraded by two or more classes.

Given such movements in covenant grading, ie overall there is less than a 50% probability of having the same covenant grading as that prior to the previous valuation cycle, there are further risks in being able to maintain a consistent funding target approach over time.

It should also be noted that, whilst a covenant-led Fast Track approach provides for the ability to differentiate the level of funding and investment risks, outside of this there is little scheme-specificity based on the actual employer covenant strength, which even amongst a single covenant grade is expected to vary. For example, while two schemes could justifiably have the same covenant grading at any point in time, for a variety of different reasons, it might not necessarily be appropriate for those schemes to have the same funding strategy.

Based on all of the above considerations, combined with the practical limitations of being able to materially deviate by covenant grading, we have decided to adopt a single set of parameters for Fast Track purposes.

Schemes with employer covenants at the extreme ends of the covenant spectrum

Whilst a single set of Fast Track parameters would appear suitable for the majority of employer covenants, we also considered allowing for the two extreme ends of the spectrum with regards to employer covenant, ie the very strong and the very weak.

Taking each of these aspects separately, for schemes that are supported by a very weak employer covenant with a high level of insolvency risk, the level of risk associated with Fast Track may be too high for both members and the PPF, as short-term volatility in the funding level may not be recovered if there is a subsequent employer insolvency increasing the risk and impact on members and the PPF. However, it would be very difficult to isolate those schemes with a very high insolvency risk or to set a benchmark for what is ‘too high’. It would also be disproportionate to require all schemes with very weak employers to fund to a low dependency level of liabilities where the data shows that even for those with higher insolvency probabilities there is only a small proportion of these employers that will actually go insolvent in the short term. As such, we are not proposing to adopt a “very weak” covenant Fast Track line, but instead we would expect trustees to consider the likelihood of insolvency and make the appropriate funding arrangements depending on their circumstances. Our code covers some of the arrangements we would expect.

In respect of the very strong employer covenants, rather than set a single set of parameters for only a select few schemes, we consider that the Bespoke route provides the necessary flexibility required. Trustees of schemes whose actual funding and investment risks being run are assessed against a truly strong employer covenant should be able to easily provide the evidence that the employer can underwrite the scheme risks.

Judgements required

There is a balance regarding where it is appropriate to set the Fast Track parameters, including but not limited to:

- the level of growth assets within the underlying investment portfolio, with consideration to the expected higher return from growth assets over the long term against the short-term downside risks associated with higher volatility and need to de-risk over time

- the level of interest rate and inflation protection versus the liquidity risks and governance issues associated with higher levels of leverage required to achieve higher levels of hedging for immature schemes

- the overall level of prudence within the discount rate

- the shape and pace of the journey plan to de-risk from the initial investment strategy to the low dependency investment strategy at the point of significant maturity

- open versus closed schemes

- all of these issues generally relate to the need to balance the level of security provided to members within the Fast Track approach versus the cost to employers of meeting Fast Track if the Fast Track parameters are too prudent

Investment strategy underpinning our Fast Track approach

We are not defining an actual investment strategy that trustees and employers should follow for Fast Track purposes. However, in order to determine the Fast Track parameters we have needed to define an underlying investment strategy in order to determine an appropriate discount rate for setting the TPs and calculating the stress factors.

Our initial consultation highlighted some potential approaches for an investment strategy at the point of significant maturity, including the Barbell strategy, Credit-based strategy and Cash flow driven investment strategy. We are not defining any particular investment strategy, so we have assumed an element of each of these approaches for the purposes of the investment strategy underlying the Fast Track approach at point of significant maturity. For completeness, it should be noted that at the point of significant maturity (ie the relevant date) we do not consider that the regulations constrain all investment in growth type assets. However, these need to be limited as an overall proportion of the strategy in order to comply with the draft regulations.

For these purposes, we have adopted the following broad investment strategy in respect of the point of significant maturity:

Table 5: Investment Strategy at significant maturity used in derivation of Fast Track parameters

| Growth | 15% |

| Corporate Bonds | 30% |

| Government | 48% |

| Gilts | |

| Cash | 7% |

In respect of the non-growth investment allocation, we have assumed that the allocation between corporate bonds and gilts reflects the actual investment bond strategies that are observed, as per the data from the Purple Book. This indicates that the proportion of corporate bonds as part of the overall bond allocation is somewhere between 30% to 40%, and so for our purposes we are assuming an allocation to corporate bonds as 35% of the non-growth portfolio. The remaining allocation to gilts and cash is based on a combination of cash flow matching and liquidity requirements combined with an approach to hedge the duration of the bond portfolio to that of the liabilities. For these purposes, we have assumed that the average duration of the corporate bond portfolio is 8.1 years and the gilt portfolio 20 years, so that the overall duration of the bond portfolio is 12 years at point of significant maturity.

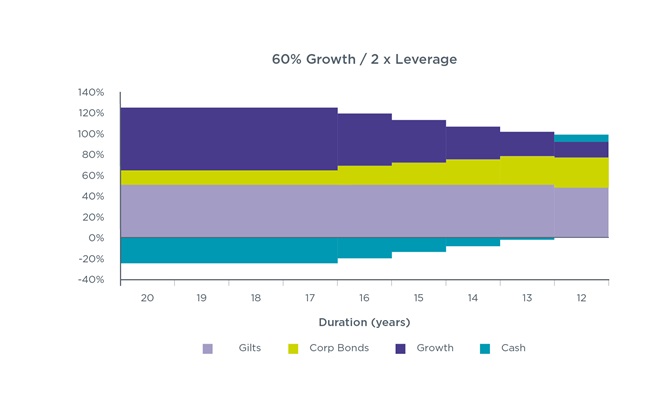

For the period pre-significant maturity, we have assumed for Fast Track purposes that schemes can invest up to 60% of the portfolio in growth seeking assets, with the bond portfolio allocated in the proportions as set out above. Additionally, for the gilt allocation we have assumed that in order to mitigate the level of interest rate and inflation risk the gilt portfolio uses leverage, up to a maximum of two times, subject to a maximum hedging ratio of 100% of the assets to that of the duration of the liabilities.

