Guidance for trustees, pension managers and administrators on checking, proceeding with and refusing transfer requests from scheme members.

Published: 8 November 2021

Last updated: 12 January 2023

12 January 2023

Direct members to mandatory guidance from MoneyHelper section updated to clarify that members need to book a pensions safeguarding appointment and not a different type of MoneyHelper appointment.

5 July 2022

Overview, Carry out due diligence, Red flag and Amber flag sections, and Appendix 1 title updated to address concerns about applying the regulations where overseas investments or small-scale incentives feature in the transfer.

13 May 2022

Update to the paragraph on how to direct members to MoneyHelper guidance.

31 March 2022

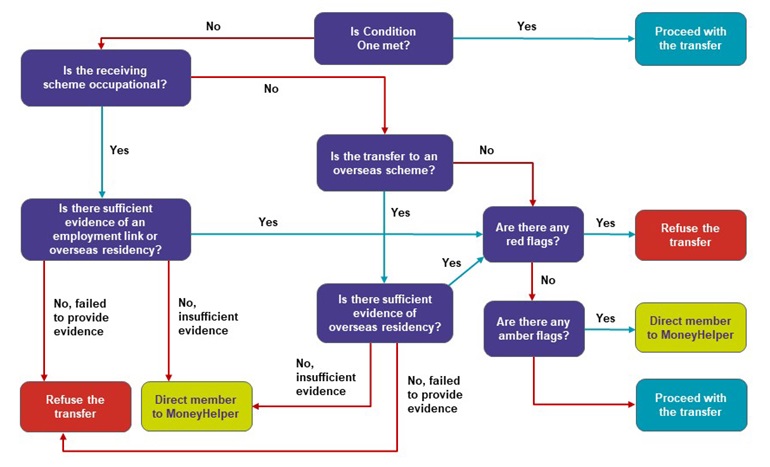

Appendix 1 decision tree and transcript amended to make it clearer that you should check for sufficient evidence of an employment link or overseas residency.

18 March 2022

Replacement PSIG link added to Overview.

24 January 2022

Correction made to the fourth paragraph under the heading 'Second condition: Check for an employment link, overseas residency and red and amber flags'.

30 November 2021

Section on directing members to mandatory guidance from MoneyHelper updated with link to book a guidance session.

24 November 2021

Section on checking residency for overseas transfers updated by removing reference to tax residency.

Overview

From 30 November 2021, trustees and scheme managers must ensure specific checks are made before complying with a member’s request to transfer their pension. This should form part of your due diligence process for transfer requests.

The regulations require trustees to carry out due diligence on statutory transfers and to refuse a statutory transfer or refer the member to guidance if the due diligence shows certain risk indicators. Your scheme rules may still allow you to make non-statutory transfers even when these risk indicators are present. You should consider the checks in this guidance when assessing whether to grant a non-statutory transfer, but the regulations do not prevent you from making a non-statutory transfer payment where you consider that the transfer is in the member’s interests and does not pose a risk. You should not use non-statutory transfers to avoid carrying out due diligence.

The checks will determine whether the request meets the conditions to enable a statutory right to transfer, including whether a member is required to have guidance from MoneyHelper. You should take a risk-based approach to your decision making based on the information you obtain during your due diligence process.

Most transfer requests are likely to be straightforward and you should be able to complete them well before the statutory six-month deadline. A minority of cases will require more investigation and you should consider what steps you can take to ensure that you complete the transfer within the statutory timeframe.

There are some receiving schemes to which a statutory transfer can proceed with no further checks. If the receiving scheme is not one of these, you will need to carry out further assessments to confirm that you are able to make a statutory transfer.

There are certain circumstances, referred to as red and amber flags, which mean that a statutory transfer cannot proceed, or where a member must obtain guidance from MoneyHelper before the transfer may proceed.

When you receive the member’s application for a statement of the cash equivalent value of their pension or the member’s request to make a transfer, you must notify the member within one month that their application will be assessed against the two conditions set out in regulations. You do not need to give this notification if the transfer is made within that period. You will need to consider whether to change your processes to meet this deadline.