We have adopted the following investment strategy in respect of the point of pre-significant maturity:

Table 6: Investment Strategy at duration 17 and higher used in derivation of Fast Track parameters

| Growth | 60% |

| Corporate Bonds | 14% |

| Government | 52% |

| Gilts | |

| Cash | -26% |

We have assumed that the investment strategy will de-risk over a period of duration 17 to duration 12.

This leads to the following overall investment strategy over time (assuming the initial starting position is duration 20):

Figure 2: Overall investment strategy over time

We note that the approach above provides a higher level of allocation to growth than is currently observed through the DB universe (see Purple Book). The principles of the draft regulations recognise that it is possible to take more risk the less mature a scheme, subject to such risks being supportable by the employer covenant. There is therefore a balance in determining how to set a single set of Fast Track parameters, as this needs to cover both open and closed schemes as well as considering member security, employer affordability and how a single set of Fast Track parameters can accommodate a range of employer covenants. However, we believe the short-term risks associated with a high growth allocation strategy can also be mitigated to an extent through the leverage of the gilt portfolio in order to reduce interest rate and inflation risks.

The above approach therefore attempts to balance these issues when determining an acceptable tolerated risk position.

Setting the Fast Track TPs parameters

Based on the above investment strategy and journey plan, and adopting a prudent long-term discount rate of broadly G+2% pa reducing to G+0.5%, this results in a scheme with an initial starting duration of 20 with TPs of c.85% of the low dependency liabilities.

Like all of the Fast Track parameters, it is a judgement regarding the level of prudence to apply for the discount rate, in particular for the growth portfolio when returns are unknown and predominantly based around future expectations. There is also the balance between the impact that higher levels of prudence have on improvements in expected member outcomes versus the higher overall expected cost to employers. We believe that a discount rate of G+2% pa is a reasonable prudent long-term return on an overall growth heavy portfolio, which balances these competing objectives.

Based on the above approach and applying a degree of smoothing by duration, this results in the following Fast Track parameters, as a percentage of the low dependency liabilities, which will apply for TPs purposes:

Table 7: Fast Track TPs test parameters

| Duration | 30 | 29 | 28 | 27 | 26 | 25 | 24 |

| Fast Track | 72.0% | 73.0% | 74.0% | 75.0% | 76.0% | 77.0% | 78.5% |

| Duration | 23 | 22 | 21 | 20 | 19 | 18 | 17 |

| Fast Track | 80.0% | 81.5% | 83.0% | 85.0% | 87.0% | 89.0% | 91.5% |

| Duration | 16 | 15 | 14 | 13 | 12 | 11 | 10 |

| Fast Track | 94.0% | 96.0% | 98.0% | 99.5% | 100.0% | 100.0% | 100.0% |

Figure 3: Fast Track - technical provision parameters

For very immature schemes with a duration of more than 30, following the trend rate over the period duration 25 to 30, the Fast Track TPs parameters continue to reduce by 1.0% per annum for each duration year lower than duration 30, whilst for very mature schemes with duration of 10 or less, the Fast Track parameters remains at 100.0% of the low dependency liabilities.

To meet the Fast Track parameters, the scheme’s TPs must be at least the relevant percentage of the scheme’s low dependency liabilities. The duration to be used to determine the parameter will be based on the accrued liabilities and the scheme’s low dependency liabilities.

We do not want to discourage trustees from choosing low dependency liabilities that are more prudent than the minimum required by Fast Track. Therefore, for trustees that have chosen more prudent assumptions and are not meeting this parameter, they can carry out an additional test based on the minimum Fast Track low dependency basis rather than the scheme’s assumptions.

In the code we recognise that it would be appropriate to make reasonable assumptions for the period of future accrual and/or the level of new entrants in determining the TPs before the relevant date. Such assumptions will mean that an open scheme can be expected to take longer to reach significant maturity than an equivalent closed scheme.

To allow for this in Fast Track, open schemes can calculate duration based on accrued liabilities combined with an allowance for prospective future service accrual.

The use of this amended approach in the calculation of duration will usually lead to a higher duration being calculated and therefore a lower minimum percentage of TPs will be required to meet the Fast Track parameter.

The rationale for using this higher duration recognises that using the combined past and future cash flows, which are used in the calculation of the combined past service liability and future service cost, would be a better proxy for projecting the time of expected significant maturity allowing for future service.

We have also set out in the code the principles for setting assumptions for the period of future accrual and any allowance for new entrants. In Fast Track, we limit accrual to six years and the assumptions for new entrants must be no more than the average number of new entrants in the three years preceding the valuation.

The code sets out our expectation that schemes should use the yield curve methodology when setting their financial assumptions. Therefore, this is required in Fast Track except for smaller schemes as described earlier.

Our modelling considers the accrued benefits only. Our code sets out the principles we expect trustees to consider when determining the cost of future service accrual. We are not proposing any additional restrictions in Fast Track on the calculation of the future service cost.

Setting the Fast Track technical stress parameters

The Fast Track parameters for determining the stress test adopt assumptions proposed by the PPF. This is what we suggested in our first consultation and is an approach familiar to the UK industry and fairly simple to apply in practice.

While our initial intention is to use factors taken from the PPF levy calculation, the factors in this Fast Track stress test are separate and will not necessarily change in future to be the same as the PPF’s.

In summary, the factors for stressing the assets and liabilities used in determining the parameters are those proposed by the PPF in their 2023/2024 consultation with the following simplifications:

- Growth assets are assumed to be invested in line with overseas equities.

- The scheme’s benefits are assumed to have 70% inflation linkage with the remaining 30% to have nominal indexation.

From the 23/24 levy, the PPF is proposing that its calculation uses two sets of stress parameters reflecting two different approaches to asset categorisation. To maintain the simplicity of approach in the Fast Track funding and investment stress test, we are using a single test using only one of these sets of parameters (Tier 1). However, it can be used by all schemes and we provide a table for how different asset categories should be mapped to those used in the test in appendix 3.

The Fast Track investment and funding stress test sets out the maximum fall in funding level for a fully funded scheme after being 'stressed' using the factors above.

The full formula is set out below as follows:

1 −Minimum (Fast Track TP Parameter, Stressed Funding Level) / Minimum (Fast Track TP Parameter, Unstressed Funding Level)

For these purposes, the above factors are defined as follows:

Fast Track TPs parameter: These are the minimum level of TPs expressed as a percentage of the low dependency liabilities. For example, as set out in ‘Setting the Fast Track parameter’ section, this would be equivalent to 85% at duration 20.

Unstressed funding level: Broadly the funding level of the scheme on the Fast Track low dependency basis.

Stressed funding level: Broadly the funding level of the scheme on the Fast Track low dependency basis after the assets and liabilities are stressed using the factors above.

Full detail describing how the test should be carried out is set out in the Appendix 1.

In our initial consultation, we provided various options for how the Fast Track stress test could be undertaken. Having considered the responses, we have opted for that as set out in option 2, albeit that the formula has been inverted and an allowance included for schemes in surplus on a Fast Track TPs basis included.

After significant maturity is reached, the scheme should be invested in an appropriate low dependency investment allocation and no changes should be needed to the investment strategy. To ensure the test is identical at and after significant maturity, the test uses a minimum value of duration of 12.

Based on the investment strategy, the Fast Track TPs, the stress factors and assumptions, and the form of the test, these produce the following Fast Track parameters in respect of the stress test:

Table 8: Fast Track funding and investment stress test parameters

| Duration | 30 | 29 | 28 | 27 | 26 | 25 | 24 |

| Fast Track | 18.7%/ | 18.1% | 17.6% | 17.0% | 16.5% | 15.9% | 15.4% |

| Duration | 23 | 22 | 21 | 20 | 19 | 18 | 17 |

| Fast Track | 14.8% | 14.3% | 13.7% | 13.1% | 12.5% | 12.0% | 11.4% |

| Duration | 16 | 15 | 14 | 13 | 12 | 11 | 10 |

| Fast Track | 7.7% | 5.3% | 4.2% | 3.1% | 1.9% | 1.9% | 1.9% |

Recovery plans

In our first consultation, we considered two approaches. The first concerned a maximum recovery plan based on the employer covenant strength, with a proposal of six years for CG1 and CG2 schemes, increasing to nine years and 12 years for CG3 and CG4 respectively. The second approach was for a single recovery plan length being the same for all schemes irrespective of covenant grading, although we did not consult on what an actual length should be under this scenario. Our proposal is now to adopt the latter approach and just use a single recovery plan length, irrespective of the covenant for simplicity and transparency.

Like all the decisions for Fast Track purposes, setting a single recovery plan length is judgement-based, balancing the security of members’ benefits compared to the cost for sponsoring employers.

Over the period of the scheme funding regime introduced as part of the Pensions Act 2004, we have seen the average recovery plan reduce with the interquartile range from 10.0 years to 5.0 years for tranche 1 down to 8.2 years to 3.2 years for tranche 15, with the median reducing from 8.8 years to 5.4 years (see Scheme funding analysis annex).

Table 9: Distribution of recovery plan lengths (schemes in deficit only)

| RP length (years) - tranche | ||||||||

|---|---|---|---|---|---|---|---|---|

| Percentile | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 95th | 15.0 | 15.0 | 17.0 | 19.8 | 17.4 | 15.9 | 18.0 | 17.6 |

| 75th | 10.0 | 10.0 | 10.0 | 12.0 | 10.0 | 10.0 | 11.0 | 11.0 |

| 50th | 8.8 | 8.0 | 8.8 | 9.4 | 8.3 | 7.2 | 7.9 | 8.1 |

| 25th | 5.0 | 5.0 | 5.1 | 6.8 | 5.0 | 4.4 | 5.0 | 5.0 |

| 5th | 1.6 | 1.2 | 2.0 | 2.5 | 1.7 | 1.1 | 1.7 | 1.2 |

| RP length (years) - tranche | |||||||

|---|---|---|---|---|---|---|---|

| Percentile | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 95th | 18.7 | 16.9 | 16.5 | 16.0 | 14.8 | 14.8 | 14.8 |

| 75th | 10.3 | 10.3 | 10.3 | 9.8 | 8.8 | 8.1 | 5.4 |

| 50th | 7.1 | 7.3 | 7.3 | 6.6 | 5.5 | 5.2 | 7.9 |

| 25th | 4.2 | 4.3 | 4.3 | 4.0 | 3.3 | 3.0 | 3.2 |

| 5th | 1.0 | 1.3 | 1.3 | 1.0 | 0.9 | 0.9 | 1.0 |

While the scheme funding information also indicates that recovery plan lengths are linked to covenant grading, as shown in Table 2, the actual size of the DRCs are broadly similar in monetary amounts.