Your communications should inform members of progress throughout the transfer process. You will also need to:

- consider when and how you may need to request additional information to assess the presence of red and amber flags

- notify members of your decisions regarding their application

You should refer to the industry good practice set out in the Pension Scams Industry Group (PSIG) Code of Good Practice.

Collect information

During your transfer processes you should collect the following information as a minimum. The information you collect will help to determine which conditions apply to the transfer application:

- name and address of the member requesting a transfer

- information about the receiving scheme including:

- name

- address

- HM Revenue and Customs (HMRC) registration number

- payment details

- type of scheme

- identity of the scheme administrator

- information about any financial adviser and other individuals involved in the transfer including:

- the firm’s name and address

- Financial Conduct Authority (FCA) registration number

- FCA permissions

- role in relation to the transfer

You should make sure that any member requesting a transfer from a defined benefit (DB) scheme to a defined contribution (DC) scheme with a value of more than £30,000 has had advice from an adviser regulated by the FCA. The adviser must have permission for the activity of ‘advising on pension transfers and pension opt-outs'. For further information on how to check this, see our DB to DC transfers and conversions guidance.

In the case of transfers of DC benefits, you should check that any adviser has permission for the activity of ‘advising on investments’. If your initial due diligence shows that the transfer is to a type of scheme other than those listed as meeting the first condition in the regulations, you must check that any adviser has these permissions. See red flag 3 for further information regarding permissions.

Carry out due diligence

You must carry out the checks in this guidance to determine which conditions apply to the transfer and whether you may proceed with a statutory transfer. You can find additional examples of the analysis process in the PSIG code.

You should be aware that no single piece of basic due diligence can definitively rule out the risk of a pension scam. Make your decision using the evidence from all the checks you carry out.

You should also be aware of member vulnerability. People can become vulnerable at any time and some members may need more support from you to avoid pension scams. Vulnerability can take many forms and some examples of vulnerability, and how support can be given, are described on the treating vulnerable consumers fairly section of the FCA website. You can also find examples of factors used to identify vulnerability in the PSIG code and the case studies in our Trustee Toolkit module on pension scams.

After carrying out such due diligence, you may conclude that while a red or amber flag might be triggered, the risk to the member is still low. Where your scheme rules allow, you may still grant a non-statutory transfer. Our expectation is that trustees will carry out enough due diligence on a non-statutory transfer to be confident that they have fulfilled their fiduciary duties to the transferring member.

First condition: The receiving scheme is listed in the transfer regulations

You must check if the receiving scheme is one of the following:

- a public service pension scheme (schemes established by a public authority for civil servants, armed forces, health service workers, teachers, judiciary, police, firefighters and local government workers)

- an authorised master trust on our published list

- a collective defined contribution (CDC) scheme that has obtained authorisation is included on the list which we will publish

If you are satisfied beyond reasonable doubt that the receiving scheme is one of those listed above, the transfer can proceed without any further checks.

You must confirm to the member that the receiving scheme is one of the types described above no later than the date you confirm to the member that the transfer has been made.

Second condition: Check for an employment link, overseas residency and red and amber flags

Where the receiving scheme is not one of those described in the first condition, you must consider whether the second condition is met. This may require you to carry out further checks to assess the level of risk to the member. You may be satisfied from previous checks on the receiving scheme that the transfer is low risk and therefore the second condition is met.

If the transfer is to an occupational pension scheme you must also request evidence from the member to demonstrate that there is an employment link.

If the transfer is to a qualifying recognised overseas pension scheme (QROPS) you must request evidence from the member to either establish overseas residency or an employment link, depending on the member’s employment status.

If you believe that the member has failed to provide a substantive response to a request for evidence, you should send a reminder at least one month after the initial request. If there is still insufficient evidence after one month from the reminder being sent, this may be treated as a red flag.

You should take a risk-based approach to your decision making. Where the receiving scheme is not occupational or a QROPS, consider whether you have enough information to determine if the transfer can proceed or whether you require further information to inform your decision.