Based on Table 9, and for practical reasons, we are setting for Fast Track purposes a maximum recovery plan length of six years for schemes at pre-significant maturity.

Six years represents a period of two valuation cycles and is broadly consistent with the maximum period of covenant reliability.

For schemes that are past the point of significant maturity, there are greater risks to members of having longer recovery plans and the need to be fully funded on a low dependency basis due to the level of benefits paid out for such schemes. Therefore, for schemes post significant maturity, for Fast Track purposes we are setting the maximum recovery plan length to three years.

Currently, recovery plan lengths may be being measured in different ways by trustees and employers – from valuation date, from completion of valuation or from submission of valuation. For Fast Track we are using the valuation date for the calculation of the recovery plan length, principally because it provides consistency across all schemes and removes any incentive to delay the completion of the valuation.

Our initial consultation also discussed recovery plan structures, including back-end loading, investment out-performance and post valuation experience.

In respect of back-end loading, in line with our initial consultation, we will allow deficit reduction contributions to increase over time up to a maximum of CPI.

Post-valuation experience will be allowed in Fast Track but only in respect of experience actually realised. Our expectations are that the actual monetary amount of experience is clearly identified in the recovery plan and is calculated at a date as close as is practical to the completion of the valuation, and that this should reflect changes to the asset value and the liability value over the relevant period.

This is distinct from expected investment out-performance, which incorporates a view about future investment expectations in excess of those adopted for the calculation of the TPs, that may or may not be realised, and the outcome not known for some time.

For Fast Track purposes, we are not intending on giving further allowance for future expected investment out-performance. Consultation responses were mixed but marginally favouring not allowing it in Fast Track. On balance, we think the simplicity of the approach of not allowing it in Fast Track will help ensure Fast Track is a clear and unambiguous framework. If schemes allow for it and are assessed on a Bespoke basis, if they are within Fast Track in all other aspects, they will only need to justify their recovery plan based on affordability rather than all aspects of their valuation. This should be a relatively straightforward process.

Modelling member outcomes

Based on the Fast Track framework, the Government Actuary’s Department (GAD) has provided modelling, which gives indicative probabilities of schemes reaching full funding by the time they reach significant maturity or, in poor scenarios, the shortfall in funding. Significant maturity is defined to be when a scheme’s duration reaches 12.

This modelling is based upon market conditions as at 31 March 2021, using a scheme with a starting duration of 20. Based on market conditions as at 31 March 2021, a scheme with a duration of 20 would be considered to be in line with the 'average' scheme from the universe of occupational DB schemes.

The modelling also applies the following assumptions:

- The scheme starts with a funding level of 100% (ie fully funded). This is equivalent to being 85% funded against a G+0.5% funding basis at time 0.

- The scheme rebalances the investment strategy each year so it follows the investment journey plan as set out in Table 6, so that by the time of significant maturity (duration 12), it is invested in line with the low dependency investment strategy set out in Table 5.

- If at the end of a projection year, the scheme is deemed to be in deficit on a Fast Track basis, it is assumed that the employer will support the scheme via the payment of a deficit reduction contribution the following year.

- For these purposes, the DRCs are calculated based on a proportion of the starting low dependency liabilities and are assumed to be paid at this notional level, allowing for annual increases of 2% p.a.

- DRCs continue to be paid until the deficit has been removed.

Based on the above assumptions, this results in the following funding outcomes:

Table 10: Modelling Member Outcomes: Impact of varying the DRCs on projected funding levels

| DRCs 1.0% | DRCs 1.5% | DRCs 2.0% | |

| Probability of F/L>=100% on a G+0.5% funding basis at significant maturity | 73% | 82% | 88% |

| Median F/L at significant maturity | 116% | 120% | 122% |

| 5th Percentile F/L at significant maturity | 73% | 88% | 96% |

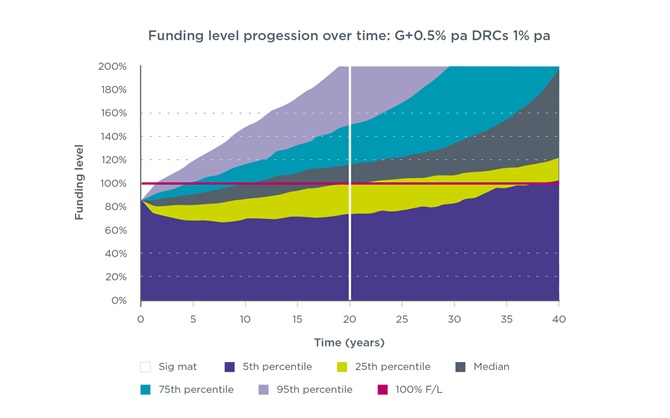

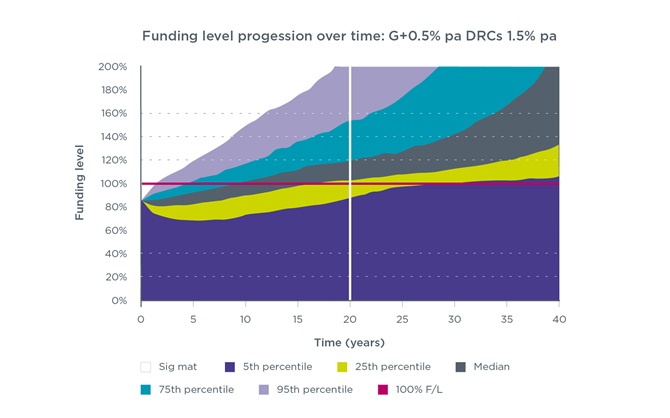

Alternatively, the range of funding outcomes can be shown as follows, which shows the progression of the potential funding levels, on a gilts + 0.5% pa basis, between the 5th and 95th percentile. Based on DRC patterns assuming nil DRCs, 1.0% DRCs and 1.5% DRCs, the progression of potential funding levels are as follows:

Figure 4: DRCs 1%

Figure 5: DRCs 1.5%

As seen from the above table and graphs, the proposed Fast Track regime is not intended to be risk-free, but within such a regime, covenant support through DRCs materially improves member outcomes where funding falls below 100% funding.

With employer covenant support, the proposals achieve a high probability that schemes that follow this approach will reach a fully-funded position at the point of significant maturity, ie this increases from 51% with no DRCs to, based on DRCs of 1% to 2%5, to 73% and 88% respectively.

For annual DRCs at the 1% level, the median funding level is expected to be in excess of 115% at the point of significant maturity, which is a funding level where the scheme would be expected to be able to buy out benefits with an insurance company.

From Table 10, it can be seen that the significance of improved covenant support primarily improves members’ outcomes in situations associated with downside scenarios. Without covenant support, the 1 in 20 (5th percentile) and 1 in 4 (25th percentile) show the scheme eventually runs out of assets to pay scheme benefits. This is in contrast to covenant support where the modelling under all three covenant scenarios the 1 in 20 probability shows that the scheme failed to reach full funding, and that increasing covenant support from 1% DRCs to 2% DRCs leads to an improvement in the funding level from 73% to 96%. Furthermore, all modelling outcomes at the 5th percentile show that with continued support post significant maturity, the scheme is able to reach a position of full funding.

We have considered alternative options with regard to improving member outcomes, primarily through increasing the level of prudence inherent in the discount rates used to calculate the Fast Track TPs. For example, assuming a Fast Track parameter of 90% of the low dependency liabilities at duration 20, the modelling implies that this increases the probability of success as follows:

Table 11: Modelling Member Outcomes: Impact of varying the Fast Track TP parameters on projected funding levels

| 85% of G+0.5% @D20 | 90% of G+0.5% @D20 | |||||

| DRCs 1.0% | DRCs 1.5% | DRCs 2.0% | DRCs 1.0% | DRCs 1.5% | DRCs 2.0% | |

| Probability of F/L>=100% on a G+0.5% funding basis at significant maturity | 73% | 82% | 88% | 80% | 88% | 93% |

| Median F/L at significant maturity | 116% | 120% | 122% | 127% | 130% | 133% |

| 5th Percentile F/L at significant maturity | 73% | 88% | 96% | 81% | 94% | 98% |

However, as set out previously, there is a balance to be achieved through improved security versus the higher costs of more prudent Fast Track TPs.

Allowance for leveraged LDI within Fast Track

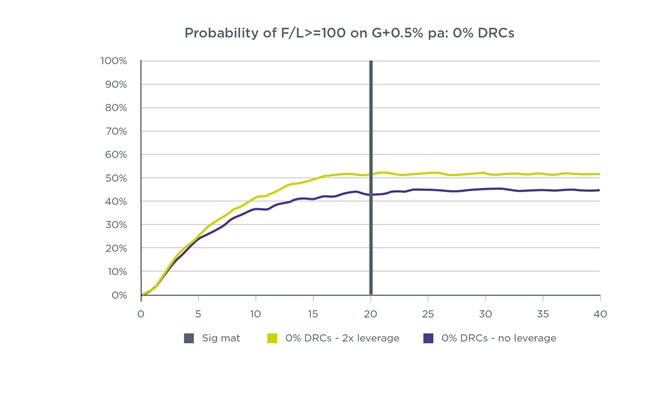

The investment strategy is based on assuming that prior to significant maturity the gilt portfolio is leveraged up to a maximum of 2x, subject to a maximum hedge ratio of 100% of the value of the assets, in order to mitigate, to an extent, the risks associated with interest rate and inflation risks. Using leverage enables a pension scheme to increase the level of exposure to interest rates and inflation to match liabilities. However, whilst the use of leverage can mitigate deficit volatility, other operational risks such as those relating to liquidity and governance require managing.

This is re-enforced through the results from our modelling, whereby an allowance of 2x leverage improves overall member outcomes when compared with an allowance of zero leverage. In this instance, we have compared the investment strategy that underlies our Fast Track parameters, which is based on 2x leverage, against the same investment strategy, but where no leverage is applied to the gilt portfolio.

This can be seen in the following graph, which is based on a scheme with an initial duration of 20 and starts fully-funded on the Fast Track TPs basis, shows the probability over time of reaching full funding on the low dependency funding basis of gilts + 0.5% per annum. This assumes no DRCs are paid when the scheme is deemed to be in deficit.

Figure 6: Probability of F/L>=100 on G+0.5% pa: 0% DRCs

Reviewing our parameters

As Fast Track is a regulatory approach based on our tolerated level of risk, we do not expect these parameters to change often. However, we do intend to review the parameters on a regular basis and may do extraordinary reviews following significant changes in market conditions.

In general, we expect the low dependency related parameters associated with the period at and after significant maturity to be stable, as they reflect the longer-term assumptions around an appropriate low dependency investment strategy and low dependency discount rate, based on long-term expected return over gilts on a portfolio of matching assets. Similarly, we would expect the stress test parameters will not change without very good reason.

For the other Fast Track parameters, TPs and recovery plans, there are two options to how we could approach our reviews:

- Given Fast Track is our regulatory risk line, we should not change them without very good reason.

- Given these parameters could be affected by changes in market conditions and movements in the universe of DB schemes’ funding levels and/or the economic environment sponsoring employers face, we should seek to adjust them regularly to reflect that.