You may wish to keep records of low-risk personal pension schemes, often referred to as a ’clean list'. These records may allow you to maintain a smooth transfer process where due diligence analysis shows no risk. You should review this list regularly to make sure that schemes continue to present low risk. You may determine that the transfer can proceed without the need for additional checks, where the receiving scheme is on your clean list.

If your initial due diligence shows that the receiving scheme is not an authorised master trust or CDC scheme, or a public service pension scheme, and it doesn’t appear on your clean list, you will need to assess it more closely.

There are certain circumstances (red flags) that you must decide are not present for you to proceed with a request to make a statutory transfer. There are other circumstances (amber flags) where there is enough risk to member outcomes to mean the member must prove to you they have obtained guidance from MoneyHelper before the transfer can proceed.

You may need to contact the member to obtain further information to assess if there are any red or amber flags. The information you request should be reasonable and proportionate to the level of risk you believe may be present. Any information requested should be for the sole purpose of helping you to decide whether the transfer can proceed.

If you are requesting additional information you should ensure that you explain why you need it. You should decide how to collect this information based on your understanding of your members and how it fits with your current processes. See our example questions to ask members (DOC, 38kb, 5 pages) which may assist you in your assessment of the presence of flags. It is good practice to call the member but if these questions are sent to the member to fill in you should check that they have completed it themselves.

If you decide that the second condition has been met, you must notify the member of your decision no later than the date you confirm that the transfer has been made. You should record all information you have requested and received, and the basis on which you make any decision.

Assess the employment link

Where a transfer is being made to an occupational pension scheme not listed in the first condition and where the residency link is not being tested or does not apply, you must request the following evidence from the member to determine whether a statutory transfer can proceed:

- A letter from the member’s employer confirming the member’s continuous employment. This should include the date that the member’s continuous employment began, that they are a sponsoring employer of the receiving scheme and confirmation that contributions on the schedule of contributions have been paid and the dates of those payments.

- A schedule of contributions or payment schedule showing the contributions due to be paid by the employer and by or on behalf of the member in the last three months and the due dates.

- Payslips for three months, or other evidence in writing, confirming the member’s salary (including any commission, bonuses or other amounts paid) is above the lower earnings limit for National Insurance.

- Copies of bank or building society statements or passbook showing the deposit of salary from the employer for the last three months.

You may request certified copies of the evidence, and in the case of print-outs of bank statements, particularly those from members who have paperless accounts, you may ask that these are endorsed as originals by the member’s bank branch. When considering whether to request original or certified copies of documents, you should consider whether this is appropriate to the level of risk indicated by your existing due diligence, and whether you need certified copies of documents to reach a decision. You should also consider issues such as safe postage and return of documents and whether any of the documents requested may be needed by the transferring member.

If the transfer is to an overseas pension and the member’s salary is paid in a different currency, you must check the rate of exchange on the date the payments were made to calculate if they meet or exceed the lower earnings limit. You can find the exchange rate for major currencies on the Bank of England website. If the required currency is not shown, you could try online search engines or financial publications.

If, based on copies of the documents referred to above, you have reason to believe that there is no employment link, this is an amber flag. If you decide there is an employment link and no other red flags or amber flags are present, you may proceed with the transfer.

Check residency for overseas transfers

This only applies where the transfer is being made to a qualifying recognised overseas pension scheme and where the member has not provided evidence that satisfies you that an employment link exists.

In these cases, you must check that the member is resident in the same country that the receiving scheme is based by obtaining a copy of the member’s formal residency documentation and at least two other items of evidence that demonstrate they are resident on the date you received the transfer application. This evidence will vary depending on the country of residence but could include:

- utility bills

- TV subscriptions

- insurance documents relating to their overseas home

- the address registered on their driving licence

- bank account and credit card statements

- evidence of local tax being paid

- registration at that address with local doctors

You may find it useful to consider the evidence that HMRC use to review someone’s residency for tax purposes.