We propose to do a deep-dive review of all of the Fast Track parameters and the assumptions underlying them every three years. The three-year period is in line with schemes’ triennial valuations. When we do this review, we will look at the method and assumptions underlying the parameters, as well as the parameters themselves. We will carry out a consultation on any changes to the method and assumptions used to set the Fast Track parameters. This is in line with our approach to consulting on the initial Fast Track parameters now.

Under option 1, we would do a lighter touch review every year, at the time to confirm that the Fast Track parameters remain unchanged given current economic and financial market conditions. We will publish the outcome of this review (including confirmation of no changes) in a statement, which could be our DB Annual Funding Statement.

Under option 2, we would carry out a fuller review every year of the TPs and recovery plan, alongside the lighter touch review of other Fast Track parameters. For this review we look at how current economic and financial market conditions have changed since the last deep-dive review and consider whether:

- there have been changes in future expected asset returns compared to gilts of sufficient size to change the discount rates underlying our TPs parameters and so the parameters themselves

- there have been changes to the universe of DB schemes’ funding levels and/or economic conditions facing sponsoring employers which mean it could be appropriate to change the RP parameters, for instance the recovery plan length, to smooth the impact on sponsoring employers’ contributions

As for option 1, we will publish the outcome of this review in a statement.

Under both options, we may also do an extraordinary review of the parameters assumptions in circumstances where economic and market conditions have changed significantly in any intervening period.

For both the annual and extraordinary reviews, we intend to engage with key stakeholders and relevant parties with the representatives across the pension industry before publishing the outcome of our review.

There are a range of factors we will take into account when reviewing the Fast Track parameters, including but not limited to:

- key economic indicators and expectations for the future

- expectations for the equity risk premium and expected returns on other growth assets versus gilts

- credit spreads for investment grade corporate bonds

- movements in yields across the gilts curve

- market-implied expectations of inflation and expectations for the inflation risk premium

- evidence of changes in mortality rates and life expectancies, including long-term future improvements

- PPF guidance, particularly in relation to changes in the stress test used for levy purposes

- market innovations

- our estimate of the universe of DB schemes’ funding levels

- covenant expectations

Extraordinary reviews would occur when we have seen big movements in financial markets relating to these factors.

15. Illustrating behaviour changes

We have undertaken internal modelling to illustrate some potential behavioural changes, if trustees adjust their approach considering Fast Track and the parameters we have set out for that basis. This is not intended to be an impact assessment of the code and Fast Track – that will accompany the finalising of our proposals. Our analysis is aimed at providing an illustration of the potential implications of some specific scenarios on scheme funding and to help put Fast Track and potential behaviour changes in context.

We have considered one scenario (referred to as 'Central Estimate'). This assumes some specific behavioural changes whereby some trustees adjust their TP assumptions and/or their recovery plans, compared with the Fast Track parameters. Details of the assumptions for this are set out in Appendix 5. This has been compared to the Counterfactual estimate, which represents our estimate of the funding approach each scheme would have adopted absent of a new regime. We have also illustrated additional scenarios as a sensitivity to these.

Our modelling has sought to consider two main areas:

- Firstly, estimate the number of schemes that would meet the Fast Track parameters with no change to their funding and investment approach on ‘Day 1’ of the new regime; and

- Secondly, estimate the aggregate impact on TPs and DRCs based on a prescribed set of assumed behavioural changes by trustees and employers.

Our analysis has been carried out as at March 2021. Since that date, there have been significant increases in gilt yields and observed inflation, with levels attained that have not been seen for several years. If we were to re-run this analysis updating to current conditions, this would likely change the overall results. However, we believe the below analysis is still helpful in illustrating the broad position and context.

We estimate that as at March 2021, over 50% of schemes meet all Fast Track parameters, whilst nearly 95% of schemes meet the parameters in at least one of the three areas.

The analysis shows that there is not a material change at the aggregate level to funding positions or DRCs when comparing the Counterfactual position to our Central Estimate. These results are based upon the fact that we assume some trustees will 'level up', whilst some 'level down', depending on their current funding strategy and estimated funding position.

Our levelling up assumption is based upon the view that, for some trustees, it may be appropriate for them to strengthen their TPs and/or increase DRCs to meet the new requirements. This might be because either the existing level of risk being run is not supportable by the employer covenant or that they do not at present have a long-term funding target in line with the DWP’s draft regulations.

We have only assumed partial levelling up. This is to reflect that, for some schemes, where the employer covenant can support the current level of risk being run and this level of risk is in excess of Fast Track, the Bespoke option allows trustees to continue with their existing funding and investment strategies.

Our levelling down assumption is based upon the fact that some trustees and employers may consider it appropriate to reduce the pace at which they are currently de-risking. However, we expect that many of those on a path to their long-term objective will continue with their existing funding and investment strategies.

The results of this sort of analysis will be very sensitive to the assumptions made and the analysis will be heavily weighted and influenced by a small number of large schemes. In practice, we expect many of these larger schemes will put in place bespoke funding solutions that take account of their scheme and employer-specific circumstances that have not been modelled as part of this analysis.

Methodology

The modelling estimates TPs and DRCs on three different bases: 'Counterfactual', 'Fast track' and 'Central Estimate'. These are outlined below and described in more detail in Appendix 5.

- Counterfactual represents our estimate of the funding approach each scheme would have adopted absent of a new regime.

- Fast track represents the theoretical position if each scheme adopted a funding approach exactly aligned with the Fast Track parameters. This is provided for context – we do not consider this an expected outcome.

- Central Estimate represents an illustration of schemes’ funding approaches had the regulations, the code and Fast Track been in force at the calculation date. It assumes behavioural changes whereby some trustees adopt more or less prudent TP assumptions, and longer or shorter recovery plans, compared with the Fast Track parameters.

The model is not intended to draw conclusions for individual schemes, given standard behavioural assumptions applied. It is aimed at providing an illustration of the potential broad aggregate impacts at the universe level.

Our modelling is based upon a calculation date and market conditions as at 31 March 2021, using scheme funding data provided to us in scheme returns and recovery plan submissions up to 31 March 2022. Further commentary is provided in the Summary of results section regarding changes in market conditions between 31 March 2021 to 30 September 2022.

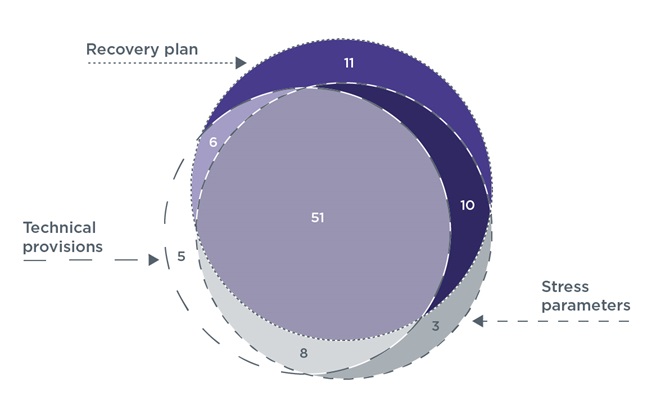

Summary of results – outcomes against Fast Track

This section sets out the proportion of schemes that meet the Fast Track parameters (and each of the TP, recovery plan and stress parameters separately). The results are based on comparing each scheme’s Counterfactual position to the Fast Track parameters.

Table 12: Proportion of schemes that meet Fast Track parameters

| Proportion of schemes (by number) | |

|---|---|

| Meets Fast Track overall | 51% |

| Does not meet Fast Track overall | 49% |

| Meets in two out of three areas | 25% |

| Meets TPs and Recovery Plan but not stress | 6% |

| Meets TPs and stress but not Recovery Plan | 8% |

| Meets stress and Recovery Plan but not TPs | 10% |

| Meets only one area | 18% |

| Meets TPs only | 5% |

| Meets stress only | 3% |

| Meets Recovery Plan only* | 11% |

| Does not meet parameters in any area | 6% |

*Note that meeting the recovery plan length parameter when not meeting the TPs parameter does not imply that the recovery plan was appropriate (as it could have been targeting a materially understated deficit). It simply reflects that the Counterfactual recovery plan length was less than the Fast Track parameter.

These results are also shown on the below Venn diagram

Figure 7: Meeting Fast Track parameters

We also split these results by scheme status. The results can be seen below

Table 13: Proportion of schemes that meet Fast Track parameters by scheme status

| Closed to accrual | Open to accrual, closed to new entrants | Open to new entrants and accrual | |

|---|---|---|---|

| Number of schemes | 3,230 | 1,372 | 449 |

| Proportion meeting Fast Track | 49% | 55% | 50% |

The modelling shows that c51% would meet all Fast Track parameters, based on their current approach. There is little difference when looking at schemes by status.

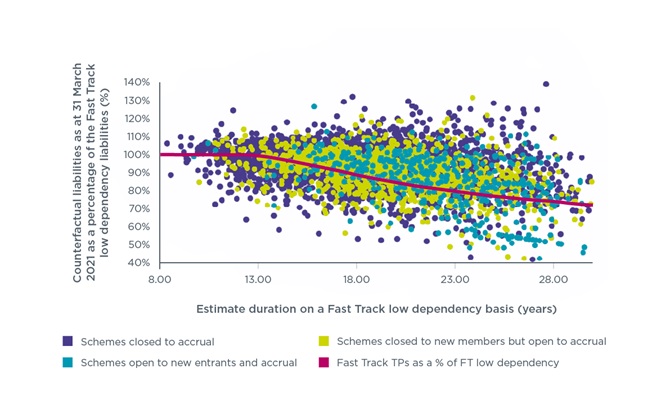

The schemes that do not meet these parameters may fall short by a very fine or very large margin – the modelling does not distinguish between these cases. To illustrate this, the following chart shows the Counterfactual liabilities as a percentage of Fast Track low dependency liabilities against duration. Schemes that lie above the solid line are those that are expected to meet the Fast Track TPs parameter without any changes.

Figure 8: Counterfactual liabilities as a percentage of Fast Track low dependency liabilities against duration

Summary of results - Aggregate TPs and DRCs

TPs

Table 14 shows estimated total universe assets, TPs and surplus/(deficit) on the three bases modelled as at 31 March 2021.

Table 14: Estimated total universe assets, TPs and surplus/(deficit)

| (£bn) | Counterfactual | Fast Track | Central Estimate |

|---|---|---|---|

| Assets | 1,710 | 1,710 | 1,710 |

| TPs | 1,712 | 1,617 | 1,707 |

| Surplus / (Deficit) | (2) | 93 | 3 |

| Funding level | 99.9% | 105.7% | 100.2% |

Table 15 shows the liabilities split by schemes with current funding assumptions more prudent, and less prudent, than the Fast Track TPs parameter.

Table 15: Liabilities split by schemes with assumptions that are more and less prudent than the Fast Track TPs parameter

| No. schemes | Counterfactual (CF) (£bn) | Central Estimate (£bn) | Change CF to Central Estimate(£bn) | |

|---|---|---|---|---|

| Counterfactual TPs more prudent than Fast Track | 3,548 | 1,377 | 1,355/ | (22) |

| Counterfactual TPs less prudent than Fast Track | 1,503 | 335 | 352 | 17 |

| Total | 5,051 | 1,712 | 1,707 | (5) |

Table 16 breaks down the aggregate funding positions between schemes in surplus and deficit.