You may request a certified copy of the formal residency document and, where the documentation is not in English, a certified translation by a professional translator of the other two items of written evidence. This should be paid for by the member. However, you should consider whether this is proportionate to the level of risk you have identified and whether you need it to reach a decision.

If you have reason to believe that overseas residency is not demonstrated, this is an amber flag. If you decide that overseas residency is demonstrated, and no other red or amber flags are present, the transfer can proceed without any further checks.

Red flags

You may take a risk-based decision, on the balance of probabilities, that red flags 3 to 6 are not likely to be present where you consider you already have enough information to make that decision. If you are not able to reach such a decision, you can make a formal request for further information from the member. After making this formal request, you must decide if any of the red flags are present. If you decide they are, you must refuse the transfer.

The examples below are not exhaustive but show some of the things you should consider when assessing the presence of flags.

This is where the member refuses or fails to respond or provides only partial information which is insufficient to decide if the employment link or overseas residency can be demonstrated or if any red or amber flags are present.

You may decide that this red flag is present if the member does not respond after one month of the second request for information. You should inform the member of the last date that you will accept information and how they can ask for extra time.

When providing information about the need to obtain MoneyHelper guidance you should allow a reasonable period for the appointment to take place and to receive the specified confirmation details. If the reasonable time elapses without contact from the member you can proceed to refuse the transfer.

This is where you have reason to believe that the member has been in contact with someone who agreed to or who has carried out any of the following regulated activities without the appropriate regulatory permissions from the FCA:

- providing pension transfer advice

- providing advice about where to invest their pension

- making arrangements for the member to buy or sell investments or making arrangements with a view to the member buying or selling investments

If you find yourself in the position of having to consider whether somebody has strayed into carrying out one of the specified regulated activities in circumstances where they do not have the appropriate FCA permission, you might find it helpful to consider the following information provided by the FCA to TPR; however, as financial services legislation falls outside TPR’s scope, you may also need to obtain your own advice:

- In practice, the FCA expects that a person advising on a pension transfer will also be advising on where to invest the transferred benefits.

- In some circumstances, a member has been in contact with an unregulated introducer. If that introducer has been involved in the transfer process and has influenced or been instrumental in the member’s decision to transfer or buy investments, depending on the particular circumstances, the introducer may have been carrying out regulated activities without the appropriate regulatory permissions.

- If the member lives abroad and wants to transfer their benefits overseas, a regulated adviser in the UK who is advising on a pension transfer may work with an overseas adviser who is advising on investing the transferred benefits in overseas investments. Depending on the particular circumstances, this may not in itself be a cause for concern.

- If there is not a regulated adviser in the UK giving advice to a UK based member about leaving the UK scheme, and an overseas adviser has advised on overseas investments that would only be possible for the member to buy if they transfer out of the UK scheme, there may be cause for concern. In such circumstances there may be scope for you to have reason to believe that the overseas advisor has implicitly advised on the transfer without the appropriate regulatory permissions.

You may decide this red flag is present if the member has received unsolicited contact such as cold calling, texts and emails about pensions. This unsolicited contact is against the law, but it may still originate from inside or outside the UK.

This flag should not capture contact from those previously unknown to the member where they have agreed to a trustee or employer passing on their details to an adviser to support the member in making financial decisions. It also should not capture calls from authorised firms and advisers where the member has an existing relationship and might reasonably receive unsolicited calls from them in connection with their pension.

You may decide that this flag is present if the member was incentivised to make the transfer. The regulations provide examples of what is and is not an “incentive” for the purpose of the regulations. These examples are non-exhaustive lists, and where a particular incentive is not included in either of these lists, we expect trustees to assess whether the type of incentive offered is one which indicates there is a heightened risk that the transfer might lead to a member being scammed.

As the examples are not exhaustive, it is important that you keep up to date with current and evolving scam tactics and consider industry good practice.

You may be faced with other examples of incentives being offered. Some could be considered normal industry practices. After carrying out due diligence you may consider the transfer is at a low risk of a scam and, where your scheme rules allow, you may consider granting a discretionary transfer.