Table 16: Aggregate funding positions between schemes in surplus and deficit

| (£bn) | Counterfactual | Central Estimate |

|---|---|---|

| Schemes in surplus | ||

| No. schemes | 2,256 | 2,343 |

| Assets | 928 | 1,049 |

| TP Liabilities | 860 | 982 |

| Surplus / (Deficit) | 68 | 67 |

| Funding level | 107.8% | 106.8% |

| Schemes in deficit | ||

| No. schemes | 2,795 | 2,708 |

| Assets | 782 | 661 |

| TP Liabilities | 852 | 725 |

| Surplus / (Deficit) | (70) | (64) |

| Funding level | 91.8% | 91.2% |

As can be seen in Table 16, both the Fast Track and Central Estimate scenarios result in lower overall levels of TPs compared to the Counterfactual.

Around 70% of schemes have Counterfactual liabilities higher than Fast Track liabilities. This means broadly that these schemes would meet the Fast Track TPs parameter if they maintained the same approach as their previous valuation.

Based on our prescribed set of assumed behavioural changes, the total Central Estimate liabilities are broadly the same as the Counterfactual liabilities. The section on 'Sensitivities to different behaviours' illustrates how this could vary under alternative assumptions.

For the Central Estimate, we assume that 2,191 schemes make no change to their TPs from the Counterfactual, whilst 1,357 schemes 'level down' to lower TPs, and 1,503 'level up' to higher TPs. We have applied broad estimates for levelling up (ie all schemes below Fast Track level up 50% of the way). This is for illustration and we do not expect this to happen in practice. These increases and decreases broadly offset each other, to give broadly the same total TPs at the universe level.

Under the Central Estimate, 87 more schemes are assumed to be in surplus at the calculation date compared with Counterfactual.

For schemes in deficit only, the aggregate funding level is broadly unchanged, 91% under Central Estimate, compared with 92% under Counterfactual.

Recovery plans

Table 17 shows the modelled aggregate DRCs in the first year following the calculation date, and the average recovery plan length, for the three bases.

Table 17: Modelled aggregate DRCs and the average recovery plan length

| Counterfactual | Fast Track | Central Estimate | |

|---|---|---|---|

| Annual DRCs (year 1) (£bn) | 13.4 | 9.9 | 12.4 |

| Average* Recovery Plan length (schemes in deficit) | 6.5 years | 5.9 years | 7.0 years |

*average is unweighted

Table 18 shows a breakdown for schemes whose modelled DRCs increase, decrease or stay the same in year 1 under the Central Estimate.

Table 18: Schemes whose modelled DRCs increase, decrease or stay the same in year 1 under the Central Estimate

| No. schemes | Counterfactual Year 1 DRC (£bn) | Central Estimate Year 1 DRC (£bn) | Change Counterfactual to Central Estimate (£bn) | |

|---|---|---|---|---|

| Increase | 1,625 | 4.0 | 5.5 | 1.5 |

| Stay the same | 2,913 | 6.3 | 6.3 | Nil |

| Decrease | 513 | 3.1 | 0.7 | (2.4) |

| Total | 5,051 | 13.4 | 12.4 | (1.0) |

Table 19 shows the impact on year 1 DRCs split by size of scheme.

Table 19: impact on year 1 DRCs split by scheme size

| No. schemes | Counterfactual Year 1 DRC (£bn) | Central Estimate Year 1 DRC (£bn) | Change Counterfactual to Central Estimate (£bn) | |

|---|---|---|---|---|

| Large schemes (>£1bn*) | 309 | 9.0 | 7.9 | (1.1) |

| Medium schemes (£100m-£1bn) | 1,135 | 3.3 | 3.3 | 0.0 |

| Small schemes (<£100m) | 3,607 | 1.1 | 1.2 | 0.1 |

| Total | 5,051 | 13.4 | 12.4 | (1.0) |

* Size bands based on Counterfactual liabilities as at 31 March 2021

As can be seen in Table 19, 309 or c.6% of schemes by number account for £9 billion or c.67% of the total level of Counterfactual DRCs. Given the size of these schemes, small changes in the estimated liabilities can have a significant impact on the aggregate DRCs. For these large schemes, the behavioural assumptions applied may not be representative of what would happen in practice. As such, the figures should be treated with caution, as they provide an illustration of how modelled behavioural changes could impact DRCs.

The total universe DRCs are modelled to be around £1 billion lower in year 1 under the Central Estimate, compared to the Counterfactual. This is driven by the behavioural assumption that some schemes funding above Fast Track 'level down” their TPs and are able to reduce DRCs, which outweighs the impact of those who are assumed to pay more due to 'levelling up'.

2,913 (c.58%) of schemes are modelled to pay the same DRCs in year 1, whilst 1,625 (c.32%) of schemes are modelled as paying more and 513 (c.10%) pay less under the Central Estimate compared to the Counterfactual. The distribution of where these changes apply by size of scheme has a significant impact on these results.

Large schemes in aggregate are modelled to have lower DRCs in year 1 under the Central Estimate, compared to the Counterfactual, although note that large schemes can significantly skew the DRC results. There is little difference in aggregate for both medium and smaller schemes.

Each of the subcategories in Table 19 include schemes modelled to pay both higher and lower DRCs, and the aggregate change shows the net effect, so it is not the case that all schemes in each subcategory change in the same way as the aggregate total.