The regulations specifically exclude situations where the member is being incentivised to transfer as part of an employer-sponsored transfer exercise. See our guidance on employer-sponsored transfer incentive exercises.

You may decide this flag is present if the member was under pressure, or indicated to you that they felt under pressure, to transfer. Pressure may be direct coercion or passive such as having a courier wait for forms to be completed.

A member may not be aware that they had been pressured. It is the behaviour of the individuals involved in the transfer that is being assessed as well as any indication by the member that they felt pressured.

Amber flags

You may take a risk-based decision, on the balance of probabilities, that amber flags 3 to 7 are not likely to be present where you consider you already have enough information to make that decision. If you are not able to reach such a decision, you can make a formal request for further information from the member.

After making this formal request, you must decide if you have reason to believe that any of the amber flags are present. If you decide they are, the member will be required to attend a guidance session with MoneyHelper before the transfer can proceed. See direct members to mandatory guidance from MoneyHelper.

The examples below are not exhaustive but show some of the things you should consider when assessing the presence of flags. It is important that you keep up to date with current and evolving scam tactics and consider industry good practice. Further examples can be found in the PSIG code.

This applies where you decide that the member’s response to a request for evidence has not fully demonstrated the employment link or overseas residency because the member has not been able to provide all the evidence requested. This might be for reasons such as the member’s earnings are lower than the lower earnings limit, they have been in employment for less than three months or there are no employer contributions.

This applies where the member provides all of the evidence requested but they have not been able to fully demonstrate the employment link or overseas residency. This may also apply if you have concerns that the evidence provided may not be genuine or that it has been provided by someone other than the member (except in cases where the member is being represented by someone with the power to make a request for a transfer).

You may decide that this flag is present if you have reason to believe that the investments in the scheme which, based on your reasonable judgement of the current market at the time of the transfer request, are beyond the normal range of investment risk, or contain a higher concentration or proportion of those investments than you’d expect to see in a balanced portfolio for an average member.

You may find high-risk investment information from the FCA useful when carrying out your due diligence.

The FCA has told us that these general examples may help you to identify a high-risk investment:

- investments that promise significant returns at a point in the future

- investments that would only normally be offered to high-net worth, sophisticated or professional investors

- investments that are unorthodox, speculative or would not feature in an investment portfolio appropriate for an average member

This flag also captures situations where the receiving scheme allows investments that are not regulated by the FCA and therefore will not provide access to services from the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS).

This does not include all situations where a member is unaware of the charges on their product. You should use your judgement and knowledge of the market to assess whether the charges are not in line with norms for comparable products.

There may be additional charges for which the purpose is unclear, exit penalties associated with lock-in periods or performance bonuses that start at low levels of return. Charges may also be unclear if they are layered so that the member is paying several charges to associated parties which together add up to an excessive amount.

You may decide that this flag is present, for example, where:

- there is direct investment into a specific asset or assets such as the unregulated investments listed in amber flag 3

- there is no clear fund wrapper or regulatory body involved in the investment

- the receiving scheme or investments in it appear to be designed to avoid regulation or exploit loopholes

The specific concern here is not whether the investment is in, for example, a global equity fund but whether the investment is in assets or funds where there is a lax, or non-existent, regulatory environment or in jurisdictions which allow opaque corporate structures. After carrying out due diligence you may consider the transfer is at a low risk of a scam and, where your scheme rules allow, you may consider granting a discretionary transfer.

Some overseas advisers recommend members invest their pension funds in an offshore investment bond in an international self-invested personal pension. The FCA has warned that this may expose members to high or unnecessary charges and has stated that the tax benefits of such arrangements are redundant for a member investing in a UK personal pension.

The risk of ‘factory gating’ (the practice of targeting specific workers where events occur that may lead to greater interest in transferring their pension) is significant in large or concentrated workforces. It is also common for victims of scams to unknowingly persuade family, friends and colleagues to become involved in a pension or investment scam, believing it to be a good deal. This can cause clusters of transfer requests to a particular scheme or using a particular adviser over a short period of time.

Transfers to a receiving scheme linked to a new employer following a corporate or TUPE (Transfer of Undertakings (Protection of Employment)) transaction are not necessarily a cause for concern. It is therefore important that you are aware of activity affecting sections of the workforce and whether these might trigger concerns.

Where you identify a sharp or unusual rise in transfer requests involving the same adviser, you should report this to the FCA via email to DBTransferSchemeInformation@fca.org.uk.

You may request additional information to help you decide if any of these flags are present.

If you reasonably believe that one or more of these flags exists, you should contact the member as soon as possible to explain that they are required to obtain guidance from MoneyHelper and why.

Direct members to mandatory guidance from MoneyHelper

The purpose of MoneyHelper pensions safeguarding guidance is to help identify common risks involved in transfers, highlight the dangers of pension scams and allow the member to consider whether to proceed with their transfer.

MoneyHelper pensions safeguarding guidance should not be used as a substitute for your own due diligence and careful consideration of the information available to you.

Effective communication with the member is important so that they understand why they have to obtain guidance and to manage their expectations. You should explain, in writing, what the amber flags are intended to achieve and then inform the member that you have assessed that one or more of the flags are present in their application.

You will need to provide this link so the member can book online or obtain the number to book by telephone. A safeguarding session cannot be booked in any other way. It is important the member uses this link to avoid them accidentally arranging a Pension Wise appointment (for over 50s about their DC pensions) or to obtain general MoneyHelper advice. These will not fulfil the requirement to have a pensions safeguarding guidance appointment.

Sessions must be booked and attended by the member, not any person acting on their behalf. You should provide the link immediately after completing due diligence to avoid unnecessary delay in processing transfers.

You should advise members consolidating more than one pension to wait until they have requested all transfers before booking their appointment. This will avoid them being asked to attend more than one safeguarding appointment.

Some members may have already received regulated financial advice about their transfer. It is therefore important that you clearly explain the purpose of the MoneyHelper appointment and how this differs from the advice they received to alleviate any concerns or confusion.

It is good practice to ask the member to confirm once they have booked an appointment so that you can determine if they will be able to confirm attendance before the statutory deadline for making a transfer.

Once the member has attended their appointment, they will receive correspondence from MoneyHelper with a unique reference number. The member must provide you with this evidence before you proceed with the transfer. If the member does not provide a unique identifier this will be grounds for stopping the transfer. See red flag 2.

After receiving MoneyHelper guidance, the member may choose not to proceed with the transfer. If this is the case you should consider whether to report the transfer as a potential scam.

If the member still wishes to proceed with the transfer, you should record the decision they have made and arrange to pay the transfer.

Refuse a transfer

Your decision on whether to refuse a transfer should be based on the balance of probabilities. This means you conclude that you have a reasonable foundation, on all the evidence and information available, that there is a red flag present. It is not necessary to prove this conclusively.

An opinion that a transfer is not in the member’s best interest, for example, you believe that a member would be better off staying in their current scheme, is not a relevant factor to stop the transfer.

If you’re not able to reach this decision based on the information available, you may formally request further information from the member. After making this formal request, you must decide if you have reason to believe that any of the red flags are present. If you decide you do, you cannot proceed with a statutory transfer.

It’s important that you clearly communicate with the member that their transfer has been refused because there are circumstances present that remove the statutory right to transfer and that the member is at risk of being scammed. You should also inform the member about your internal dispute resolution (IDR) process should they wish to appeal your decision.

You must notify the member of your decision that neither of the conditions have been met within seven working days of your decision.

You should keep records of your assessment, decision and communications with the member. You should consider industry good practice set out in the PSIG code. These records will demonstrate that you have taken reasonable action to warn the member of the risks and have considered your reasons for refusing the transfer. This evidence will be essential if a complaint is referred through your IDR process or to the Pensions Ombudsman.

If you’re concerned about a potential scam it is important that you report your suspicions. See report a scam.